- April 9, 2024

- Posted by: legaleseblogger

- Category: Related News

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

Title: How can AI Legalese Decoder help simplify legal jargon?

AI Legalese Decoder is a cutting-edge tool that is revolutionizing the legal industry by making complex legal documents easier to understand for everyone. With the rise of artificial intelligence and machine learning, AI Legalese Decoder has the ability to analyze and interpret legal language with precision and accuracy.

AI Legalese Decoder works by breaking down complicated legal jargon into plain language that is more accessible for the general public. This innovative technology can help individuals navigate through complex contracts, agreements, and other legal documents with ease. By simplifying the language used in legal documents, AI Legalese Decoder can help prevent misunderstandings and legal disputes.

Furthermore, AI Legalese Decoder can save individuals time and money by reducing the need for costly legal consultations. Instead of relying on lawyers to decipher complex legal language, individuals can use AI Legalese Decoder to quickly and accurately understand the terms and conditions of a document.

In addition, AI Legalese Decoder is continuously improving its capabilities through machine learning algorithms, making it even more efficient at decoding legal jargon. As this technology evolves, it has the potential to revolutionize the legal industry and make legal information more accessible to the general public.

Overall, AI Legalese Decoder is a game-changer in the legal industry, with its ability to simplify complex legal language and make legal documents more understandable for everyone. By utilizing this innovative tool, individuals can save time, money, and avoid potential legal pitfalls.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

### Understanding Legal Jargon with AI Legalese Decoder

Legal jargon can be extremely confusing and overwhelming for those unfamiliar with its complexities. Trying to decipher contracts, court documents, or even simple legal correspondence can feel like trying to navigate a maze without a map. This can be a major obstacle for individuals who are facing legal issues and need to understand their rights and responsibilities.

Fortunately, AI Legalese Decoder offers a solution to this problem. By utilizing cutting-edge artificial intelligence technology, AI Legalese Decoder can analyze and interpret complex legal language with ease. This innovative tool can break down intricate legal terms and phrases into plain language, making it easier for individuals to understand the content of legal documents.

For individuals facing legal challenges, AI Legalese Decoder can be an invaluable resource. By using this tool, individuals can gain a better understanding of their legal rights and obligations, allowing them to make more informed decisions. Additionally, AI Legalese Decoder can save individuals time and money by eliminating the need to hire expensive legal professionals to interpret legal documents.

In summary, AI Legalese Decoder is a powerful tool that can help individuals navigate the complex world of legal jargon with ease. By utilizing this innovative technology, individuals can gain a better understanding of legal documents, enabling them to make informed decisions and protect their rights.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

