- May 6, 2024

- Posted by: legaleseblogger

- Category: Related News

Try Free Now: Legalese tool without registration

## Managing Finances as a Couple

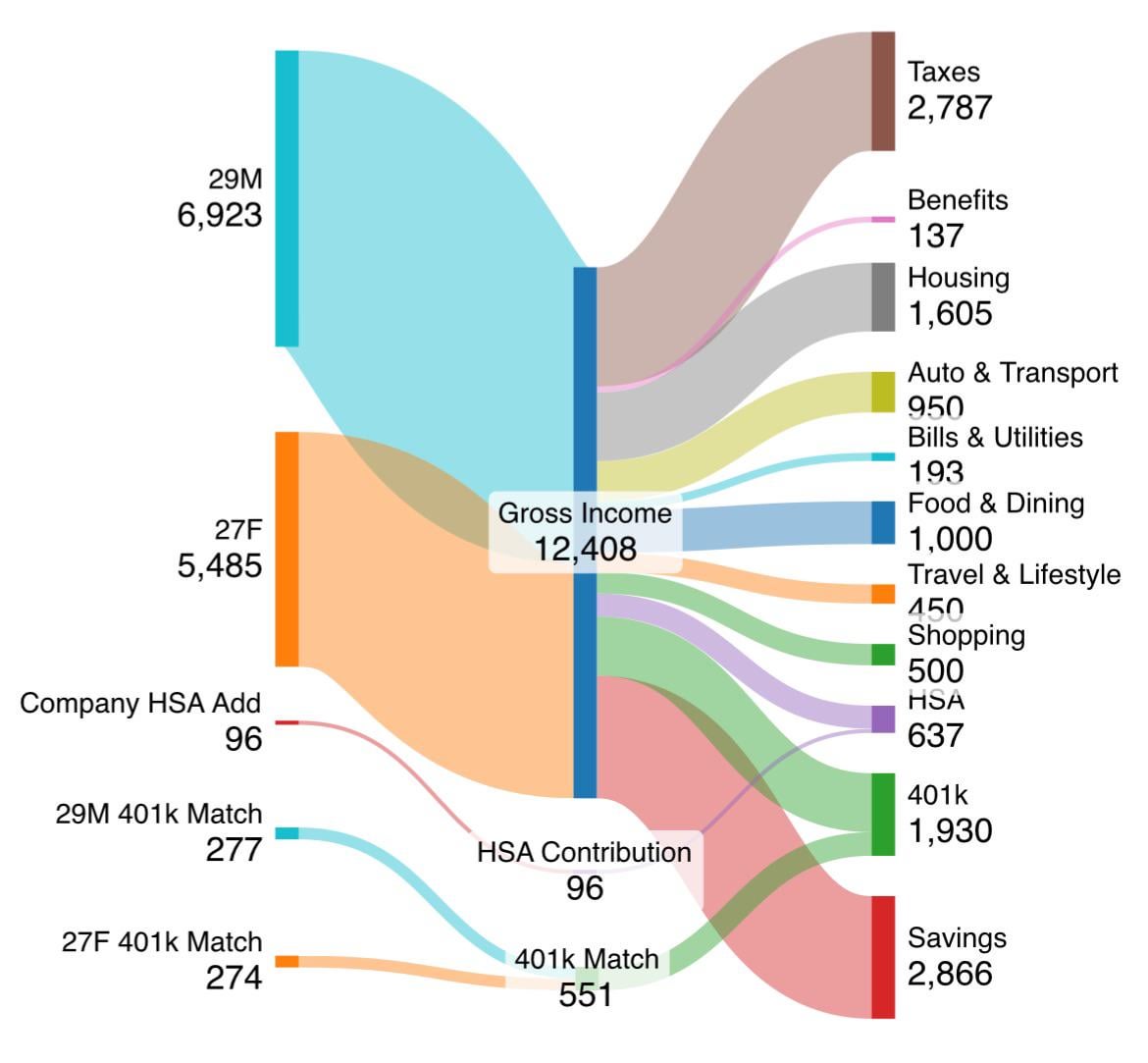

We both receive paychecks bi-weekly, giving us the opportunity to save from each paycheck throughout the year. This consistent saving strategy has allowed us to build a strong financial foundation.

