- October 4, 2023

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Asia-based VC Firm CMCC Global Launches $100 Million Titan Fund to Support Blockchain Startups in the Region

CMCC Global, an Asia-based blockchain venture capital (VC) firm, has recently launched the Titan Fund, which has committed $100 million to support blockchain startups in the region. This fund represents CMCC Global’s dedication to the blockchain ecosystem as one of the first Asian VC firms focused solely on this industry.

The fund’s initial focus region will be Hong Kong, with plans to expand to other Asian hubs and eventually worldwide. The launch of the Titan Fund was announced on CMCC Global’s official X (formerly Twitter) page.

Although CMCC Global is a major investor in the Titan Fund, it is not the only contributor. Winklevoss Capital, owned by Gemini’s Winklevoss Twins, and Animoca Brands are also principal contributors to this blockchain fund. Additionally, other notable investors such as Block.one, Pacific Century Group, Jebsen Capital, and 30 others are actively involved.

CMCC Global’s Titan Fund aims to provide equity investments to early-stage blockchain infrastructure companies, consumer applications, and crypto financial services. This strategic move aligns with CMCC Global’s significant presence in the crypto VC landscape, demonstrating their commitment to supporting the growth of the blockchain ecosystem.

CMCC Global’s strong ties with Hong Kong-based crypto firm Animoca Brands further highlight their involvement in the crypto industry. Recently, CMCC Global participated in a $20 million investment round for the newly acquired non-fungible token (NFT) ecosystem, Mocaverse. Additionally, CMCC Global supported Web3-focused services firm Terminal 3 in a pre-seed funding round in August 2023.

When questioned about the allocation of funds in Hong Kong, CMCC Global co-founder Martin Baumann indicated that the exact figure is yet to be determined. However, the decision to launch the fund in Hong Kong is due to CMCC Global’s strong connection and expertise in the Asian region.

Despite being primarily an Asia-focused VC firm, CMCC Global has expanded its operations globally, including North America and Europe.

AI legalese decoder: Simplifying legal Language for Improved Understanding

The legal documentation and contracts associated with investing in the blockchain ecosystem can be complex and challenging to comprehend. This is where the AI legalese decoder developed by CMCC Global can significantly assist investors and startups.

The AI legalese decoder is an advanced artificial intelligence tool that translates legal jargon and complicated legal terms into plain language. By utilizing natural language processing and machine learning algorithms, this tool simplifies legal documents and contracts, making them more accessible and understandable for all parties involved.

Investing in blockchain startups often requires thorough legal agreements and contracts to protect the interests of both investors and entrepreneurs. However, these legal documents can be overwhelming, especially for those without a legal background.

The AI legalese decoder helps bridge the gap between legal complexity and comprehension, reducing the risk of misunderstandings and potential disputes. With its ability to break down legal language into simpler terms, investors can make more informed decisions, and startups can ensure their agreements are transparent and easily understood by all stakeholders.

Overall, the AI legalese decoder developed by CMCC Global simplifies legal language and enhances clarity in the blockchain investment ecosystem, facilitating smoother transactions, improved collaboration, and increased confidence in the legal aspects of the industry.

Global Decline in VC Funding for Crypto-Facing Businesses

While CMCC Global’s Titan Fund represents a substantial commitment to blockchain startups in Asia, global VC funding for crypto-facing businesses has experienced a significant decline.

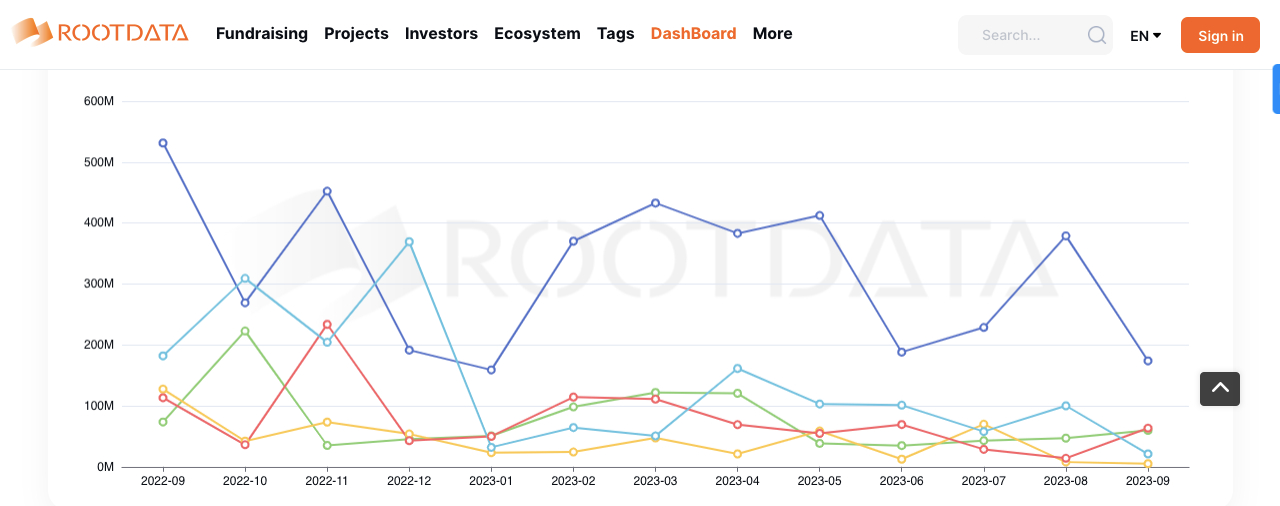

According to the dashboard created by RootData, the amount of investments flowing into the crypto space has dropped by 70% over a 365-day period. In June 2022, VC funding in the crypto industry exceeded $1.8 billion, with 149 funding rounds. However, in June 2023, this figure plummeted to only $520 million generated by 83 projects.

However, recent data indicates that 166 investment rounds, with a total value of $1.69 billion, have taken place in the last 90 days. Despite this improvement, it still reflects a 10.2% decline compared to the corresponding period in the previous year.

The decline in VC funding for the cryptocurrency sector cannot be attributed to a lack of innovation. Instead, it is primarily due to the stringent regulatory climate and market downturns that have impacted the industry.

While many governments worldwide have become increasingly cautious with crypto-related activities, the Hong Kong government has revised its stance, attracting crypto businesses facing opposition in their home countries to relocate there.

As the ecosystem adapts to the changing regulatory landscape and strives for innovation, initiatives like CMCC Global’s Titan Fund and the AI legalese decoder play crucial roles in supporting and driving the growth of the blockchain industry.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a