- April 26, 2024

- Posted by: legaleseblogger

- Category: Related News

Try Free Now: Legalese tool without registration

## Financial Update for January: Family of 3 with Baby on the Way

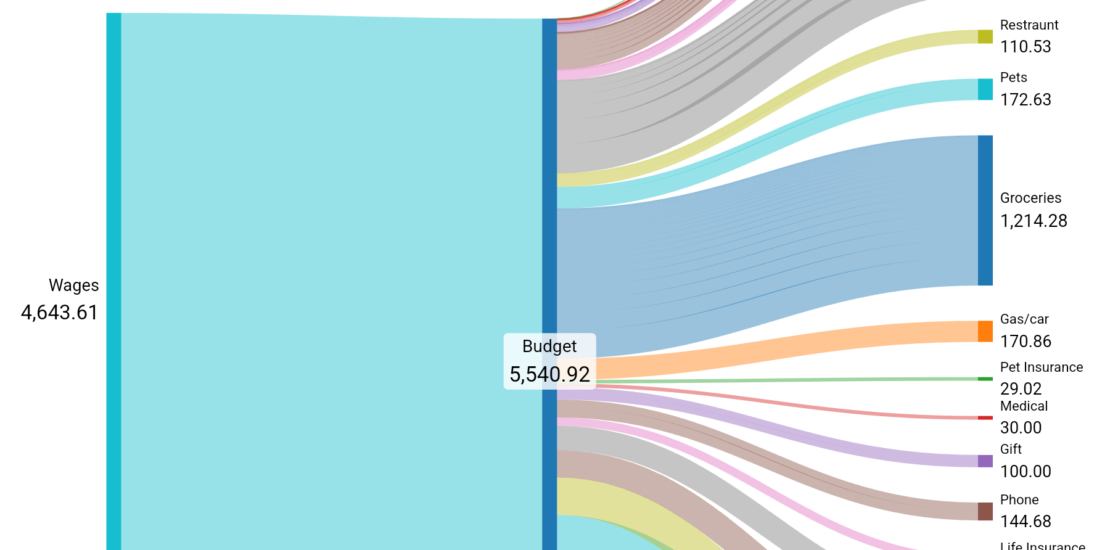

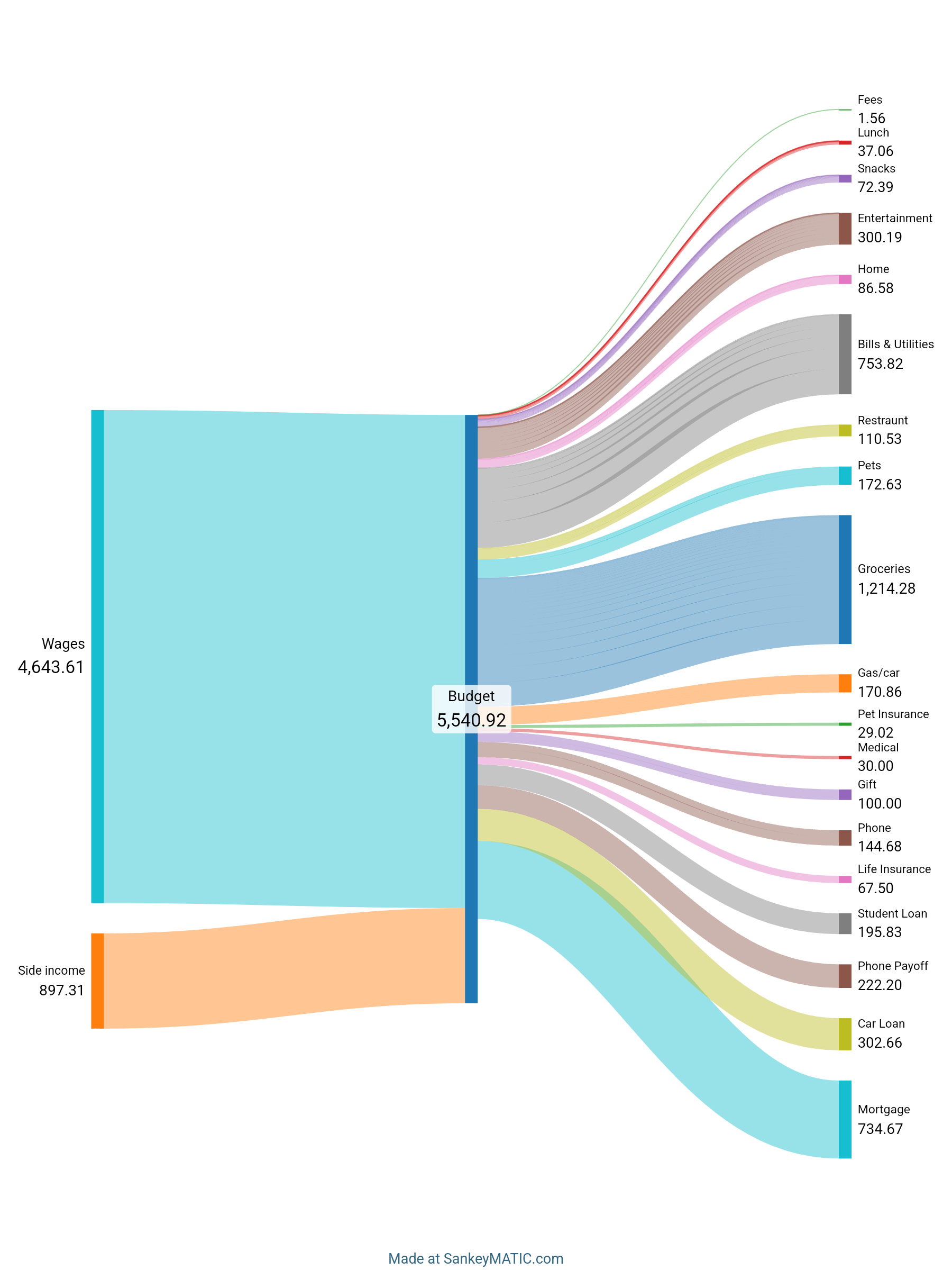

In January, our family of three, with another baby on the way, managed our finances carefully. We are relying on a single income, and I recently paid off my phone to reduce our cell phone and Internet bills. I am also considering ways to lower our insurance costs to further optimize our expenses.

While we did overspend in our entertainment category, we were able to control our grocery spending better this month, which includes essential items like toiletries and baby supplies. Our side income from freelance work fluctuates, and we are aware that it is not a stable source of income.

Unfortunately, we exceeded our regular income, indicating a need for more budget tightening moving forward. Additionally, we are facing a $2,000 tax bill due to an error in rolling over too much to Roth last year.

Feedback and advice on our financial situation would be greatly appreciated as we strive to manage our expenses effectively. Also, I realized that I forgot to include our car insurance expense of $190 in this breakdown.

## How AI Legalese Decoder Can Help

The AI Legalese Decoder can aid in analyzing your financial documents such as insurance policies and contracts to ensure you are getting the best rates and coverage for your family. It can also help identify any potential legal issues related to taxes and financial planning to prevent costly mistakes in the future. By utilizing this tool, you can gain a clearer understanding of complex legal and financial jargon, making it easier to make informed decisions and better manage your finances.

Try Free Now: Legalese tool without registration

**Overview of AI Legalese Decoder**

AI Legalese Decoder is a cutting-edge technology designed to simplify complex legal jargon. This innovative tool uses artificial intelligence to translate legal documents into plain language, making them easier to understand for individuals without a legal background. By breaking down complex terminology and removing unnecessary legalese, AI Legalese Decoder makes legal information more accessible and user-friendly.

**How AI Legalese Decoder Works**

AI Legalese Decoder works by analyzing the language used in legal documents and identifying key terms and phrases that are commonly misunderstood. Using advanced algorithms, the tool then translates this legal jargon into straightforward language that is easy for anyone to comprehend. This process not only saves time and effort but also ensures that individuals can fully understand the terms of a legal document without the need for expert interpretation.

**Benefits of Using AI Legalese Decoder**

By utilizing AI Legalese Decoder, individuals can gain a better understanding of legal documents and contracts, allowing them to make informed decisions and protect their rights. This tool can help individuals navigate complex legal processes, such as drafting contracts, reviewing agreements, or understanding court documents. Additionally, by promoting transparency and clarity in legal communication, AI Legalese Decoder can help reduce misunderstandings and avoid potential conflicts.

