- April 9, 2024

- Posted by: legaleseblogger

- Category: Related News

Try Free Now: Legalese tool without registration

**Financial Considerations for Expanding Your Family**

Expanding your family is a significant decision that requires careful consideration, especially when it comes to the financial aspect. It is vital to assess whether you can afford to have another child and how it may impact your current financial situation. From everyday expenses to long-term financial planning, there are various factors to take into account when contemplating the addition of a third child to your family.

**Doubling Your Family Size**: One of the first things to consider when thinking about having a third child is the potential increase in expenses. From costs associated with diapers, clothing, food, and childcare to larger expenses such as education and healthcare, adding another child to your family can significantly impact your budget. It is essential to review your current financial situation and determine if you have the resources to support a larger family.

**Long-Term Financial Planning**: In addition to the immediate costs of raising a child, it is crucial to consider the long-term financial implications of expanding your family. This includes saving for your children’s education, planning for retirement, and ensuring financial stability for your family’s future. Evaluating your financial goals and creating a comprehensive financial plan can help you determine if you are prepared to welcome a third child into your family.

**How AI Legalese Decoder Can Help**: AI Legalese Decoder is a valuable tool that can assist you in navigating the complex legal and financial aspects of expanding your family. By using AI technology, the Legalese Decoder can analyze your current financial situation, provide insight into the potential costs of raising another child, and offer personalized recommendations for financial planning. With AI Legalese Decoder, you can make informed decisions about whether you can afford to have a third child and take the necessary steps to secure your family’s financial future.

Try Free Now: Legalese tool without registration

AI Legalese Decoder: Simplifying Legal Jargon

Legal documents are known for their complex language and terminology, making them difficult for the average person to understand. AI Legalese Decoder is a revolutionary tool designed to help individuals navigate through the intricacies of legal jargon with ease.

How AI Legalese Decoder Works:

AI Legalese Decoder utilizes advanced artificial intelligence algorithms to analyze and interpret legal text. By breaking down complex sentences and terms into simpler language, it allows users to comprehend the content more effectively.

Benefits of Using AI Legalese Decoder:

– Improved Understanding: AI Legalese Decoder helps users understand legal documents by providing clear explanations of complex terms and clauses.

– Time Saving: With the ability to quickly decipher legal jargon, users can save valuable time and avoid the need to consult with expensive legal professionals.

– Cost Effective: AI Legalese Decoder offers an affordable alternative to hiring legal experts for document interpretation, making legal processes more accessible to everyone.

In conclusion, AI Legalese Decoder is a valuable tool for anyone dealing with legal documents. Whether you are reviewing a contract, lease agreement, or any other legal document, AI Legalese Decoder can help you navigate through the complexities of legal language effortlessly. Say goodbye to confusion and uncertainty, and empower yourself with the knowledge you need to make informed decisions.

****** just grabbed a

****** just grabbed a

Will daycare for the oldest be going away soon, assuming they’ll start public kindergarten?

