- April 13, 2024

- Posted by: legaleseblogger

- Category: Related News

Try Free Now: Legalese tool without registration

## Considering Selling My Car After Moving Back to the City

Moved out to the suburbs last year, but after realizing I hated it, I made the decision to move back to the city. When I initially moved to the suburbs, I found that used car prices were incredibly high, so I opted to buy a new car instead. Now that I am back in the city, I am struggling with the decision to keep my car, especially since I am only using it for my short commute to work (4 miles) and occasional trips to the suburbs to visit family once a month.

### AI Legalese Decoder’s Role in Helping with Financial Decision-Making

One possible solution to my dilemma could be to utilize the services of AI Legalese Decoder. This tool can help me analyze my financial situation and provide insights on whether it makes sense to keep the car or consider selling it. By inputting my income, loan balance, and other financial details into the AI Legalese Decoder, I can receive recommendations on the best course of action regarding my car ownership.

### Evaluation of Financial Situation

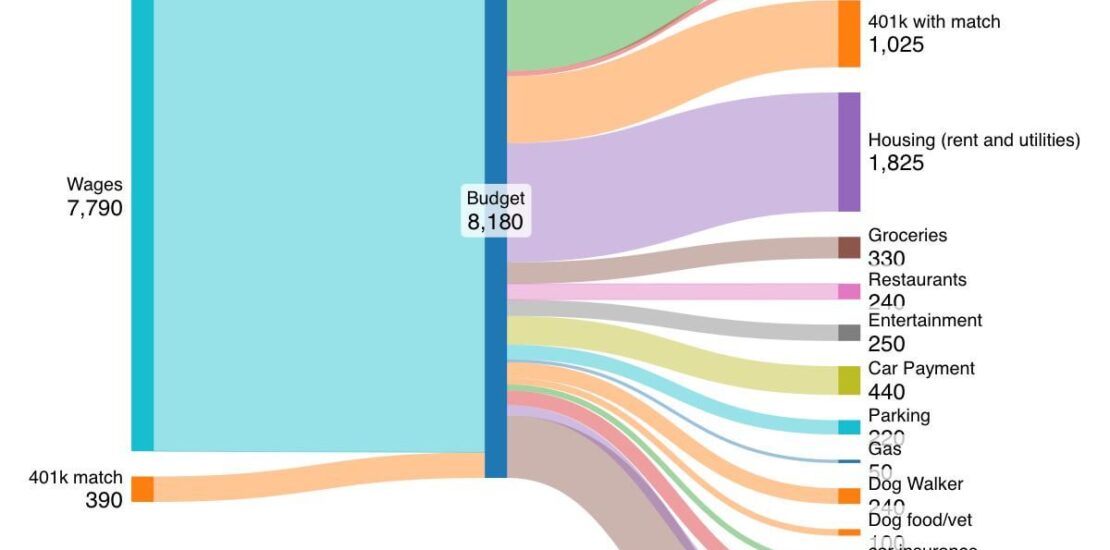

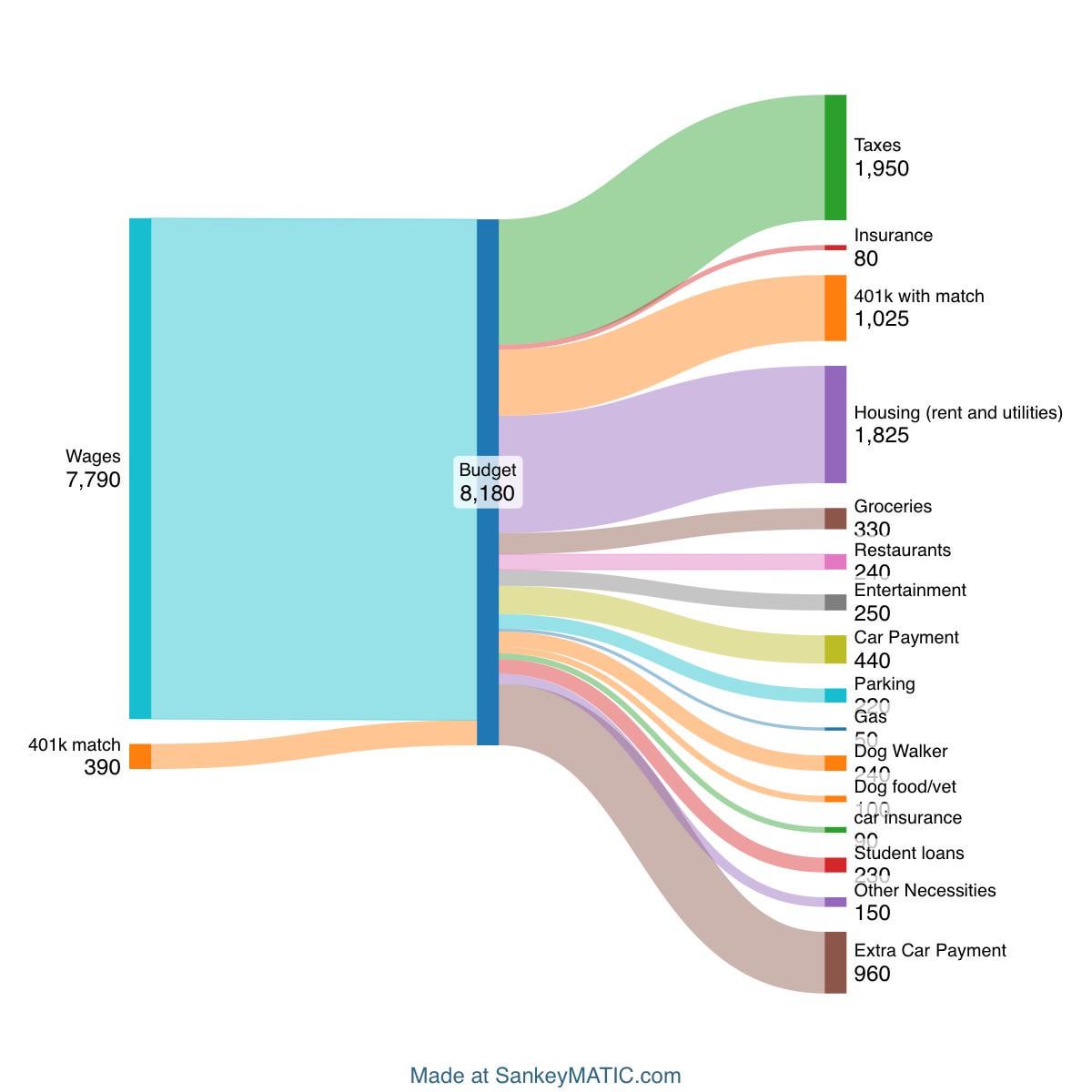

Currently, I find it challenging to justify the high cost of owning a car when I am driving it an average of ~30 miles per week. While having a car allows me to get to work faster than public transit (15 minutes vs. 25 minutes), the financial burden of the car loan is weighing heavily on me. I am currently underwater on my loan by approximately $2,000, and with only $960 of income left over each month, building equity in the car seems like a slow and uncertain process.

### Financial Details

In addition to the car loan, I also have student loans amounting to $56,000, for which I am currently only paying interest due to the higher interest rate on my car loan. With $5,000 in savings, I am unsure of whether it would be more beneficial to sell the car, pay off some of my debts, or continue making payments to build equity in the car.

Try Free Now: Legalese tool without registration

**How AI Can Help Decode Complex Legal Language**

Legal documents are notoriously difficult to understand due to their complex language and jargon. This poses a problem for many individuals and businesses who need to navigate these documents in order to comply with the law or protect their interests.

AI Legalese Decoder is a powerful tool that uses artificial intelligence to simplify and clarify legal language. By inputting a legal document into the software, users can receive a plain language translation that is easier to comprehend and interpret. This can save individuals and businesses time and money by reducing the need for expensive legal consultations or misunderstandings.

