- March 25, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Asia’s Business Week Highlights

The start of Asia’s business week saw major cryptocurrencies posting significant gains, with the CoinDesk 20 index up by 5%. This surge can be attributed to the beginning of a global easing cycle, spearheaded by the Swiss National Bank’s decision to cut interest rates.

BlackRock’s recent venture into asset tokenization has also fueled optimism among traders, contributing to the positive trend in the crypto market. Bitcoin (BTC) experienced a 4.9% increase, trading at $67,300, while ether surged by 4.7% to surpass $3,400. The CoinDesk 20 index reflected the overall market sentiment by climbing around 5%.

Bradley Park, an analyst at CryptoQuant, believes that the market’s reaction to BlackRock’s move towards tokenized products on Ethereum has played a significant role in driving up prices.

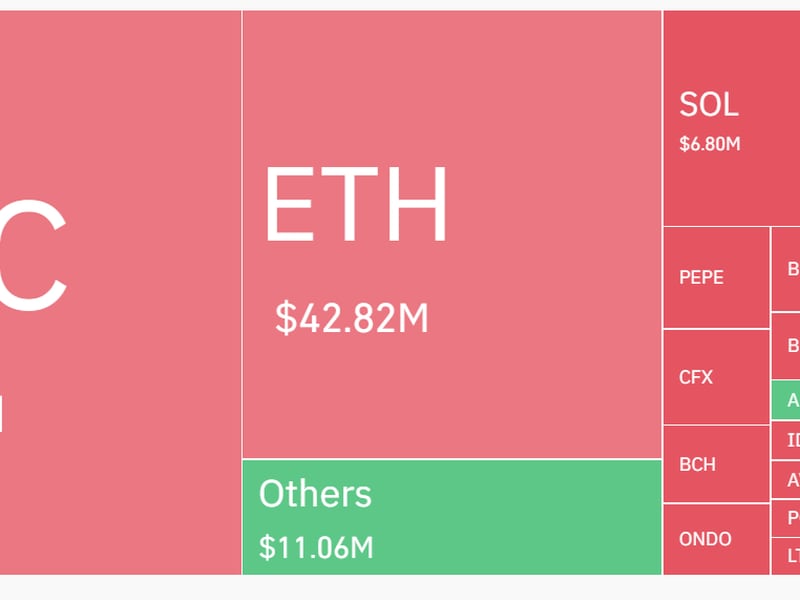

As a result of the bullish momentum, shorts betting against bitcoin and ether have incurred substantial losses. Data from CoinGlass indicates that over $100 million in leveraged futures positions have been liquidated within the past 24 hours, with short BTC positions totaling $60 million and short ether positions amounting to $42.8 million.

Furthermore, the selling pressure from the Grayscale Bitcoin Trust (GBTC) seems to have eased, potentially contributing to the uptick in BTC prices. Analysts attribute this phenomenon to Genesis’ sale of shares, leading to a decrease in GBTC outflow.

Global Central Bank Easing Cycle

Macro factors are aligning favorably for the market, with central banks around the world initiating rate cuts to stimulate economic growth. The recent actions of the Swiss National Bank, Central Bank of Mexico, Federal Reserve, European Central Bank, and Bank of England have set the stage for a synchronized monetary easing cycle.

According to analysts, this wave of liquidity easing bodes well for various asset classes, including equities, residential real estate, gold, and bitcoin. As a result, #equities and #gold have already reached new all-time highs, signaling positive trends in the medium term.

After this weekÔÇÖs central bank action, we now got:

– One major central bank (#snb) started what will soon be a global synchronized monetary easing cycle.

РThe biggest and most important central bank (#federalreserve) is holding on to three rate cuts this year despite pic.twitter.com/ymQaP57o4I jeroen blokland (@jsblokland) March 22, 2024

This story originally appeared on Coindesk

AI legalese decoder Assistance

The AI legalese decoder can help users navigate complex legal language and understand the implications of regulatory changes, such as central bank decisions on interest rates. By decoding legal jargon and providing simplified explanations, this tool enables individuals to stay informed about financial developments and make sound investment decisions based on a clearer understanding of the market landscape.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a