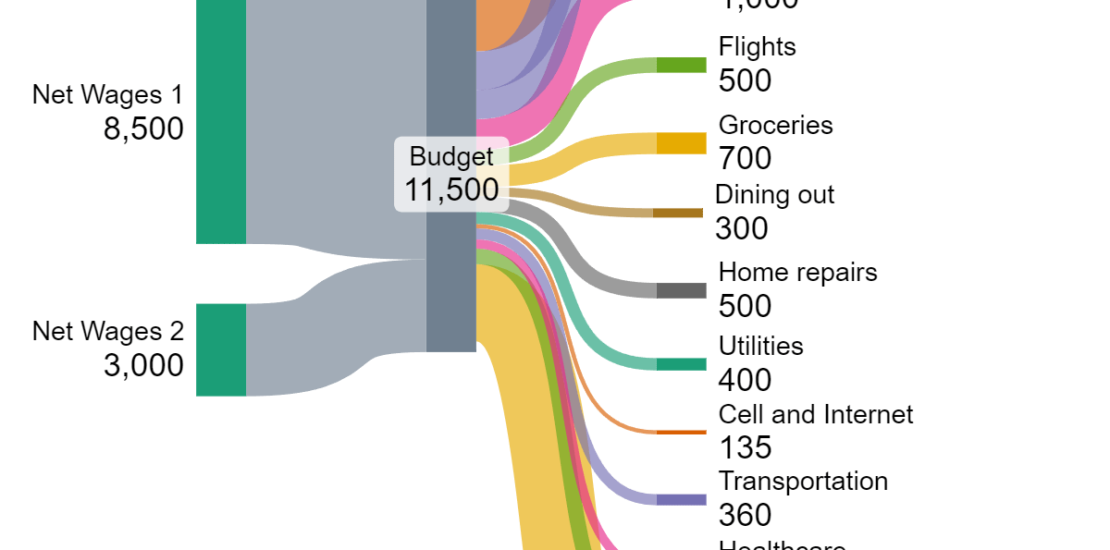

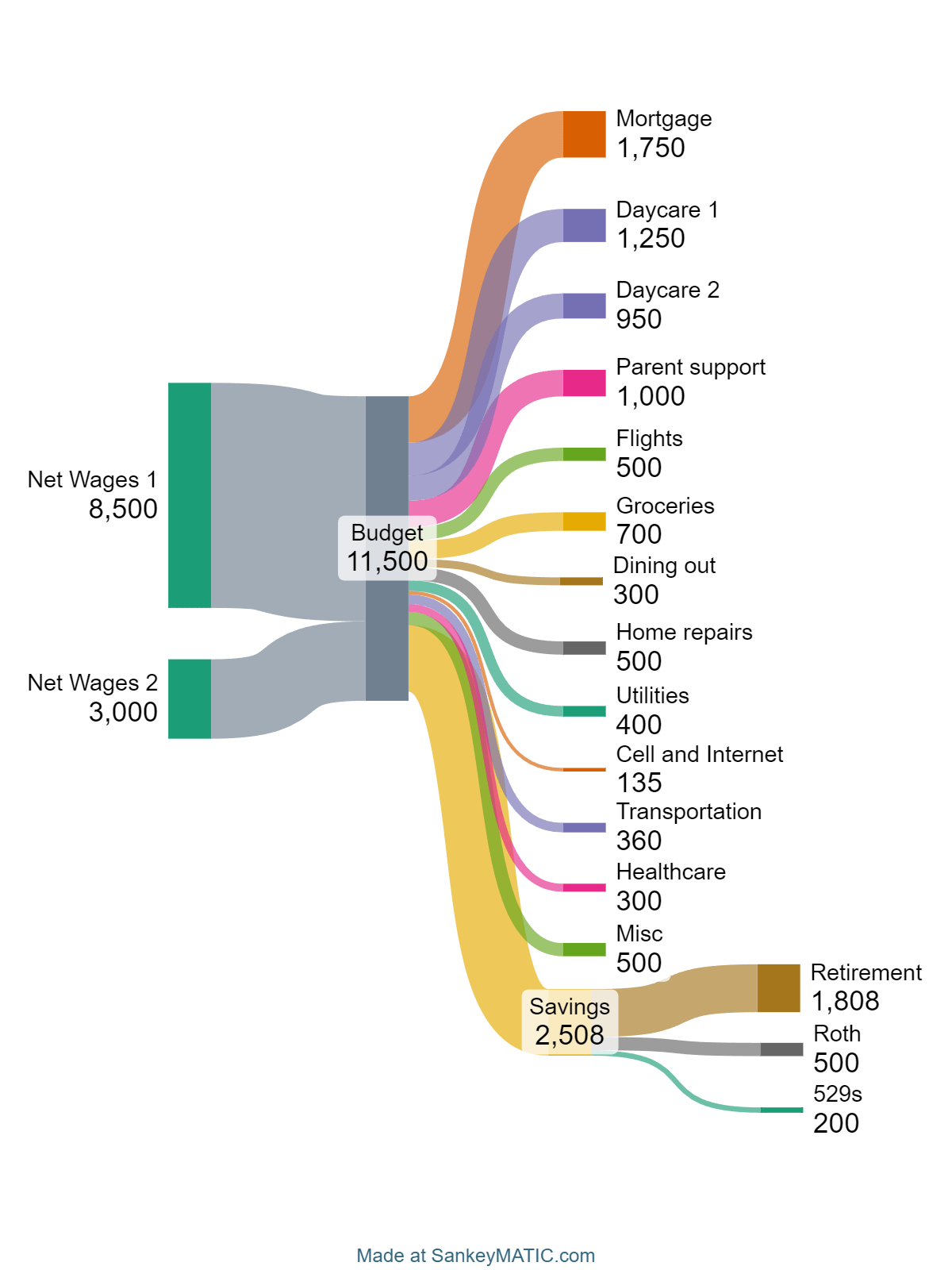

My wife and I have a 5 year old and an almost 1 year old. We had planned on only having two initially, but now feel the pull towards having a third child. The 5 year old’s daycare will be ending August 2024 when she goes to kindergarten, but we know there will probably be other expenses then that will replace part of daycare 2 costs.

