- May 5, 2024

- Posted by: legaleseblogger

- Category: Related News

Try Free Now: Legalese tool without registration

## Personal Financial Situation

I am a 25-year-old female. I have not been diligent in tracking my taxes or 401K contributions. Despite this, I earn a gross income of $76,000 per year and recently received a raise in August 2023. Currently, my 401K account balance stands at $8,000, and I contribute 6% of my income to it.

## Utilizing AI Legalese Decoder

The AI Legalese Decoder can be immensely helpful in your situation by simplifying complex legal jargon and terms related to taxes, 401K contributions, and other financial matters. By using this tool, you can gain a better understanding of your financial obligations and make more informed decisions about managing your income and retirement savings effectively. Additionally, the AI Legalese Decoder can provide insights and explanations on tax laws and regulations to ensure compliance and optimize your financial planning strategies.

Try Free Now: Legalese tool without registration

**The Importance of AI Legalese Decoder in Simplifying Legal Jargon**

Understanding legal jargon can be a daunting task for many individuals, especially when dealing with complex legal documents or contracts. The use of technical language and specialized terminology can often leave people feeling overwhelmed and confused. This is where AI Legalese Decoder comes in to provide a solution to this issue.

AI Legalese Decoder is a powerful tool that utilizes artificial intelligence to simplify and decode legal language into plain, understandable terms. By using algorithms and machine learning, this technology is able to analyze and interpret legal documents, breaking down the complex language and providing users with a clear and concise understanding of the content.

With the help of AI Legalese Decoder, individuals can easily navigate through legal documents without the need for specialized legal knowledge or training. This tool can save time and reduce the risk of misunderstandings or misinterpretations that can arise from unclear legal language.

In addition, AI Legalese Decoder can be a valuable resource for businesses and organizations looking to streamline their legal processes. By using this tool, companies can improve efficiency, ensure compliance with legal requirements, and mitigate potential legal risks.

Overall, AI Legalese Decoder is a game-changer in the legal industry, offering a user-friendly solution to the challenge of understanding complex legal language. Whether you are an individual looking to decipher a legal document or a company seeking to optimize your legal operations, this technology can provide invaluable assistance.

