- May 3, 2024

- Posted by: legaleseblogger

- Category: Related News

Try Free Now: Legalese tool without registration

## Thoughts on Budgeting in a Low Cost of Living Area

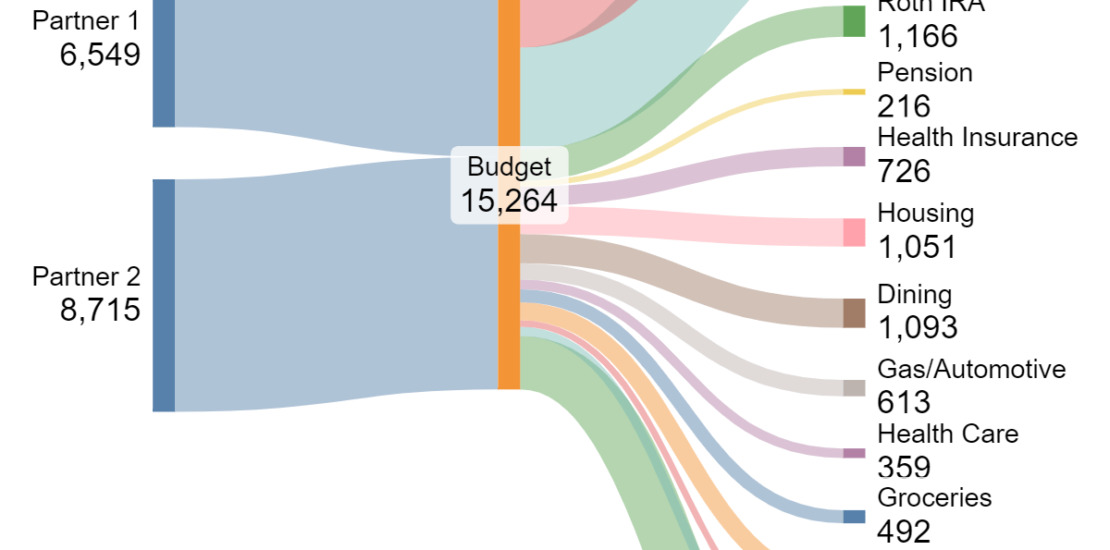

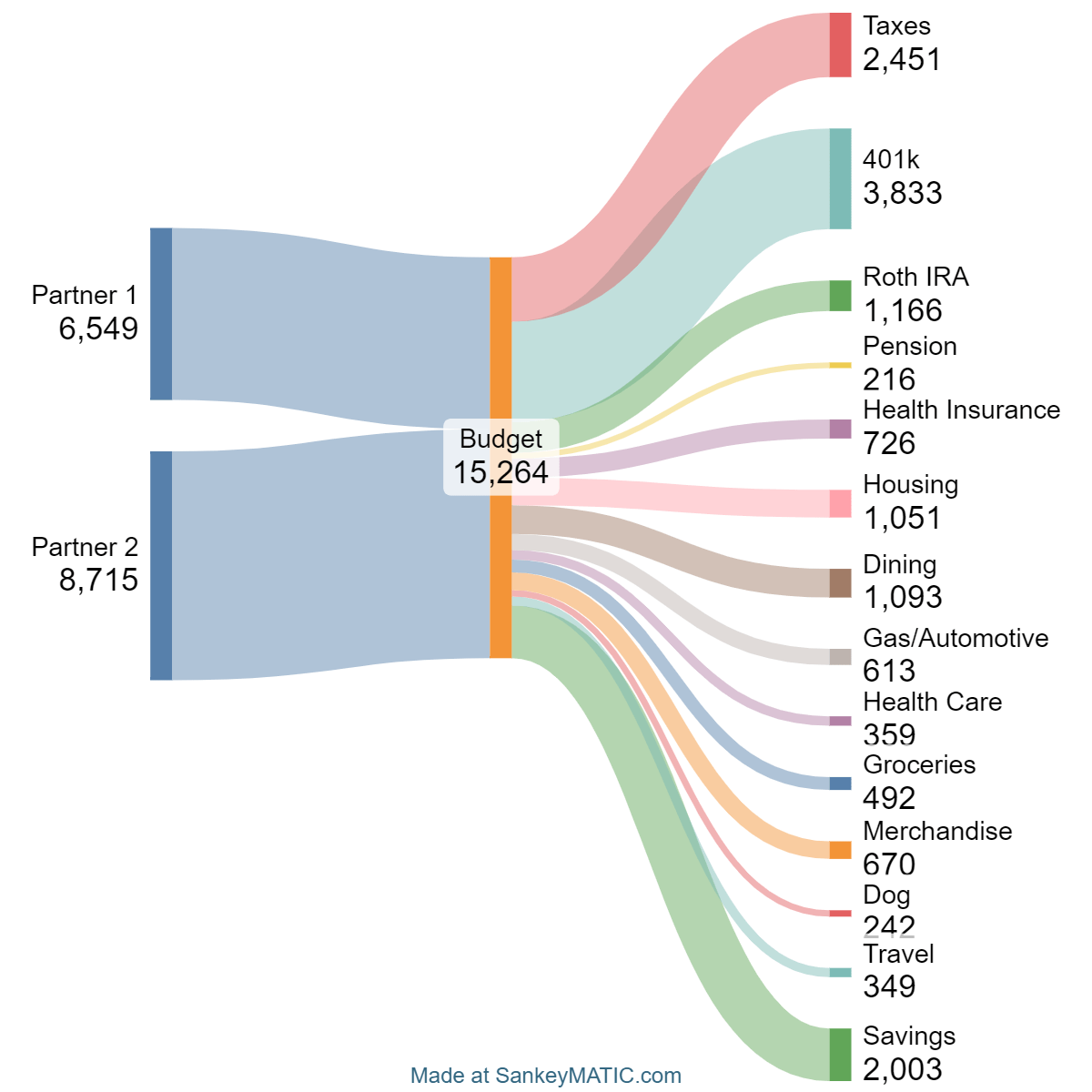

As a couple in our late twenties with a combined net worth of $440k, living in a low cost of living area has allowed us to save for retirement while enjoying a comfortable lifestyle. Despite our higher salaries for the area, we still feel guilty about our spending habits, especially when it comes to making big purchases like a new car. While we want to be responsible with our finances, we also want to enjoy the fruits of our labor without feeling strapped for cash.

## How AI Legalese Decoder Can Help

Using AI Legalese Decoder can help us analyze our spending habits and identify areas where we can make adjustments to better align with our financial goals. By inputting our income, expenses, and financial goals into the tool, we can receive personalized recommendations on how to optimize our budget and make smarter decisions with our money. This can help alleviate any guilt we may feel about spending and provide us with a clearer path towards achieving our financial objectives.

## Additional Insight into Our Financial Situation

In addition to our regular income, we receive a combined $7k in bonuses each year. Our health insurance costs stand out due to the decision to opt for the more expensive plan offered by Partner 2’s job, which reimburses $5k ($417/month) for opting out of coverage. While this may seem like a significant expense, the reimbursement makes it a worthwhile investment in our health and financial well-being.

## A Momentary Snapshot of Our Spending Habits

The above information provides a glimpse into an average month of spending where we are not overly conscious of our financial decisions. By using AI Legalese Decoder to track our expenses over time, we can gain a better understanding of our overall financial health and make more informed choices moving forward.

Try Free Now: Legalese tool without registration

**Original Content:**

AI Legalese Decoder is a cutting-edge software tool designed to simplify legal documents by translating complex legal jargon into plain, easy-to-understand language. With the AI Legalese Decoder, individuals no longer have to struggle to decipher legal contracts or agreements on their own. Instead, they can simply input the document into the software and receive a clear, concise translation that breaks down the key terms and clauses in a way that anyone can understand.

**Expanded Content with AI Legalese Decoder:**

**How AI Legalese Decoder Can Simplify Legal Documents**

AI Legalese Decoder is revolutionizing the way individuals navigate complex legal documents. This cutting-edge software tool is specifically designed to simplify legal jargon by translating intricate legal language into clear, easy-to-understand terms.

One of the key benefits of using AI Legalese Decoder is the ability to effortlessly decipher legal contracts or agreements that may have previously caused confusion or frustration. By simply inputting the document into the software, users can receive a straightforward translation that breaks down key terms and clauses in a manner that is accessible to all.