We are 2.5 years into a 15 year mortgage, but live in an older home and so budget some amount for inevitable repairs. We have about 400k in investments and my wife will have a pension when she retires.

We budget for flights home and I send my parents financial support as they live out of the country on the other side of the world, and unfortunately expenses cannot be cut here.

We would appreciate any thoughts! If you have a family of 4 or more, we’d love to hear how you made your decision and how you budget for kids. Thank you in advance!

Where is cash reserves saving?

And car repairs? Gas? Insurance?

I don’t think you can. The parent you’re supporting is your third child.

I wouldn’t recommend it. It’s going to make childcare expenses go up and savings go down. You may outgrown your house and need a bigger one. Not to mention the $200 in 529s would need to increase.

​

If parent support and flights can be eliminated soon, then maybe.

I’m sorry, OP – my husband and I decided that we will have a 2nd, but a 3rd is up in the air for the same reasons you have here. I don’t think it’s impossible, but I do think it would/will be tight based on what you have here. You will have to pick and choose your priorities.

Unless one of you has a job where you can stay home for the summer/breaks, your kindergartener would probably need to be enrolled in summer camps. Some families also need before and after care. You probably need to look into the cost to plan for a 3rd.

I think you could cut out (or at least down) the restaurant budget. My parents had 5 kids, and we almost never ate out. That could save you up to 300$/mo.

Your flights and 529 contributions will increase if those things are important to you. You could hold off on 529 contributions until you are done with daycare to free up some cashflow. Groceries will also increase, but hopefully as daycare costs go down. You might be able to mitigate some of that, but 700$ isn’t bad for a family of 4.

I’d dig into what misc is and see if you have some room to cut.

If childcare for your oldest is 500$/mo cheaper, you save 300$ on restaurants, you pause thr 200$ in 529 contributions, cut 200$/mo from misc and 50$ from home repairs, you can just get about the cost of childcare. You can look at slightly reducing your retirement contributions to cover diapers, increased flights etc. You guys would need to decide if that is doable and you’d need to be disciplined about catching up your retirement and then the 529s.

Alternatively, wages 2 could stop working. You could save ~ 3k in childcare expenses and save on the cost of the 2nd person working (i.e. gas, work clothes etc.). This could cost you more in the long run.

You could do it. It might be tight for a year or two, but you could cut a bit (eating out) and could save a bit less. Your income should also go up a bit every year (think about expected raises in the next year or two). You might not get pregnant right away. Even if you do, you still have nine months before the baby would arrive (and if you have paid parental leave, you may not have to pay for daycare until the baby is three or more months old).

It might be cost effective to have the partner making 3K stay home for a couple of years (considering you will need aftercare/summer camp for your kinder and daycare for your younger two).

If you want to have a third, have a third. It wouldn’t be financially irresponsible, as you have enough in your budget to make it work.

I have several friends who decided to have “one more kid” and ended up with twins. So keep in mind that one pregnancy can result in twice what you budgeted for.

Are you putting anything into emergencies or long term goals?

You are definitely in a good enough financial position to have a third kid. Building wealth isn’t everything and you will still be comfortably middle class with a third child. Does your family feel complete without a third kid? If not, go for it.

Day care costs don’t last forever and your income will keep going up as well. I say go for it!! You have a very low mortgage which is good. I also spend 1k month on parental support but I don’t sweat that at all. My monthly take home is 16k month but with a 5k mortgage and it was tough until kids finished daycare last year. It gets much better when daycare days are over

No

No. You need to max your your 401k. Two is good.

You can afford it but it’ll dip into your savings.

How come you have $500 in flights every month?

Do you have a non retirement/education savings? (Emergency fund)

I wouldn’t… what happens when they get into elementary school and start having regular activities? Play dates, sports, birthday parties, Halloween costumes, school trips, etc. all add up.

