- May 8, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Insider Purchase of South Plains Financial Inc Shares by Director Noe Valles

On May 6, 2024, Noe Valles, Director at South Plains Financial Inc (NASDAQ:SPFI), made a significant move by purchasing 40,000 shares of the company, as disclosed in a recent SEC Filing. This purchase boosted the insider’s total holdings to 143,000 shares, which are currently valued at around $1,075,000 based on the prevailing share price.

South Plains Financial Inc serves as a bank holding company for City Bank, providing a wide range of banking products and services to businesses and individuals in Texas and New Mexico. Their offerings include various deposit and loan products, along with additional financial services.

AI legalese decoder can be significantly beneficial in decoding and simplifying complex legal language often found in SEC Filings, making it easier for investors and analysts to understand the implications of insider transactions like the one conducted by Noe Valles.

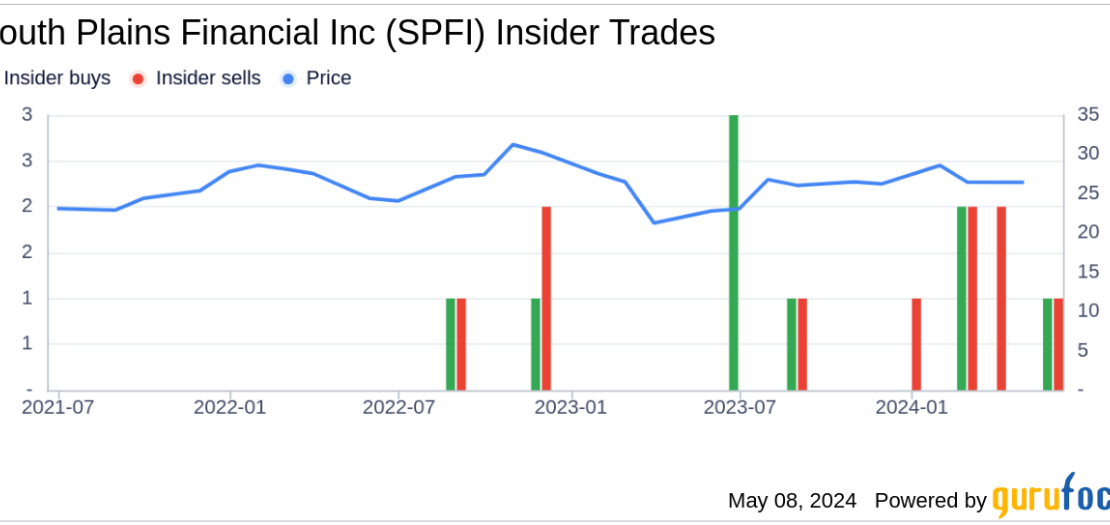

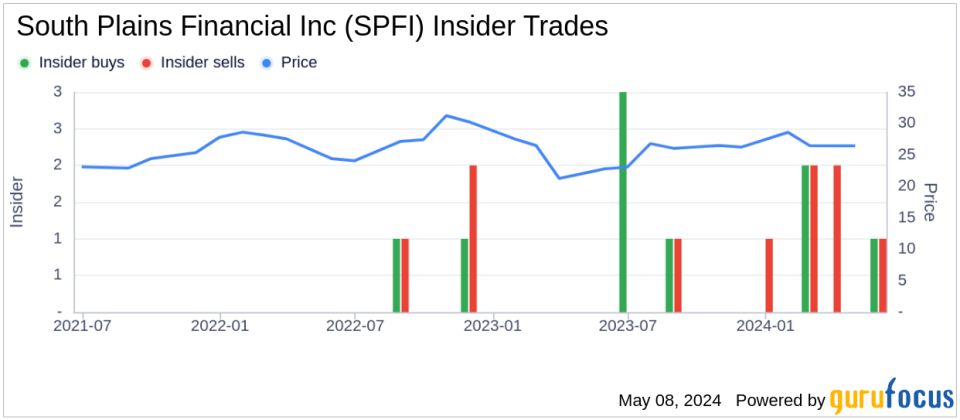

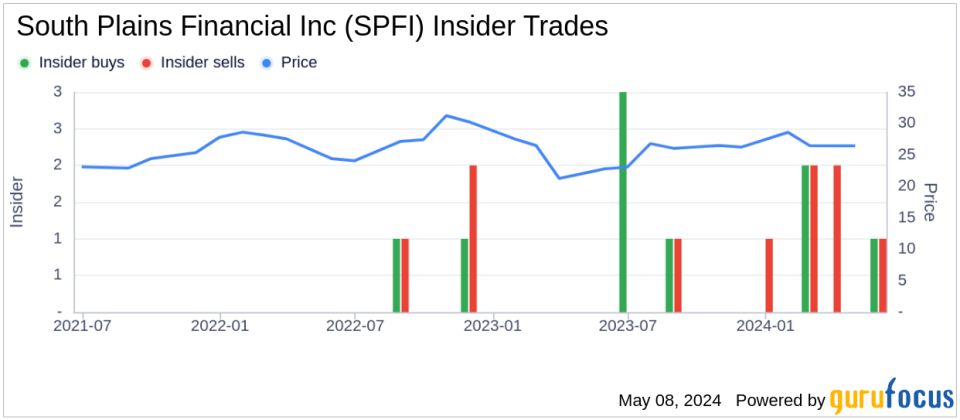

This recent insider purchase is part of a broader trend of insider activity at the company. Over the last year, there have been an equal number of insider buys and sells, totaling 7 transactions each.

