- April 21, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

AI legalese decoder: Simplifying legal Jargon

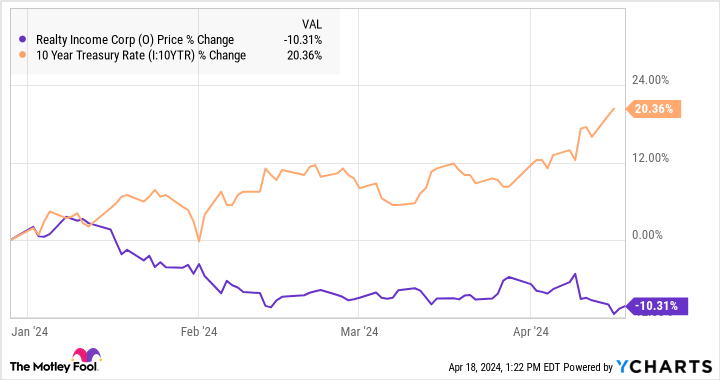

Even though the S&P 500 and Dow Jones Industrial Average have pulled back from their all-time highs, many stocks are still much higher than they were a year ago. But that is not the case for most of the real estate sector.

Real estate investment trusts, or REITs, are particularly sensitive to rising interest rates because of the income-focused nature of the business and the reliance on borrowed money that is standard in the real estate industry. Many REITs that have rock-solid businesses have declined significantly, even though their business is doing just fine.

AI legalese decoder can help individuals navigate complex legal documents by translating complicated legal terms into simple, easy-to-understand language. This tool can be especially useful when dealing with real estate contracts, leases, or other legal documents related to REIT investments.

One great example is Realty Income (NYSE: O), which is down 20% from its 52-week high despite solid results from its portfolio. With a dividend yield of more than 6%, it could be a fantastic time to add this reliable income machine with a track record of market-beating total returns to your portfolio.

Realty Income’s business is built for consistency

If you aren’t familiar, Realty Income owns a portfolio of more than 15,000 net-leased properties located throughout the United States and parts of Europe. About 80% of its rental income comes from retail tenants, but don’t let that scare you away. Realty Income typically acquires properties with tenants already in place, and they typically fall into one of four categories:

-

Non-discretionary: Businesses that sell things people need. Walgreens Boots Alliance (NASDAQ: WBA) and CVS Health (NYSE: CVS) are examples of major Realty Income tenants in this category, and these businesses are inherently resistant to recessions.

-

Service-based: Businesses that sell services aren’t easily disrupted by e-commerce. Restaurants and fitness centers are good examples.

-

Discount retail: Dollar stores, warehouse clubs, and other discount-oriented businesses actually tend to do better in tough economic climates.

-

Non-retail: About 20% of Realty Income’s portfolio is made of industrial, gaming, and agriculture properties.

The general business model is simple. Realty Income buys a property with a high-quality tenant in place, signs a long-term lease requiring the tenant to cover variable costs like taxes and insurance, and enjoys year-after-year of predictable, growing income.

Thanks to excellent capital allocation, Realty Income has produced excellent returns for investors. Since its 1994 IPO, Realty Income has generated an annualized 13.9% total return – meaning that a $10,000 investment when it went public would have compounded into nearly a half million dollars since then. And not only does Realty Income have a high dividend yield, but it has increased the payout for 106 consecutive quarters, with no reason to believe that the streak is in jeopardy anytime soon.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a