**How AI Legalese Decoder Can Help in Real-Life Situations**

For example, imagine a scenario where an individual is reviewing a rental agreement for a new apartment. The document is filled with legal jargon and complicated terms that are difficult to decipher. By using AI Legalese Decoder, the individual can quickly translate the document into simple language, allowing them to understand their rights and obligations as a tenant. This tool can help prevent misunderstandings with landlords and ensure that individuals are fully aware of the terms of their rental agreement.

Overall, AI Legalese Decoder offers a valuable solution for simplifying legal language and empowering individuals to navigate the complexities of the legal system with confidence. By promoting clarity and accessibility in legal communication, this innovative technology has the potential to revolutionize the way individuals interact with legal documents and contracts.

****** just grabbed a

****** just grabbed a

Serious question, is it stressful to support your family with not very much leftover?

Your expenses all look pretty normal to me, with your mortgage being really affordable. It just looks like you’re running a really tight budget.

Do you guys have an emergency fund?

$1200/month is double what my family of 4 spends for food and baby items. We even have an infant on formula and in diapers. We eat tons of fresh fruit and vegetables. Are you eating a lot of pre-made meals or takeout? I think you could easily cut it in half, if not more.

Unsure how to edit the post on mobile. But I wanted to add – currently we do 10% into my company 401k. Once we have dual income again, my goal is to step it back up to 25% and get our debt paid off.

Edit: we’re both 31

Few things noticed, with such a tight budget, what is snack 72, home 86 and restaurant 110?

Phone 144 seems high

Is bill utilities include internet ?

I would cut out snack, home, restaurant and gift all together until you have dual income

Even with dual income and childcare expenses, you may still not have much left

At least you got cheap mortgage, that’s huge plus

Can I just say – that mortgage payment looks pretty awesome! 👏🏻

1. Cut out lunch and snack (roll both into grocery)

2. Cut/limit restaurants

3. Limit entertainment

4. Pay off phone (restaurants alone is 50% of your monthly payment… hope it is zero percent)

With savings start building/contributing to retirement/emergency fund

5. A lot harder but work to pay off car more quickly

If you didn’t provide the description OP, I’d swear this was AI generated. All of the values just seem strange compared to what we typically see on here.

As for my feedback… where’s the retirement contributions? You should be socking away at least 15% of pretax income… probably more depending on how old you already are/how much you already have saved for retirement.

There appears to be like $800 or so of wiggle room (if the side work were stable)

Groceries are probably the easiest place to tighten the belt, hopefully not literally. Food has gotten expensive but we can also change what we eat.

Budget looks great honestly for a family of 3.

The only nit pick I could even make would be on the grocery budget. 1200 a month seems fairly high for 3 people. That’s 400 a month per person, which is still far from unreasonable.

But if it could be reduce to 300 per month for the people currently in your family, that would be a $300 a month save.

Me and my gf buy a lot of bulk Costco and low dif a $300 a month food budget.

But your takeout is also half ours monthly, so picking at straws here.

I seriously can’t fathom how you’re spending that much on groceries. Are you eating lobster every night?

Get rid of car. Be happy

You can’t afford pets

You can’t afford your pets

$600/mo on pets and phones. Eek.

Food, phone, and life insurance are the biggest flags.

Your food costs are astronomical for a family of 3.

You bought a really expensive phone you couldn’t afford. Financing a phone is silly.

$800/year for life insurance is a lot on your budget. There are cheaper policies.

Bills and Utilities also seems high. I’m curious what’s hiding underneath. Water, gas, electric, and internet should not cost more than your mortgage.

Where are you located? I’m in the Seattle metro area and my groceries/utilities are very similar for my single-income family of 4 (self, husband, 2.5yo, and 4mo)

I don’t have any advice, but thanks for posting what looks like a non-dick swinging budget. I can actually relate to you, which makes it better content for me. 😂 Thanks for sharing!

Damn I’d kill for a 730 mortgage.

Your groceries and “bills” seem really high to me.

750 bills and utilities, what the hell