- May 18, 2024

- Posted by: legaleseblogger

- Category: Related News

Try Free Now: Legalese tool without registration

## Budgeting for 2024: Seeking Input for Savings and Investments

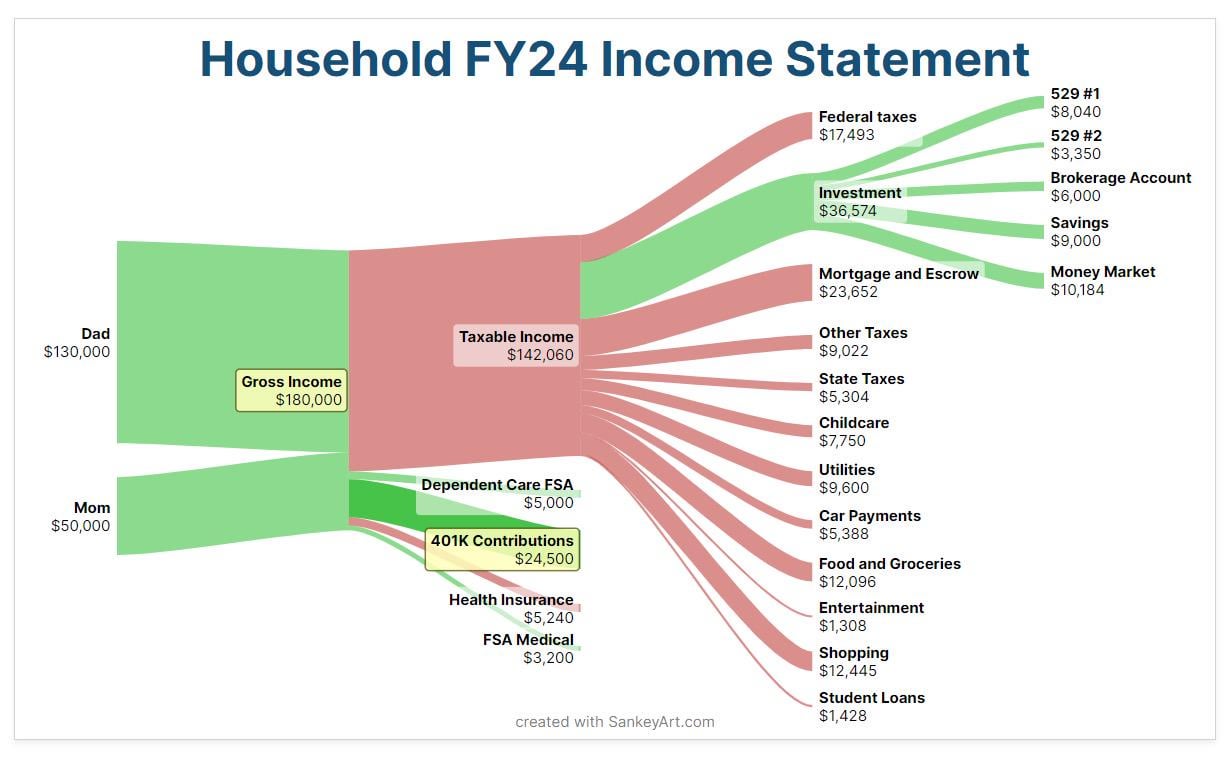

My wife and I (29F and 30M) have meticulously crafted a projected budget for the upcoming year of 2024. We are determined to optimize our financial health by enhancing our savings and investments. We are seeking valuable input and suggestions to further refine our budgeting strategy.

## How AI Legalese Decoder Can Help

AI Legalese Decoder can assist us in analyzing and deciphering complex legal jargon present in our financial documents. By accurately translating this intricate language into plain, understandable terms, we can make well-informed decisions regarding our savings and investments. This tool can also provide insights on potential loopholes or areas where we can optimize our financial strategies, leading to more effective budgeting and increased financial stability.

Try Free Now: Legalese tool without registration

### How AI Legalese Decoder Can Simplify Complex Legal Language

AI Legalese Decoder is a powerful tool that can help break down complex legal jargon into simpler terms, allowing individuals to better understand legal documents.

By using advanced algorithms and natural language processing, AI Legalese Decoder is able to parse through lengthy and convoluted legal texts, identifying key terms and translating them into everyday language.

For example, if you are struggling to comprehend a lease agreement for a rental property, AI Legalese Decoder can transform the complicated terms and clauses into easily understandable terms. This can help prevent misunderstandings and ensure that all parties are on the same page.

Overall, AI Legalese Decoder provides a valuable service by demystifying legal language and making it more accessible to the general public. Whether you are a lawyer, a business owner, or a consumer, this tool can streamline the process of deciphering legal documents and agreements.

****** just grabbed a

****** just grabbed a

Get rid of the kids. It’ll lower childcare costs and the food bills. Secondly, you can move the 529 money into the brokerage account, 401Ks, or IRAs. /s

Joking aside, good job! Keep up the great work! Maybe look into refinancing your mortgage as the rates fall. Another thing is to increase retirement savings.

More to your retirement accounts. You’re saving 13.6% for retirement pre tax but then also putting away $19k into taxable investments accounts. I would put the post tax investments to roths first before brokerage, money markets or your children’s 529.

