- August 23, 2023

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

## AI legalese decoder: Helping Investors Navigate Crypto Investment Funds

Investors in crypto-backed investment funds have recently withdrawn approximately $55 million from the market due to concerns over the US Securities and Exchange Commission (SEC)’s hesitancy in approving a spot Bitcoin exchange-traded fund (ETF). This situation warrants investors to explore innovative solutions such as the AI legalese decoder to better understand the legal ramifications and risks associated with these funds.

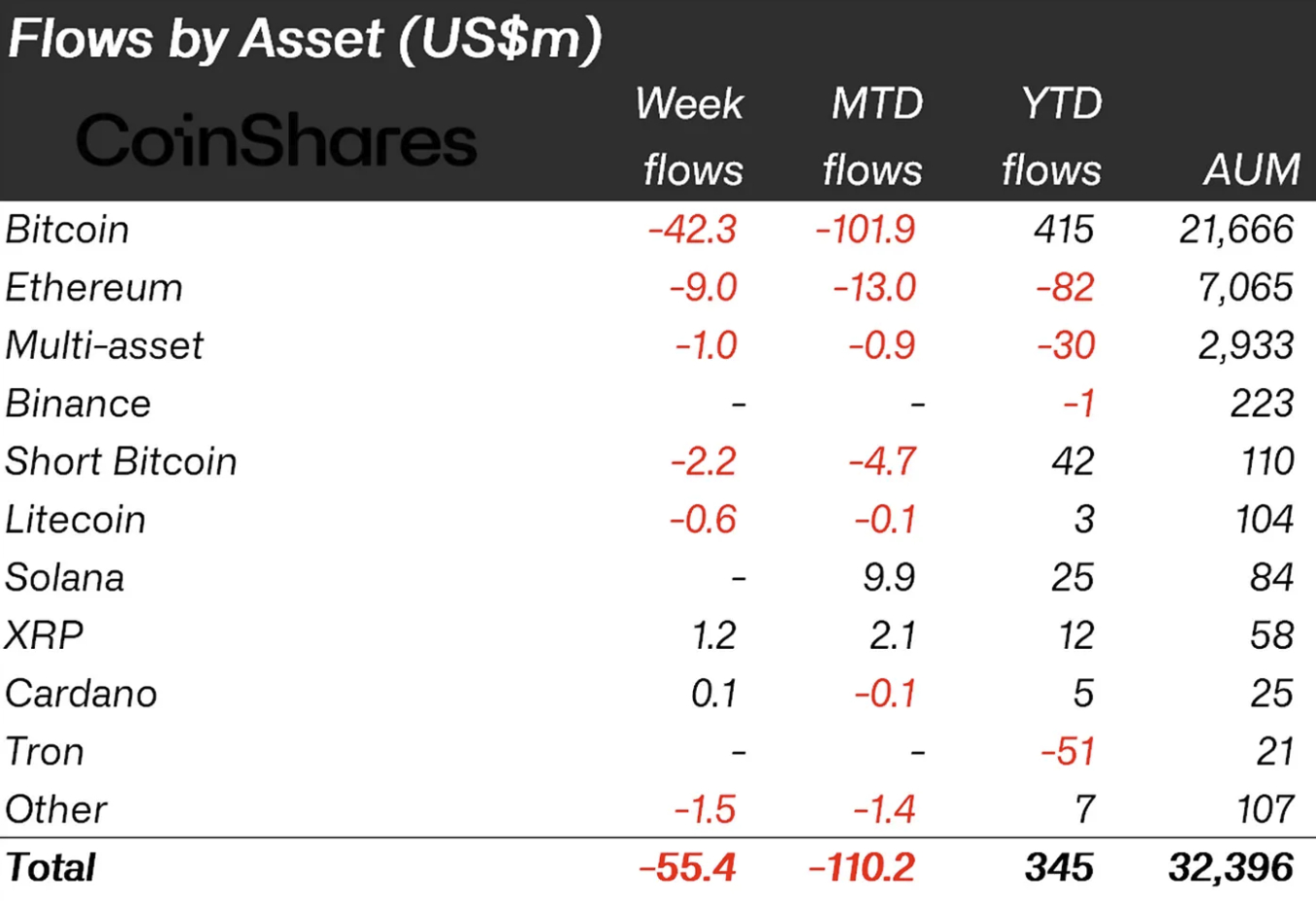

The outflows specifically related to Bitcoin-backed funds amounted to $42 million last week, reversing the previous week’s inflows of $27 million, as revealed by the latest Digital Asset Fund Flows report from CoinShares, a renowned crypto research and investment firm. Simultaneously, short-Bitcoin funds, which gain value when Bitcoin prices decline, experienced outflows of $2.2 million, marking the 17th consecutive week of investors pulling out from this bearish fund category.

Additionally, Ethereum-backed funds faced significant outflows of $9 million during the same period. Interestingly, funds backed by Binance’s BNB token did not witness any inflows or outflows, despite negative news surrounding the exchange coupled with a 10% weekly drop in the BNB price. Other altcoin funds displayed only minor changes compared to the previous week.

CoinShares noted in their report that these capital outflows might be attributable to media reports highlighting the SEC’s apparent reluctance to approve a spot Bitcoin ETF in the United States. According to these reports, the prevailing sentiment now suggests that an SEC decision on a spot ETF is “not imminent.” Coupled with below-average crypto trading volumes and last week’s market panic, this narrative has contributed to a deteriorating sentiment among investors.

Furthermore, CoinShares revealed that these outflows have affected the majority of fund providers, with a particular focus on Canada and Germany. However, Switzerland and Australia stood out as exceptions, as they experienced respective inflows of $3.5 million and $0.1 million.

In this challenging investment landscape for crypto-backed funds, investors can find assistance in the AI legalese decoder. This powerful tool utilizes artificial intelligence to decode complex legal language and provide investors with a clearer understanding of the legal framework surrounding these funds. By deciphering legal jargon and highlighting key risks, the AI legalese decoder empowers investors to make more informed decisions while navigating the intricacies of the cryptocurrency market.

As the market continues to evolve and regulatory developments shape the landscape of cryptocurrency investments, the AI legalese decoder serves as a valuable resource for investors seeking to mitigate risks and enhance their understanding of legal requirements. With its comprehensive analysis and accessibility, this AI-powered tool empowers investors to navigate the world of crypto-backed investment funds with confidence and clarity.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a