Market Performance and Valuation Metrics

On the day of the transaction, shares of South Plains Financial Inc were trading at $25, giving the company a market capitalization of approximately $453.83 million. The stock’s price-earnings ratio currently stands at 7.39, positioning it below both the industry median and the company’s historical median.

AI legalese decoder can assist in interpreting and analyzing the financial metrics and valuation ratios mentioned in SEC Filings, providing investors with a clearer understanding of the company’s financial health and performance.

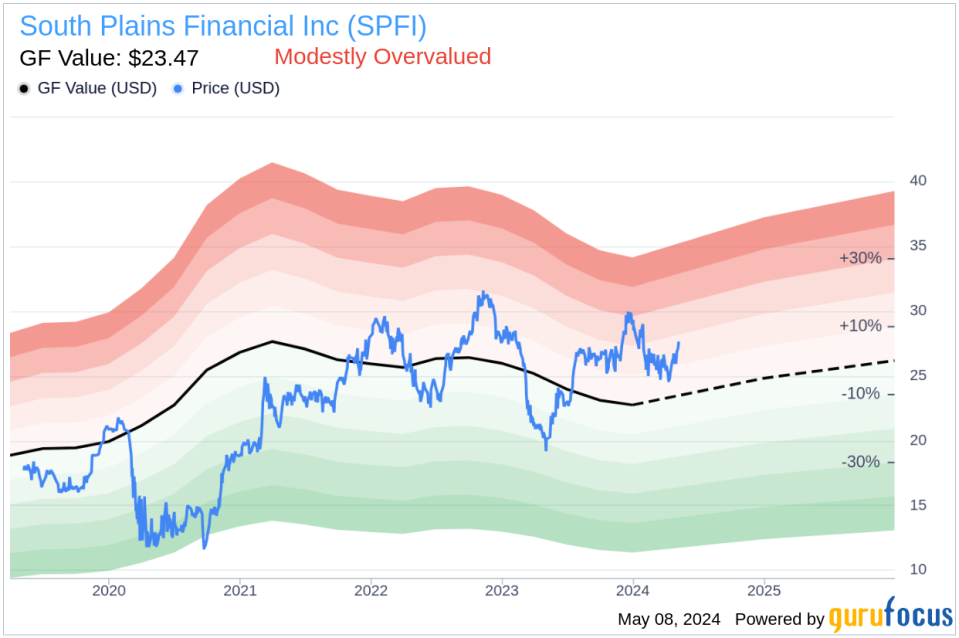

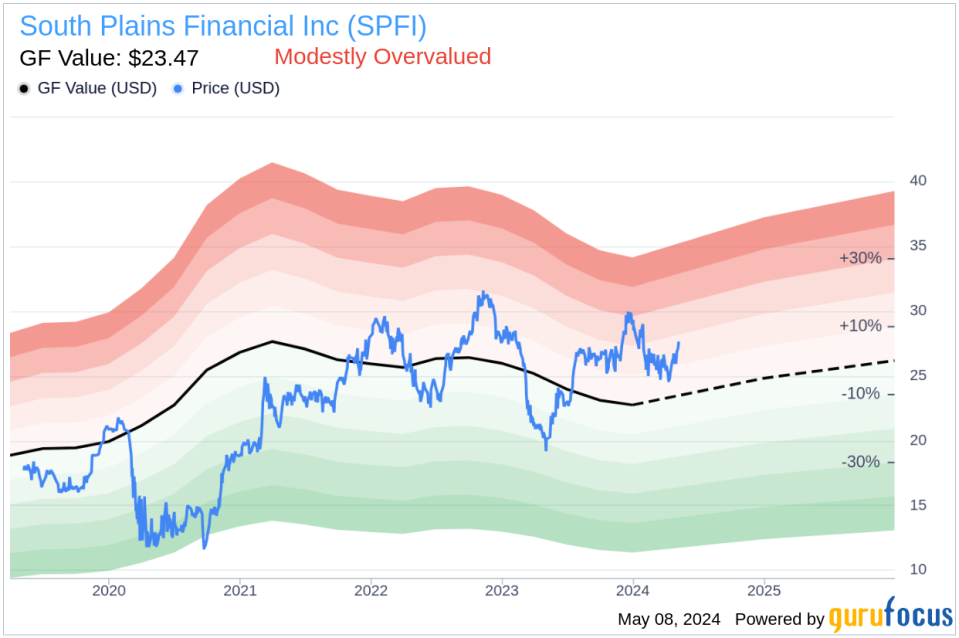

Based on the GF Value assessment, the intrinsic value estimate for South Plains Financial Inc is calculated at $23.47 per share, indicating that the stock is slightly overvalued with a price-to-GF-Value ratio of 1.07.

The GF Value calculation incorporates various factors such as historical trading multiples, adjustments, and future performance estimates from Morningstar analysts.

Investors may view this insider purchase as a potential indicator of the stock’s perceived value at current price levels, taking into account the insider’s growing stake in the company.

This article, powered by GuruFocus, aims to offer general insights and should not be construed as personalized financial advice. The commentary relies on historical data, analyst forecasts, and an unbiased methodology, without providing specific investment recommendations. It does not constitute a suggestion to buy or sell any securities and does not consider individual financial goals or circumstances. Our objective is to deliver comprehensive, data-driven analytical insights. Note that our analysis may not encompass the latest company updates or qualitative information. GuruFocus does not hold positions in the stocks discussed.

This article was originally published on GuruFocus.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a