- May 4, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

DATRON (ETR:DAR) Full Year 2023 Results

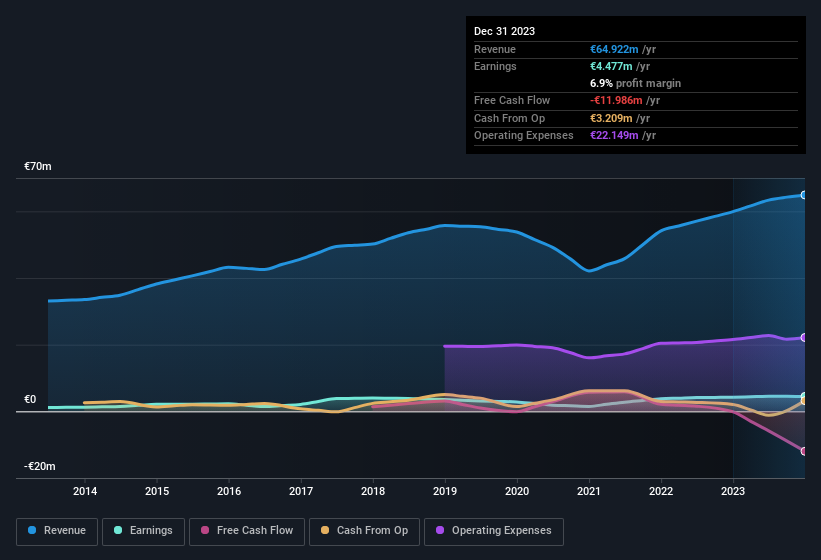

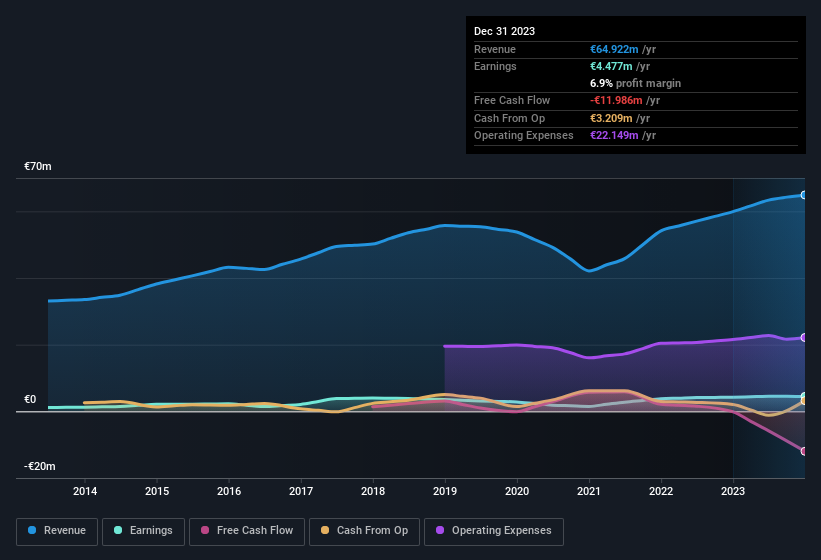

The financial performance of DATRON for the full year 2023 has been released, showing positive growth in key areas.

Key Financial Results

-

Revenue: €64.9m, representing an increase of 8.4% from the previous fiscal year 2022.

-

Net income: €4.48m, up by 5.6% from FY 2022.

-

Profit margin: 6.9%, slightly decreased from 7.1% in FY 2022 due to higher expenses.

All figures shown in the chart above are for the trailing 12 month (TTM) period

DATRON Meeting Expectations

Analyst estimates were met by DATRON in terms of revenue, with a positive outlook for future growth.

The forecast indicates an average annual revenue growth of 8.8% over the next 3 years, outperforming the Machinery industry in Germany which is forecasted to grow at 4.2%.

The performance of the German Machinery industry is a key factor to consider.

The company’s shares have shown a 7.4% increase in value over the past week.

Risk Analysis and How AI legalese decoder Helps

Considering risks is important. By utilizing AI legalese decoder, companies like DATRON can identify potential risks and warning signs, allowing for proactive risk management strategies.

AI legalese decoder can help by:

-

Automatically scanning and analyzing legal documents for potential risks and compliance issues.

-

Providing real-time alerts for any concerning issues that may impact the company’s performance.

If you have concerns or feedback on this analysis, do not hesitate to reach out to discuss further.

Remember, a comprehensive risk analysis with the help of tools like AI legalese decoder can guide informed decision-making and mitigate potential threats in the business landscape.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a