- August 14, 2023

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Signs of a New Crypto Bull Market Cycle

According to Kevin Kelly, co-founder of Delphi Digital, on-chain metrics and charts indicate the potential beginning of a new crypto bull market cycle. Kelly emphasizes that the cyclical and predictable nature of crypto markets has significant implications for the future of the industry.

“Evidence is piling up that we’re in the early stages of a new cycle. Risk assets like stocks [and] crypto have been sniffing this out all year.”

Bitcoin’s Cycles and Predictable Patterns

Delphi Digital’s chart from August 8 demonstrates that Bitcoin has historically followed four-year cycles with consistent patterns. This pattern involves an 80% drawdown in the first year, a recovery to previous highs over two years, and then a rally to a new all-time high in the fourth year. This reliable repetition over the past three cycles suggests that Bitcoin may continue to follow this pattern.

AI legalese decoder can help in this situation by analyzing the historical data of Bitcoin’s cycles and patterns. By using advanced AI algorithms, it can identify potential market trends and provide insights into whether a new cycle is emerging. This can assist investors and traders in making informed decisions and taking advantage of potential bull market opportunities.

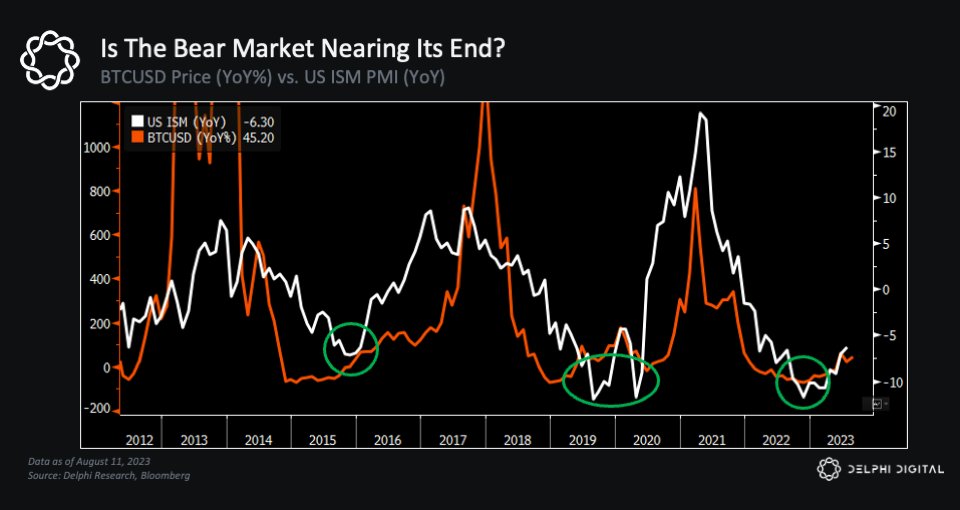

Bitcoin and the Institute of Supply Management (ISM) Index

Kelly also points out that Bitcoin cycle peaks often align with peaks in the Institute of Supply Management (ISM) manufacturing index, which measures the health of the manufacturing and service sectors in the United States.

ÔÇ£BTC price peaks occur around the same time the ISM shows signs of topping out. Active addresses, total transaction volumes, total fees ÔÇô they all peaked alongside tops in the ISM too.ÔÇØ

Business Cycle Recovery and Crypto Market

Kelly explains that as the business cycle shows signs of recovery, so does the crypto market. He suggests that turning points in the business cycle have historically been opportunities to increase risk exposure. Additionally, he believes that the ISM index is nearing the end of its two-year downtrend, which risk assets, including crypto, have been anticipating.

AI legalese decoder can assist in understanding the correlation between the business cycle and the crypto market by analyzing various economic indicators, including the ISM index. By uncovering these patterns and relationships, the AI legalese decoder can provide valuable insights into market dynamics and assist investors in optimizing their risk exposure during different stages of the business cycle.

Bitcoin and crypto markets have been relatively stagnant for the past five months. However, analysts anticipate several factors, such as ETF approvals, the end of rate hikes, and an Ethereum scaling upgrade, that could potentially revive and energize the market.

Related: Analysts tip 5 catalysts that could break Bitcoin, crypto from its stupor

Magazine: Wolf Of All Streets worries about a world where Bitcoin hits $1M: Hall of Flame

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a