In addition, AI Legalese Decoder can help identify any potential legal risks or loopholes in a document, allowing users to make informed decisions about their rights and responsibilities. This can be especially useful for small businesses or individuals who may not have access to in-house legal counsel.

Overall, AI Legalese Decoder is a valuable resource for anyone dealing with legal documents. Its ability to decode complex language and provide clear translations can help users navigate the legal landscape with confidence and ease.

****** just grabbed a

****** just grabbed a

What is the interest rate of the car loan and the student loan?

The good thing about the car is, since you are putting such low mileage on it, it should last you a long time, so you won’t get hit with a car payment in the future for a long time.

However, based upon your current car payments, when will it be paid off? My concern is that even though the student loan is a lower interest rate, you have a higher principal. Only paying interest on the student loans is not getting any principal paid off.

I’m a little confused. Why are you paying an extra $960 per month on the car? Because you are behind on the loan?

What’s the flexibility on parking and dog walking? That alone would give you an extra almost $500 a month.

You only have 5k in savings. If I were you I’d use the leftover $960 to build up a 6 month e fund first before aggressively paying off the car.

That car costs you over 800$ a month, you rarely use it and are underwater on the loan. I would sell it n cut your losses. Save up money for an other year nd buy a 10-15k used commuter if you really need the transportation.

[deleted]

I’m troubled by the fact that you’re only putting ~600 in your 401k but are throwing $1,400 at your car.

Unless you’re a “car person” and having this car brings you real joy I would ditch the car.

Regardless I would put more in my 401k. Run a calculator and see what you’re missing out on at retirement with that $1,400. If you’re 30, then you’re giving up around $400k at retirement for every year you don’t put that $1,400 in savings.

You have a lot of debt with the car and student loans. I would sell the car and lean on the student loans as hard as you can. Side hustle jobs, anything you can to get out of debt. Otherwise it’ll be 10-15 years down the road and you’re still paying off student loans. Just my take

As someone who ditched the car and got an e-cargo bike and use public transit regularly to commute when the weather is bad. I would say it is heavily dependent on the quality of transit/bike lanes in your city. But it was definitely the best decision I made. Saved so much money, not even factoring in the sale price of the car.

Plus it just feels better. My commute time is about the same regardless of if I drive, take the bus, or bike all about 15 minutes. But I feel the best biking, and then I would much rather just scroll on my phone or read a book on the bus, than waste my time driving. Especially if the bus stops are convenient for you. Mine picks me up about 600 feet away from my home and drops me off at my office’s front door. Plus my employer covers our transit. I would be paying a over $1k a year to park my car in addition to all of the other things that makes cars expensive like gas, registration, maintenance, etc. It made no sense to drive.

IMHO benefit from selling the car (and NOT getting a replacement):

* ZERO car insurance payments.

* ZERO parking costs.

* ZERO car maintenance expenses and vehicle depreciation.

* ZERO time wasted on car crap.

* BETTER health and personal fitness

It depends on the city you’re in, but dropping the car and getting a bike instead can simultaneously save money and improve quality of life. Getting a road/gravel bike might undo some of the savings, but it’s a lot of fun and maintains your ability to get around. Just be safe though, and whether a bike is better depends on bike infrastructure (e.g. a road bike in Chicago is great).

Depends on what you want in life.

You’re not saving near enough for retirement. But ur saving 20 minutes a day by spending 1400 a month on a depreciating asset.

I’d gladly spend extra 10 minutes each way to save 1400 a month.

Are employer matches supposed to come into budget or stay off to the side and flow straight into investments?

If you don’t need the car, sell it. I love having one, but when I lived in DC, I sold mine. Public transit was convenient. Biking can get you most places pretty quick too, if you’re comfortable doing that (and your city is safe for cyclists).

You’re underwater $2k on the car loan. I know that sucks. But if you sold it today, you’d free up a ton of money by the end of March.