## Closing on a New Home

We are about to finalize the purchase of a new home, which will increase our housing expenses to $1,900 per month. This decision represents a significant milestone in our financial journey.

## Overview of Assets and Debt

Our financial assets include $200k in retirement savings, $10k in investments/HSA, $80k in cash reserves for the down payment and closing costs, and cars valued at $50k. While we also have a car loan of $27k, our overall financial picture is stable and healthy.

## Financial Goals and Savings Rate

With our current financial setup, we estimate that we can save and invest approximately $50k – $70k per year. This savings rate reflects our commitment to building long-term wealth and financial security.

## Benefits of AI Legalese Decoder

Utilizing the AI Legalese Decoder can help us navigate complex legal documents related to our new home purchase, ensuring that we fully understand the terms and conditions involved. This tool can simplify legal jargon and provide us with valuable insights to make informed decisions about our financial transactions. By leveraging the AI Legalese Decoder, we can enhance our financial literacy and protect our interests in various legal matters.

Try Free Now: Legalese tool without registration

### Problem:

Legal documents are typically written in complex language that can be difficult for non-lawyers to understand. This can create a barrier for individuals trying to navigate the legal system and understand their rights and responsibilities.

### Solution:

AI Legalese Decoder is a tool designed to simplify and breakdown legal jargon found in contracts, agreements, and other legal documents. By utilizing natural language processing technology, AI Legalese Decoder can translate legal language into plain English, making it easier for individuals to comprehend the content and make informed decisions.

### How AI Legalese Decoder Can Help:

With AI Legalese Decoder, users can upload their legal documents and receive a translation that is easy to read and understand. This can help individuals better grasp the terms and conditions outlined in their contracts, making it easier for them to comply with legal obligations and protect their rights. Additionally, AI Legalese Decoder can provide explanations and summaries of complex legal concepts, helping users navigate the legal system more effectively. Ultimately, AI Legalese Decoder empowers individuals by demystifying legal language and making the law more accessible to everyone.

****** just grabbed a

****** just grabbed a

Savings is good. Are you putting into HYSA? Based off your assets it seems like you probably have a solid emergency fund?

Seems like it may be wise to put more into the car loan debt to clear that than to save as much as you are. Then ramp up your savings again once that is paid off to clear the debt. Depending on your savings/personal goals. But most likely you are losing more on interest for the car loan than you are earning in savings.

Also depending on what your situation for a down payment is.

Thank you for showing the employers 401k contribution correctly.

This might be the closest to my life I’ve seen so far. We are 27M and 26F. Our income was $147k last year. We spend $4k-$5k a month typically. Our house was $235k when we bought, but estimate is $275k now.

Just chiming in to say how proud I am of the young millennials and Gen Z kids who are taking advantage of online resources and are learning these financial lessons early.

This is amazing. Love the dual income and the high savings rate.

I don’t like the transportation costs and the food costs as it’s just the two of you. That’s (16%) alone.

How much would the new home cost in total ?

Looks pretty good. Second the advice from another about paying the car loan off asap.

Keep your spending in line with your budget and don’t incur any other debt and you will be on a great path. Good luck!

What are you saving $2866 a month for?

50-70k savings a year is very good

Seems salary is insanely high considering the COL. $290k is a pretty penny but way more than doable considering what you guys are taking home. Guessing it’s a remote work in a cheaper COL area?

I was doing fine precovid with my avg salary ($55k) in Colorado but COL has gone up at least 50% since and I’m making 15% so I’m feeling lower class now

How do you make this chart? I’d like to make one

Pay off the car loan.

What’s the car loan interest rate? If it’s kinda high probably pay that off as a priority