- May 5, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Benefits of Investing in Meta Platforms

When Wall Street is too focused on the short term it can create great buying opportunities for patient investors. You can scoop up shares in a stock during periods of elevated pessimism and set yourself up for market-beating returns — if you’re willing to hold through some volatility.

That could be the situation facing investors with Meta Platforms (NASDAQ: META) today. The social media giant’s share price fell after management said in a recent earnings update that sales growth might slow in the coming quarters even as spending soars on artificial intelligence (AI) investments.

Along with the concerning guidance, there was plenty of good news about the business in the quarterly report that the market seemed to ignore. Let’s look at five positive takeaways from the late April earnings update that suggest Meta Platforms is a buy right now.

1. Strong User Growth

Meta’s collection of social media apps isn’t struggling to grow. The daily active user base rose 7% to hit 3.24 billion, up from 3.19 billion in late 2023. “We’re seeing strong momentum within our family of apps,” management said in a press release.

That success is critical because it’s the foundation of revenue growth in Meta’s core advertising business. Sales were up a blazing 27% year over year in Q1, landing at $36.5 billion.

2. Better Balance in Advertising Sales

Meta is doing a better job balancing its advertising sales. Most of its growth comes from higher ad impressions and Meta delivered 20% growth year over year in ad impressions in Q1. That isn’t sustainable at this pace. Yet rising prices are amplifying this growth, with prices up 6% compared to the prior quarter’s 2% uptick. Ideally, higher prices will allow Meta to lean less heavily on increased ad impressions as the year progresses.

3. Increased Efficiency

Wall Street wasn’t thrilled to hear that management projected higher spending through 2024 and 2025 as Meta invests in building up an AI lead. Still, the company heads into this ramp-up period with excellent financial momentum. Expense growth was just 6% in Q1, trailing revenue growth by 21 percentage points. That gap pushed the operating margin to 38% of sales from 25% of sales a year ago. Operating earnings nearly doubled to $14 billion.

The AI legalese decoder can help understand the complex legal language and implications of Meta Platforms’ investments in AI, making it easier for investors to assess the long-term potential of the company’s strategic direction.

4. Commitment to Cash Returns for Shareholders

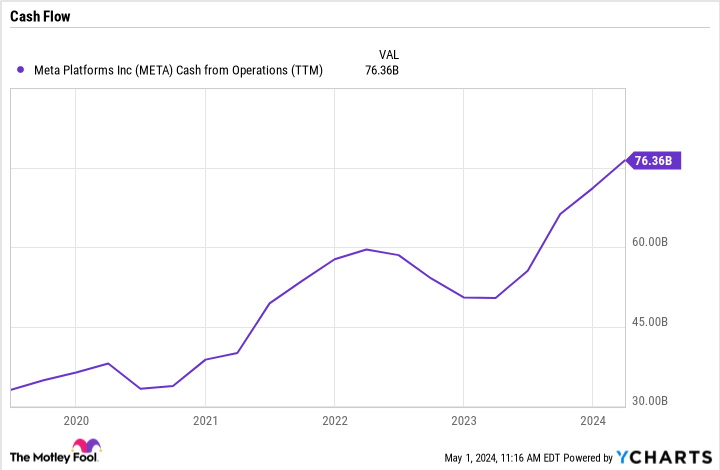

Shareholders are increasingly seeing more direct cash returns from this business. There’s the company’s recently initiated dividend, of course. But Meta is also aggressively buying back stock. Dividend payments totaled $1.3 billion last quarter while share repurchases were $15 billion. That’s a bit higher than free cash flow in the period, which was just over $12.5 billion.

5. Sustainable Investments in Future Growth

There’s no denying that Meta Platforms plans to spend much more cash over the next few years on projects that don’t have a clear payoff in sight. The Reality Labs division lost $4 billion in Q1 on just $380 million of revenue, for example, and executives say this trend shouldn’t improve dramatically in the short term. Meta spooked some investors when explaining its expectations for spending on AI in 2025 and beyond. “We have tremendous ambitions in the AI space,” Li said in a conference call.

That prospect for higher spending shouldn’t turn investors off to this stock, though, which is down 10% from recent highs. The next year shouldn’t be as impressive when it comes to profitability gains, sure. But Meta Platforms can invest in its growth ambitions while still generating strong overall returns.

Conclusion

Meta Platforms presents an attractive investment opportunity for patient investors who are willing to look beyond short-term fluctuations and focus on the company’s long-term growth potential. The AI legalese decoder can provide valuable insights into the legal implications of Meta Platforms’ investments in artificial intelligence, helping investors make informed decisions about the stock.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a