Moreover, AI Legalese Decoder can help individuals save time and avoid costly mistakes by ensuring they fully comprehend the legal implications of any document they encounter. This tool acts as a valuable resource for individuals seeking to protect their rights and make informed decisions when faced with complex legal language.

In conclusion, AI Legalese Decoder offers a user-friendly solution for simplifying legal documents and empowering individuals to confidently navigate the often intimidating world of legal jargon. With its innovative features and easy-to-use interface, this software tool provides a valuable resource for anyone looking to enhance their understanding of legal contracts and agreements.

****** just grabbed a

****** just grabbed a

When you say thoughts on the budget. Do you expect anyone to tell you to spend more or less on stuff? To save more?

Because looking at the amounts you spend and the income level you are at I cannot for the life of me determine if you truly don’t know if the amounts are typical for a family in your area.

You’re spending too much on dining and not enough on travel

I don’t remember all the great meals I ate 5 years ago, but I remember that trip to Japan, Amsterdam, etc

What are your goals? Kids? House ownership? What is an adult car and how is that different than what you drive now?

It’s good you have the self-awareness that you have a complicated relationship with money (wouldn’t necessarily label it unhealthy). I suggest unpacking that with a therapist.

Gotta say it’s depressing to see how little taxes some people are paying. I’m in Alberta Canada and I pay 7-8k on 16k (ish) per Month.

No debt and you’re saving >15% of pretax income for retirement. Looks fine to me.

I think you earn too much for a Roth IRA?

You’re putting more than the median income into a 401k/IRA. You’re financially stable, I’m honestly not sure you can put that much into a 401k annually and still receive all the tax benefits. It’s safe to say you can spend a little, get an adult car.

Wrong sub.

I know people will roll their eyes at this, but it’s a very interesting/valid question of: Great income (but not absurd), young, very healthy financial position from a retirement perspective – but how do I balance that between spending money on things that make me happy and enrich my life?

My wife and I are in a very similar position to you – we spend more on travel, hired someone to come clean our house 2x/month, pay people for home maintenance projects (rather than doing them ourselves), go out to dinner a couple times a month, indulge in a few hobbies, drive good but not expensive cars, and plan to retire in our 50s. The way I look at it is, time is the only thing we can’t get back, so we prioritize our money to do things we want with that time and offload the things we don’t want to do. We don’t have FU money, but enough to be in the fortunate position to make that choice. We plan to have kids, and some of the money we’re spending/income growth will be put toward daycare, 529, etc. as our lifestyle evolves.