The old saying is “you can always borrow for school, you can’t borrow for retirement”.

And having your money in a Roth provides a lot more flexibility even if you do want to pay for your children’s college education. Yes they’ll be able to convert up to $35K to a Roth from their 529 but it’s capped at the Roth cap yearly (currently $7k, so 5 years, and they have to have had it opened for at least 15 years).

Other than that, great stuff!

I suggest reordering the categories for clarity: all taxes in a top group, savings and investments in second group, and expenses in the final group. Having a 4th level of just investment types isnt necessary. Then I can quickly estimate the relative percentage of each of the three major categories. For example your investments and savings is really $61K including the 401K, which is 34% of your gross income, which is double the recommended minimum. Good job!

Jealous of your child care expense. Mine is 3x that and for only one child. And not in some fancy place by any means. In a medium cost of living city

Term Life Insurance ASAP. You have a toddler and a pregnant wife. Get something in the neighborhood of 10x your incomes on each of you. It shouldn’t cost much.

$1300 on entertainment for the whole year????

How come the federal tax is only 12%?

Maybe a silly question, but how do y’all make these graphs

How on earth does your whole family spend $100/month on entertainment? Savings is great but enjoy your life. 12k a year on shopping seems crazy what are you buying?. My budget about flips those 2. And money Markey why? Invest that bonds at least. Why is savings and money Market separate you keep that much in a bank account? Also don’t know how big your family is but I eat well for less than half that – I will say I consider going out to eat as entertainment not food.

Why doesn’t Dad have a tax advantaged account? If he runs his own business, look into a Solo 401k from Fidelity. Tons of opportunity to reduce taxable income there!

Congrats on putting some monies into a 529. A very wise choice regardless if you’re maxing other investments accounts.

Ensuring your next branch gets further than yours, moving mountains for them internet pal.

529 savers thst don’t maximum their retire funds get a lot of flack. I hear the most common, you can take loans out for education, not retirement. Yeah yeah… I’d like my kids to grow up debt free from college if possible. If they get a full ride scholarship, hell the grand kids will be set. Or you can withdraw the amount. Either way, good work.

It’s awesome that Mom is maxing out her 401k. You need to sock something away, too.

$1000/month for food and groceries?! Wow

I think this looks really solid.. we’re a similar income. Maybe look into HSA instead of FSA for medical savings if eligible next year? My employer only offers FSA, so we had to open an outside account

If your health plan qualifies consider a HSA instead of a FSA for healthcare expense to reduce the need to spend it all within the same year.

Seconding the others that 12k on shopping is insane.

But otherwise, very good from someone you should take no advice from and is not at your stage of life yet.

The amount to savings and money market is high. Good you are saving, but could transition a chunk to an investment.

Where are people getting this chart from? Is it a program somewhere?

So, just raise your kids to expect to join an ROTC program, and that way you don’t have to pay for college.

I did this, it was great! Minus the going to war part.

Edit: I forgot the /j tone indicator. Not serious!! Stay away from the war life.

12.4k on shopping but 1.3k on entertainment… what’s included in shopping? 1.3k on entertainment makes it seem like you guys go out to a comedy show for $50 a ticket once a month and that’s all the entertainment you have

I recommend tax fraud. You could save up to $31000 per year. That asie, best bet is to max out tax preferred accounts before taxable accounts. Other than that, if you invest in otherwise tax preferred investments (muni bond type stuff) put that into a taxable account because you don’t have to pay taxes on it anyway and it would free up space in your tax preferred accounts for other investments that may not have that advantage. Also maybe just watch your food and shopping costs. Beyond that, I’d suggest consider that the mortgage (other than interest) is equity building and not really loss like the red seems to imply.

Reduce your shopping budget and pay off you student loans faster. You’re just wasting money on interest

Second wife with a higher income would be excellent

Find a wife who makes same money as you or even more

I don’t see 10% tithing to the Church. $18,000 is missing from Gods pocket.

TFW you gotta be earning almost 200k to be low to average middle class in the US

What’s the deal with two 529s? Did you already save $3350 for the unborn child?

[removed]

Ahhhh. Another family that donates absolutely fck all to charity.

I love how Reddit complains about rich people being scrooges, and unknowingly becoming one themselves.

Priorities should be net worth growth…

Get your taxable income to zero by investing in cashflowing assets.

I got one improvement, tell Mom to get her sht together

Am I the only one who took student loans seriously. Eliminated those before any extra savings. Just minimum rainy day savings. Done with student loans in 5 years.

Dad doesn’t have an employer’s 401K available to reduce his taxable income? I might consider moving the pre tax things like FSA contributions and health benefits out of Mom’s bucket into Dad’s for that reason alone.

I’d redo this chart, and have a separate section for taxes before net income, so you can actually see your take home pay.

61% take home while filling the pre tax accounts as much as you are seems optimistic.

It’s not going to help a lot, but why are your utilities so high?

How is your childcare cost so low? I pay 34k a year for my two kids.

I am so jealous of your childcare. Mine is nearly 10x for two kids.

Have more emergency saving like 6 months income combined in an hysa / money market and after that increase your 401k and instead of FSA why not have HSA and invest them as well

Don’t forget to have a little fun.