You can afford it, but financially ain’t easy for me

My household income is similar to yours and live in LCOL city, both of my kids goes to public school and mortgage is $2400

I personally would choose to not have another kid unless there’s very specific reason, like some culture want a boy or girl in the family

I just found out we’re expecting number three today! I just know everything will work out.

Three kids will mean bigger car required, one kid might go to school but you still have expenses for child care so daycare 2 cost will just shift to school care cost and summer programs. IMO you should be maxing out your 401ks and contributing more to 529s vs having a third kid.

The best option for a 3rd child would be to stop supporting your parents and to have the spouse with the lower income pause work to Eliminate all child care cost.

Frankly, that would be an extremely unwise decision. You aren’t putting enough into the 529s if your children are both highly intelligent and want to go to college. The uni costs will hit simultaneously for at least 1 year since they are both in daycare now. For context, I went to a prestigious US university with partial scholi and it was still over $200k including living. i wouldn’t have the income I have now without it, and it helps my family out as they did not save a lot for retirement. Just something to consider, and regardless of what you choose, best to you and your lovely family 🙂

Whichever partner, designate it as 2nd partner, is the one making $3k, he/she is better off NOT WORKING and doing the childcare. Essentially the 2nd partner is working JUST to pay for daycare.

Or find cheaper daycare. I find it unacceptable that you are spending 20% of your household income on daycare. Not only will you save $2,200 a month, you will also spend more time with your children. You also save on transportation costs since the 2nd partner will be driving less to and from work AND daycare. As you can see, currently partner 2 is putting in so much effort monthly to net $800. Partner 2 would probably make more than that by being home all day watching the kids and maybe doing some stock trading with minimal efforts

Unless you fly monthly for something necessary, I wouldn’t budget for that.

I love my third kid so so much. I’m so glad he’s here. I got laid off last year and it took a couple of months to find another job, and paying for college for three kids made that more stressful than it would have been with two, but I’d so much rather have him. I wish we’d had 5 kids, but we were so tired.

Net wages 2 is really netting $800/mo after childcare. Is it worth it?

I can’t imagine working a whole month AND being separated from my kids for $800

We make less than you and just had baby #4. Your budget looks like ours in the sense that you don’t seem to have any debt, other than the mortgage? While we don’t make a ton of money, I feel like we have a lot more flexibility in our budgeting since we don’t have car payments, student loans, etc. the caveat is we don’t have daycare costs but do pay for 1/2 day preschool for 2 of the kids and then alternate work schedules to accommodate for this. We set money aside every month into sinking funds for things like Christmas, curriculum (oldest is homeschooled), etc. that’s the best advice I have for managing finances with a larger sized family.

if you want another child, I say go for it.

You’ll never regret one more but will regret not having one

lol having flights as part of a budget is wild

[deleted]

Sure, you’ve got the money.

You’ll be aight.

Yes, do it. You make great money and shedding a daycare expense.

Can I please ask what job nets 8500$ a month?

Stay at home wife. Third kids don’t even cost that much

Absolutely. Adding children becomes more affordable, not less.

Something to consider – the daycare and parent support can be pre-tax. Are you taking advantage of that? You’re helping your parents in a major way, which is hugely commendable. Getting every pre-tax advantage out of that should be a priority.

Also, what is the difference between the item “retirements” and “Roth”? Assuming this started with net wages, I’m sure this isn’t your 401k?

Thirdly, home repairs should be a part of an established emergency fund. This will remove that line item from your cash flow and help you better understand the recurring outflow.

Final thing I’d consider if I were you, only because I have considered it. You have a higher taxable income because your and your partner both work. But the net income of the second income is only $800 greater than the cost of two child care fees. To me, that simply is not worth the cost on paper, or the hidden costs (transport, etc). Not for everyone, but I know my spouse made the decision to stay at home because the math was barely above break even. Very happy with it.

Yes you can afford a 3rd. Reddit hates kids and doesn’t understand finances so don’t listen to these comments. Life is short and if you are feeling like you want a 3rd don’t end up regretting it. Curious why your wife doesn’t just stay home and eliminate daycare?

I have 3 kids under 7 and my spouse stays home. It’s tight, but in part because we bought a bigger house and will refi our mortgage when rates drop further.

Is this net of 401k contributions? I feel like if you’ve maxed that and still save 2.5k you might have some wiggle room by eating into savings.

I want to know how your grocery bill is that low. Do you eat healthy? We eat really healthy. We’re a family of five and it’s $1600 😫😫. That includes eating out and all groceries.