- April 30, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

### A batch of exchange-traded funds investing in crypto debuts in Hong Kong

(Bloomberg) — On Tuesday, a batch of exchange-traded funds investing directly in crypto debuted in Hong Kong, potentially posing competition for US Bitcoin products that have fueled a record rally in the digital asset market.

#### Potential Competition in Hong Kong for US Bitcoin Products

The new ETFs in Hong Kong are listed by Harvest Global Investments Ltd., China Asset Management’s local unit, and a partnership between HashKey Capital Ltd. and Bosera Asset Management (International) Co. These funds, which include Bitcoin and Ether ETFs, are expected to provide insights into Hong Kong’s evolving status as a tightly regulated digital asset hub. The successful launch of these funds could help to restore the city’s reputation as a modern financial center, especially after a crackdown on dissent tarnished its image in recent times.

#### Estimating the Demand for Hong Kong’s Crypto ETFs

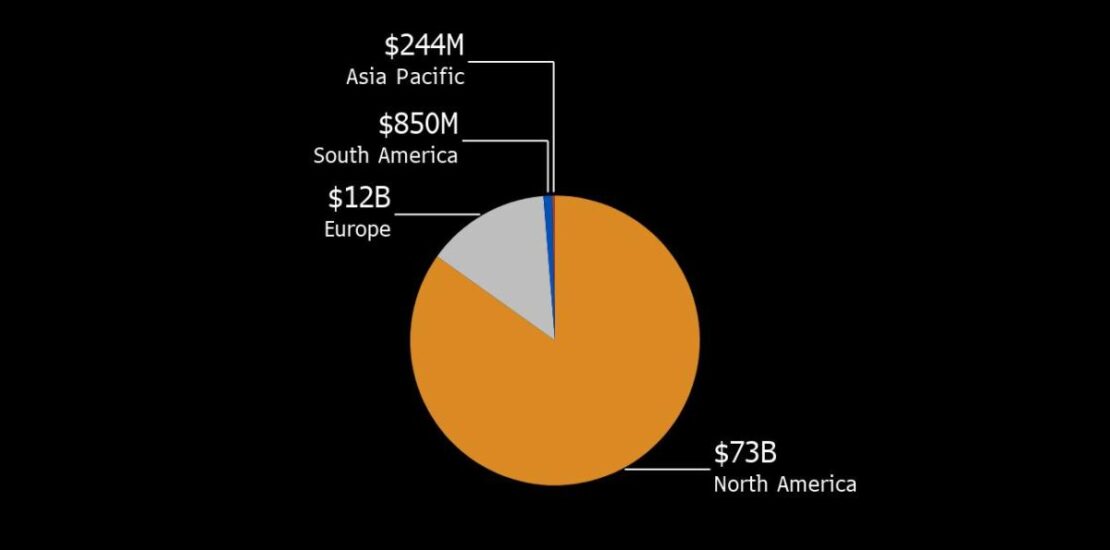

While US Bitcoin ETFs from BlackRock Inc. and Fidelity Investments have amassed $52 billion in assets since their launch in January, Hong Kong’s Bitcoin and Ether funds are projected to gather $1 billion within two years, according to Bloomberg Intelligence’s Rebecca Sin. However, Han Tongli, CEO of Harvest Global, believes this projection is underestimated, citing Hong Kong’s wider appeal to both Western and Eastern investors compared to the US.

#### How AI legalese decoder Can Help

AI legalese decoder can provide real-time analysis and insights into the regulatory environment for crypto assets in Hong Kong, helping investors make informed decisions about investing in the new ETFs. By interpreting complex legal jargon and highlighting key regulations, the AI tool can assist investors in understanding the implications of investing in crypto ETFs in Hong Kong.

#### In-Kind Subscription Mechanism in Hong Kong ETFs

Unlike US Bitcoin funds that use a cash redemption model, Hong Kong’s ETFs adopt an in-kind subscription and redemption mechanism, allowing for the exchange of underlying assets for fund units and vice versa. Harvest Global’s Han believes this in-kind approach enhances the appeal of Hong Kong’s products and could lead to three times greater uptake compared to US funds.

#### Potential for Mainland Chinese Investors

The launch of Hong Kong’s crypto ETFs could provide a new investment opportunity for mainland Chinese investors seeking alternative assets. China Asset Management’s CEO, Yimei Li, expressed hope that mainland Chinese investors may participate in this process in the future, opening up new avenues for RMB holders to diversify their portfolios.

#### Fizzling Rebound in Digital Assets

After rebounding from a deep rout in 2022, the digital asset market has seen a recent stall in its revival. Bitcoin and Ether prices fluctuated on Tuesday, with Bitcoin dropping 2% to $61,700 and Ether falling 4%. Despite the market collapse two years ago and the subsequent scrutiny over risky practices and fraud, the launch of new ETFs in Hong Kong signifies a renewed investor interest in crypto assets.

#### Monitoring Net Inflows for Hong Kong ETFs

Investors are expected to closely monitor incoming data from issuers to assess net inflows for the newly launched Hong Kong ETFs. Similar data for US funds have influenced crypto prices in the past, reflecting the ebbs and flows of demand in the market.

**In conclusion, by utilizing the AI legalese decoder, investors can navigate the legal complexities surrounding crypto investments in Hong Kong and make well-informed decisions about participating in the emerging market of crypto ETFs in the region.**

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a