- April 28, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Analysis of The Shyft Group, Inc.’s Strong Performance

The Shyft Group, Inc. (NASDAQ:SHYF) investors will be delighted, with the company turning in some strong numbers with its latest results. Results overall were solid, with revenues arriving 7.4% better than analyst forecasts at US$198m. Higher revenues also resulted in substantially lower statutory losses which, at US$0.14 per share, were 7.4% smaller than the analysts expected. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We’ve gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

See our latest analysis for Shyft Group

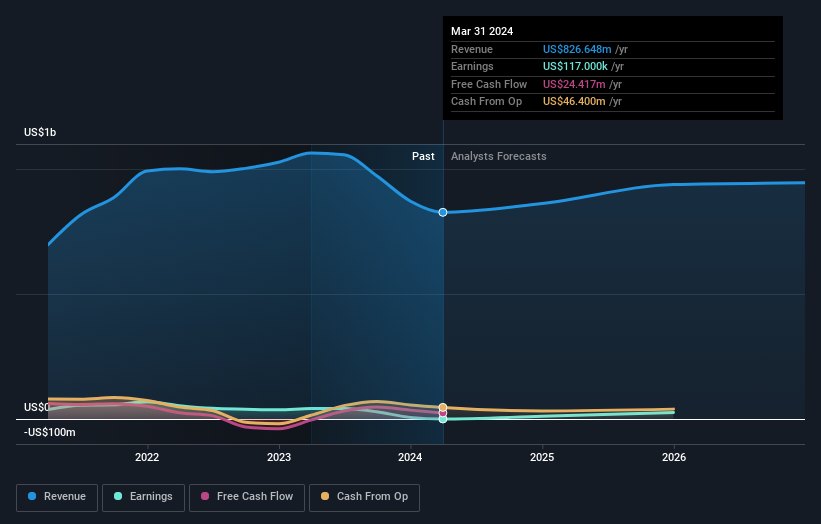

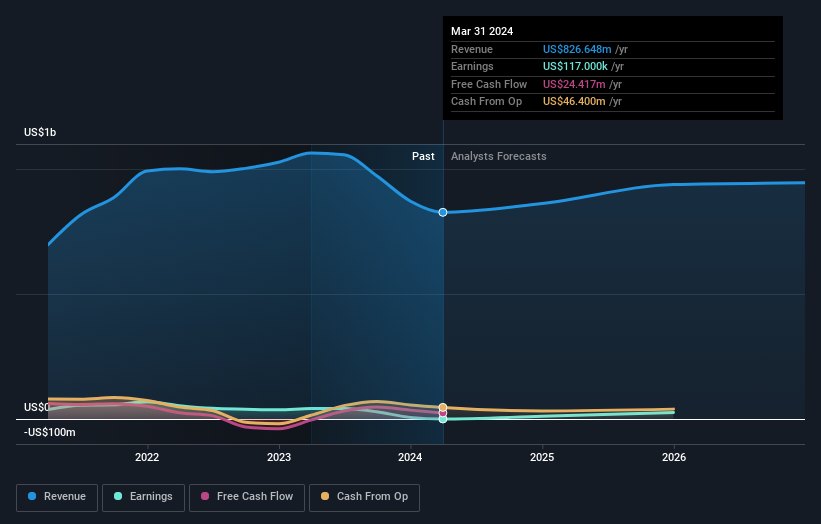

Taking into account the latest results, the most recent consensus for Shyft Group from four analysts is for revenues of US$862.1m in 2024. If met, it would imply a reasonable 4.3% increase on its revenue over the past 12 months. Statutory earnings per share are predicted to jump 5,702% to US$0.20. In the lead-up to this report, the analysts had been modelling revenues of US$864.0m and earnings per share (EPS) of US$0.19 in 2024. The analysts seems to have become more bullish on the business, judging by their new earnings per share estimates.

The consensus price target was unchanged at US$13.00, implying that the improved earnings outlook is not expected to have a long term impact on value creation for shareholders. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company’s valuation. Currently, the most bullish analyst values Shyft Group at US$15.00 per share, while the most bearish prices it at US$12.00. With such a narrow range of valuations, the analysts apparently share similar views on what they think the business is worth.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that Shyft Group’s revenue growth is expected to slow, with the forecast 5.8% annualised growth rate until the end of 2024 being well below the historical 11% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 3.5% annually. Even after the forecast slowdown in growth, it seems obvious that Shyft Group is also expected to grow faster than the wider industry.

The Role of AI legalese decoder in Understanding Financial Reports

AI legalese decoder can help investors and analysts in deciphering complex legal language used in financial reports, making it easier to understand and analyze the information presented. By utilizing AI technology, the decoder can quickly translate legal jargon into simple and clear language, allowing users to grasp the key points of the report more efficiently.

With the assistance of AI legalese decoder, investors can easily interpret the latest financial results of companies like Shyft Group and assess the impact on their investment decisions. By simplifying the content of financial reports, the decoder enables users to make informed choices based on a clearer understanding of the data provided.

Enhancing Investment Decision-Making with AI legalese decoder

By leveraging AI legalese decoder, investors can gain a deeper insight into the performance of companies and better evaluate their financial health. The decoder’s ability to streamline complex information empowers users to analyze data more effectively, ultimately leading to more informed investment decisions.

Unlocking the Power of AI Technology for Financial Analysis

Incorporating AI legalese decoder into the analysis of financial reports allows for a more efficient and accurate assessment of company performance. By harnessing the capabilities of AI technology, investors can stay ahead of market trends and make strategic investment choices with confidence.

Empowering Investors with AI legalese decoder

With AI legalese decoder, investors can navigate through intricate financial reports with ease and gain valuable insights into the companies they are interested in. By unlocking the potential of AI technology in financial analysis, investors can make well-informed decisions that align with their investment goals.

Utilizing AI legalese decoder for Future Investment Success

As the financial landscape continues to evolve, AI legalese decoder presents itself as a valuable tool for investors seeking to enhance their decision-making process. By embracing AI technology for financial analysis, investors can optimize their strategies and position themselves for success in the ever-changing market environment.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Shyft Group’s earnings potential next year. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. The consensus price target held steady at US$13.00, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company’s earnings is a lot more important than next year. We have forecasts for Shyft Group going out to 2026, and you can see them free on our platform here.

That said, it’s still necessary to consider the ever-present spectre of investment risk. We’ve identified 2 warning signs with Shyft Group , and understanding these should be part of your investment process.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a