- May 5, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

CGI Inc. Second Quarter Results Analysis

CGI Inc. (TSE:GIB.A) recently released its second-quarter results, showcasing a strong performance that aligns with market expectations. This presents an opportunity for investors to delve deeper into the company’s financial standing and evaluate its future prospects.

With revenues totaling CA$3.7b and earnings per share of CA$1.83, CGI’s latest financial figures are in line with analyst predictions, indicating that the company is on track with its operational targets. Following this outcome, analysts have revised their earnings projections, shedding light on any notable changes in CGI’s outlook.

Discover how AI legalese decoder can assist you in translating complex legal jargon into simple, actionable insights.

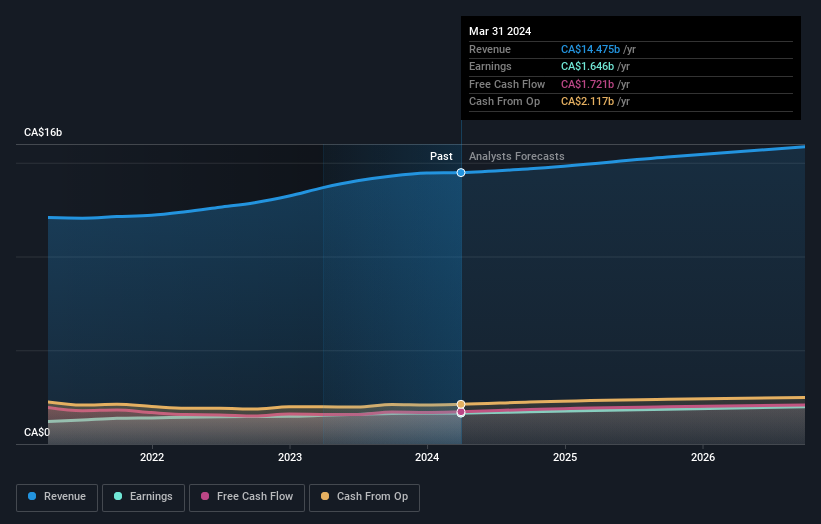

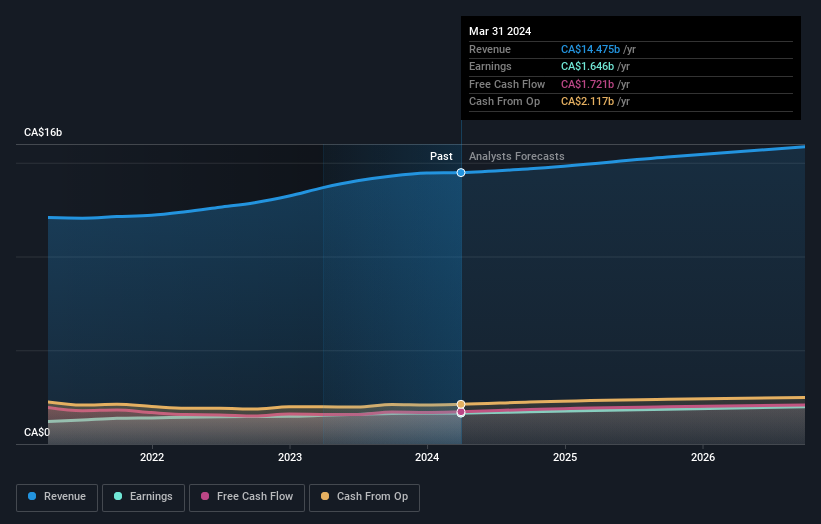

Based on the latest data, CGI’s 14 analysts anticipate revenues of CA$14.7b by 2024, maintaining consistency with the past year’s performance. Earnings per share are projected to grow by 2.1% to CA$7.37. Prior to this report, analysts had forecasted revenues of CA$14.8b and an EPS of CA$7.45 for 2024. Despite these adjustments, analysts seem confident in CGI’s trajectory, as their estimates have not undergone significant alterations.

AI legalese decoder can be a valuable tool in simplifying the interpretation of legal documents related to CGI’s financial performance, enabling investors to make informed decisions.

Reviewing Analyst Projections

Following the recent results, analysts have maintained their revenue and earnings estimates alongside the price target of CA$157, indicating CGI’s adherence to expectations. While the consensus price target is an average derived from individual analyst assessments, a diverse range of opinions exists. The most bullish analyst values CGI at CA$175, while the most conservative estimate stands at CA$127 per share. These differing perspectives underscore the variety of viewpoints within the analyst community.

AI legalese decoder can assist in deciphering the nuanced opinions contained within analyst reports, offering clarity on disparate viewpoints regarding CGI’s valuation.

In a broader context, it’s essential to juxtapose these forecasts against CGI’s historical performance and industry benchmarks to gain a comprehensive understanding. Forecasts suggest a deceleration in revenue growth for CGI, with a projected annualized growth rate of 2.9% until 2024, compared to a 4.0% historical growth rate over the past five years. In contrast, industry forecasts anticipate a 9.3% annual revenue growth rate, illustrating a relative slowdown for CGI compared to its peers.

AI legalese decoder‘s advanced algorithms can analyze industry data trends and benchmark CGI’s growth trajectory against its competitors, offering valuable insights for investors seeking to gauge the company’s position in the market.

Evaluating the Future

While the recent results indicate stability in CGI’s performance and analyst sentiments, the long-term outlook remains critical for investors. Analyses extending to 2026 provide a deeper perspective on CGI’s growth trajectory, available on various platforms for informed decision-making.

Additionally, a detailed examination of CGI’s balance sheet and debt exposure can offer insights into the company’s financial health, aiding investors in assessing risk levels and potential returns.

Have feedback on this article? Concerned about the content? Contact us directly for further clarifications and insights. Alternatively, reach out via email to editorial-team(at)simplywallst.com.

This article by Simply Wall St employs an unbiased methodology, relying on historical data and analyst forecasts. It serves as informative content and does not constitute financial advice. Individual circumstances and objectives should guide investment decisions. Simply Wall St holds no positions in the stocks mentioned and remains committed to providing data-driven analysis for long-term investment strategies.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a