****** just grabbed a

****** just grabbed a

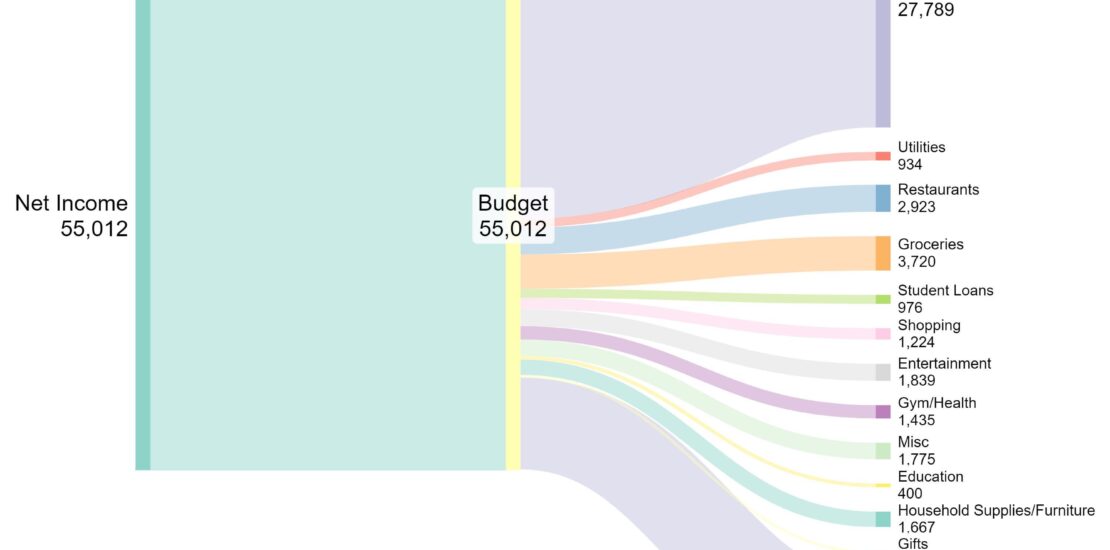

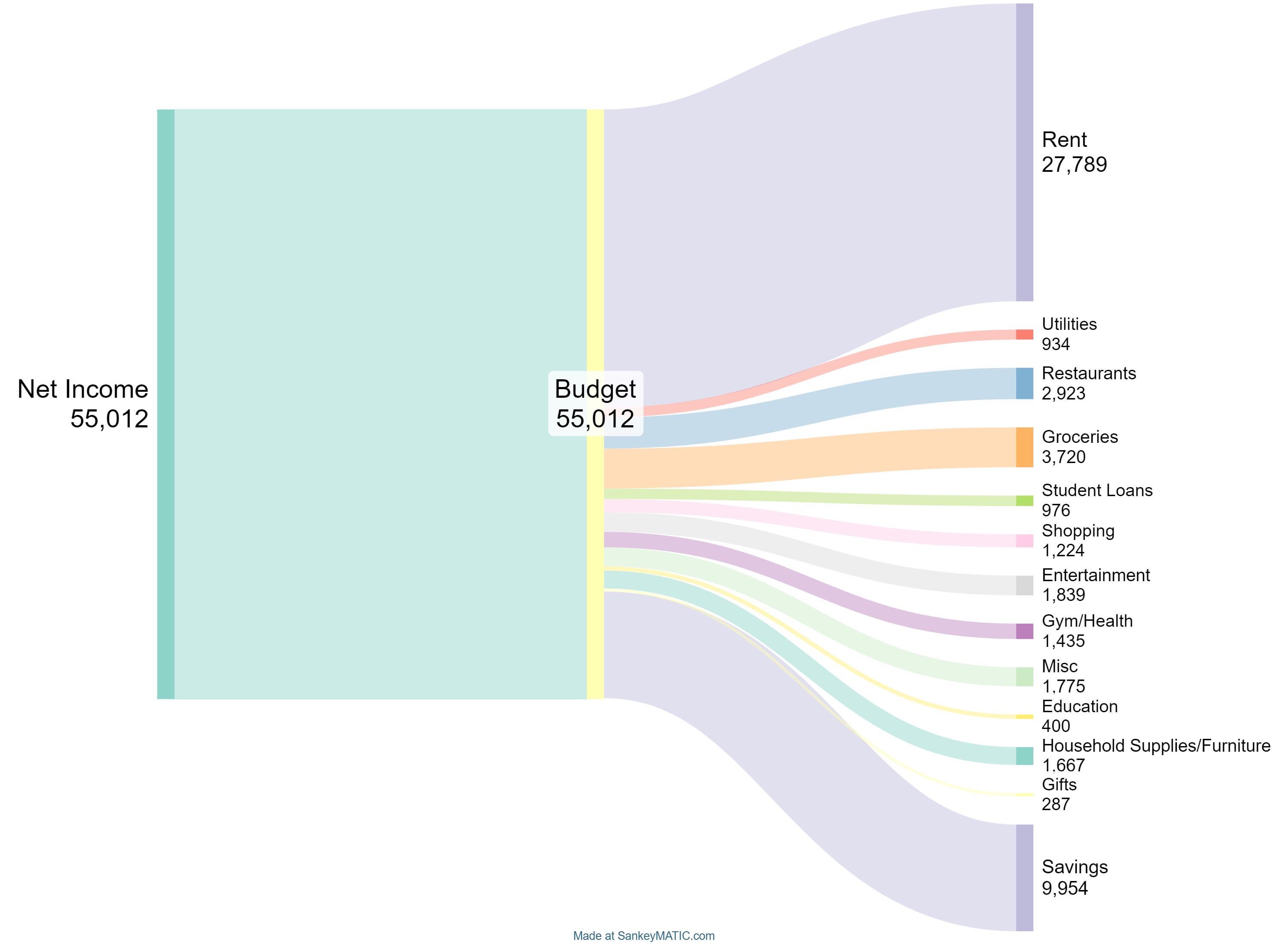

Very good savings for how high your rent is relative to income. Great job!