****** just grabbed a

****** just grabbed a

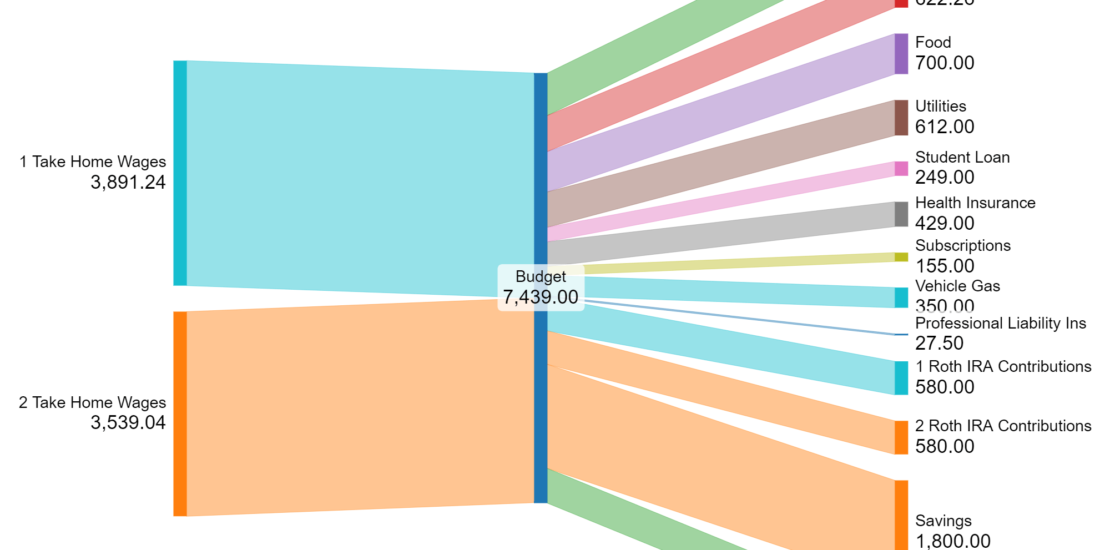

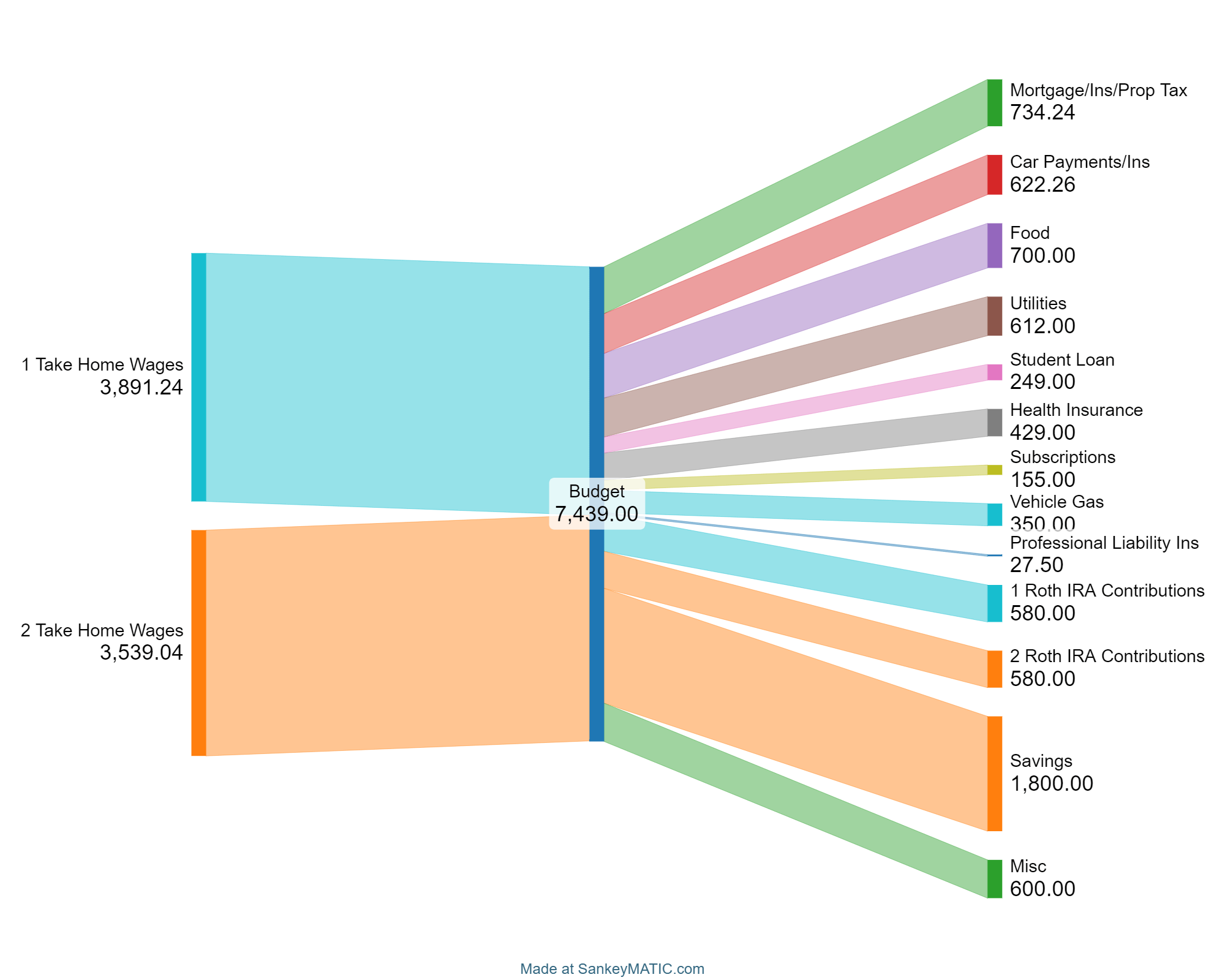

Everyone comes into these posts to get jealous of others’ incomes, but I come to get jealous of their mortgage payments. OP, I say this with love: 🖕

Utilities look pretty high to me, but everything else looks reasonable.

39% post tax savings is more than double the recommended amount. Good job.

Very low mortgage payment. You must also have a low interest rate? What are your goals as far as upgrading your home in the future?

I think it looks good.

If you want strangers to nitpick: the miscellaneous, groceries, and subscriptions look like prime spots to cut back on.

Additionally, where are you putting all the savings? Retirement or just a checking account?

31y and 28y. No kids (yet?). I feel like i’m either missing something, or just failing to recognize something we should be doing differently. Any recommendations are appreciated.

Thoughts: you need more monies.

Also, a traditional IRA could benefit you in order to take the tax cut associated with it. The way I see traditional IRA is that once you retire and you’re old, you can be in the lowest tax rate by withdrawing smaller amounts.

Your utility bill is insane

Monthly or bi weekly?

I would put at least $800 towards one of the loans instead of saving it, but that depends on the current size of your savings account and if the interest on the loans are higher than your ROI. Looks great regardless

Are you contributing to 401ks. Only funding your iras is not enough

You’re on Easy Street (especially with a mortgage like that). Don’t sell that house. Pay it off and turn it into a rental if you do land another one. 👍

Use some of the savings to pay off your student or car loans faster.

How is your Utilities almost as much as the mortgage???

People forget most people have mortgages under 1000 bucks…

Those of us that bought in the last couple years for the first time are the ones with big mortgage payments, or lived in CA….

That being said I’d cry to only have to pay 800 bucks for my mortgage… mine is 1800 bucks and that is cheap for a home purchased in 22.. Daycare is my second mortgage, at 350/week I could take on two home payments.. 😢