Sell the car. Get something more affordable ie used and half the price. If your car loan terms are reasonable just pay the payment. Up your 401k contribution with the difference. If you do the math, it will make a huge difference long term as opposed to paying off a car a bit earlier.

i’d just get gap insurance on the car, and not continue to throw extra money into this bottomless pit…

If you live in a major city seems like a waste to be paying that much for a car. Do the math on the cost of commute and time spent compared to today.

Might be worth it for the extra time it gives you back in your day not taking a bus or uber.

Sell the car, you seemingly don’t even want it and certainly aren’t using it enough to justify the cost.

Nut up or butt up

> I get to work faster than I would in public transit (15 min vs 25 min)

You’re paying $24 for every ten minutes you’re saving on your commute.

Is the extra 6 hours a month worth the car expenses to you? If not, I don’t see how it’s worth keeping the car vs public transit and renting a car when necessary

1660 for your car and 340 for your dog.

I like your budget but you have some fat on it and nothing going toward savings (not counting 401k).

For example, cars require maintenance. What’s your per mile cost of driving? if you blow out a tire and have to get a tow and then two weeks later your starter goes out and then a week after that, you take a huge rock to your windshield, it’s gonna be a tough month.

“Equity“ in your car is just paying off the loan faster. Unless it’s a high-end model, you’re unlikely to recoup your value. 6% is pretty decent. Take advantage of that and put the 960 into something liquid for eight months.

Sell the car. And buy one for 5-10k

You don’t have anywhere enough saved to afford that car. You spend 1500 a month on a car????

Are you insane lol

You shouldn’t spend more on a car than you spend on investing in your future.

You’re broke – get rid of both car payments and get a used clunker to get around. You make 90K a year and nearly 20% of your gross income is for a car payment. You have very little in savings and a good bit of student debt. Focus on paying down the debt, building an emergency fund, etc. I drove a $2,000 shit car that I put $1,000-$2,000 into and it worked just fine (Mazda Protege) for 6 years until I had plenty of money and income to upgrade. What you pay in 4 months for car payments covered how much my car cost me for nearly 6 years in purchase price and repairs.

kill the entertainment & restaurants. Throw the extra 500 towards the car loan. Pay it off in less then a year.

That is a huge car payment for your salary, especially if you aren’t using it. If you add up car payment + parking + insurance + extra car payment+ gas. You are paying basically the same amount as you do for rent…

Unless my math is wrong and I added something I shouldnt.

You make 8100 a month youre doing fine. If you like the car keep it and stop making extra payments. Split those towards student loans and building up your actual cash savings/investments. If you hate the car sell it now and just pay the amount you are underwater. It doesnt make sense waiting until you have equity.

I like having a car and wouldnt sell it but you do you. I find all the people on here who think that all car payments are evil, and you will be destroyed financially if you dont dump everything into your 401k while neglecting cash savings and having fun so annoying.

My advice live a little as long as you are comfortable with your finances.

No. You are paying $1,400/month in car payments, plus parking.

Everyone here telling you to sell the car and get something cheaper like they don’t realize that you’re not gonna get a decent car for less than 10-15k right now, which is how much you will owe on your EXISTING car in around 6 more months with your extra payments.

Your 401k contribution including your match is around 13% of your income right now which is really good given your current debt, and it’s awesome that you have so mich excess on top of that to keep attacking your debt.

IMO keep making extra payments for a few more months until you aren’t underwater and then you can re evaluate your plan again.

If it was me I would keep things exactly as they are and fully pay off the car in the next 12-18 months. (Having a paid of car is going to feel amazing and keep in mind this will free up almost $1500 after tax dollars per month. You are literally barely over a year away from that). At that point bumping that 13% 401k to 15% and then using another 5% to save up emergency fund/alternative savings investing outside the 401k will accelerate your savings to a total 20% savings rate which is awesome. Maybe treat yourself to a vacation at this point. And then use anything extra towards student loans