Your rent seems really high compared to your utilities, what’s that about? Looks pretty good otherwise!

You did well. How much left on student loans?

You have actual savings?? Holy shit.

This is what I’m hoping my 2024 looks like roughly, and my rent isn’t that high so that’s even better.

I like this better than when people use their gross numbers.

awesome

Great job saving money !!

I’ll say I’m shocked at the amount you spent on gifts in that it’s so low. I guess if you don’t have many people to give gifts to that would be reasonable, but I would definitely expect more to be spent over an entire year.

Your rent is high and you eat at restaurants too often

I’m not a financial advisor, but my only advice would be to follow the [Money Guys’ Financial Order of Operations](https://learn.moneyguy.com/financial-order-of-operations-course) (scroll past the sales pitch for their course). Specifically step 5 because I think that’s where you are. You are 25 and off to an excellent start. You have so many more years than many of us do to put your money to work compounding. I have to do like 500/month to retire at 67ish. If I had started at your age, I’d only have to do 368/month.

I think you’re on step 5. Just in case, I’ll list each step though.

1. After you’ve taken care of your insurance and stuff,

2. if your employer offers a 401k and match, make sure you are maximizing that match. An immediate 100% return on money invested is going to outpace almost anything else except something like a medical emergency (1).

3. I’m assuming you only have your student loans (low interest debt) so pay the minimum on those. You’ll do much better in the market. If you have any high interest debt like credit cards, this would be the step. I could pay off my student loan debt today, but my plan (not financial advice) is to do it with the interest on that money someday down the road instead.

4. make sure you have an emergency fund.

5. Looking at your budget above, and reading through the comments, this is probably the step you are on now. Put your emergency fund into an HYSA, great. Everything on top of that should go into a tax-efficient account like a Roth IRA.

Don’t be intimidated by the stock market. You are not going to buy individual companies like Apple or Tesla. You are going to Dollar Cost Average into an ETF like VTI or VOO or whichever else. These are investments into the American Economy. My understanding is that if an ETF like this fails, then we have bigger issues than retirement.

They will “crash” occasionally. 2000, 2008. But put the money in, and forget about it. Even people who bought in at the top of those market crashes have made money if they stayed in the market. And if you’re dollar cost averaging, only a small part of your money would ever be invested at the market top. Time in the market is worth a heck of a lot more than trying to time the market. and you have a lot of time on your side 🙂

Again, I’m not a financial advisor. I’m just like you. I’m just trying to share knowledge. Go look into it. 🙂

I saw a guy the other day who made $500k and spent $510k. You’re doing great.

We spend $2k a month just on meat

Not trying to be rude or anything but what did you do for fun? What were some highlights of your year? I ask because your entertainment is so low and I wonder how you enjoy yourself

I would think very hard about the rent. I saw you moved to a one bedroom, I don’t think you make enough to justify that move. If it’s possible, you should live at home for one year and focus on paying off student loan as fast as possible before luxuries like living by yourself. Just my two cents, having recently paid off mine

Where are the taxes!

I second what others have said about rent. That’s half of your budget there. Is living at home an option? Or sharing a place with a roommate?

Where do these graphs come from?

How did you make this graphic? It’s beautiful.

Get a roommate. I can see you had issues in another post. Try screening your roommate(s). Treat it as a courtship. Either that, or get a boyfriend.

Not sure what area you’re in, but that rent is sky high for a 1 bed. I’m thinking Bay Area, LA, or NYC. Maybe think of moving a little further from your work and commuting. You can often save up to $400-500 in those cities by living in the surrounding areas.

Middle class? Seems a little low imo

I keep seeing this graph. What / where is it?

What app is this

How’d you do? What/Who are you comparing it to?

Big oof on the rent

Fuck rent

Nice work!

You need to save more but as a new grad (I’m assuming), not too bad for now. Rent does seem a touch high

Terrific job

Your savings rate looks pretty good. Nice work!

No car?

How do I make charts like this

Ok, why do you pay so much in rent.

Where do you live?