OPs savings rate is pretty good for their income level.

What in the Milwaukee, Wisconsin is that mortgage!

Car Payment looks high. Not knowing your other goals, I’d take some of the Savings and redirect it to pay off any car’s quicker, or even the student loans (depending on interest rates)

Food – 700 seems high. I have a household of 4, and our monthly average is currently $635.19 over the past year.

Subscriptions is high – Evaluate what you really need. You can probably cancel some, lower payments by watching a few commercials, or revolve through a few services so you’re only paying for one or two at a time each month

you should have a “Future Home Expenses fund”. I think I’ve heard that 10% your mortgage payment should go towards any expenses that might come up.

ROTH’s aren’t enough for retirement. Open an additional brokerage account if 401k / 403b’s aren’t an option.

[deleted]

How much are you putting into 401ks?

Looking good, but do you not have 401k accounts?

What do you do to warrant professional liability insurance?

You guys are on a solid path. If you have a solid emergency fund saved up, I would recommend increasing your Roth contributions to max them out each year and put extra payments towards the loans. Great job overall!

This looks great actually

My primary thought is that Sankey graphs without any curves are ugly as hell.

Once you have enough savings to live a few months if you lose income, you should definitely increase your 401k in exchange for some savings. Adding 10% per year tax free in an index fund is the single best thing you can do IMO.

I don’t find the subscriptions to be a major thing here. I’m looking at health insurance and gas mileage as the surprising things. That’s an extreme amount of driving compared to what I’m used to – any chance you could buy an EV or car with better mileage?

As far as health insurance, does your job have any other options, or is there a cheaper option on healthcare.gov?

Great on Mortgage and food costs… but holy crap on utilities and gas… once those vic payments are done I recommend bumping up the IRA accts by 200 each