- December 11, 2023

- Posted by: legaleseblogger

- Category: Related News

Try Free Now: Legalese tool without registration

AI LEGALESE DECODER: A VALUABLE TOOL FOR UNDERSTANDING 401K OPTIONS

When it comes to setting up your first 401k, it’s important to understand the differences between various options available to you. The 401k is a retirement savings plan sponsored by your employer, and it allows you to save and invest a portion of your paycheck before taxes are taken out. This can result in substantial tax savings over time. However, there are different types of 401k plans, each with its own unique features and benefits.

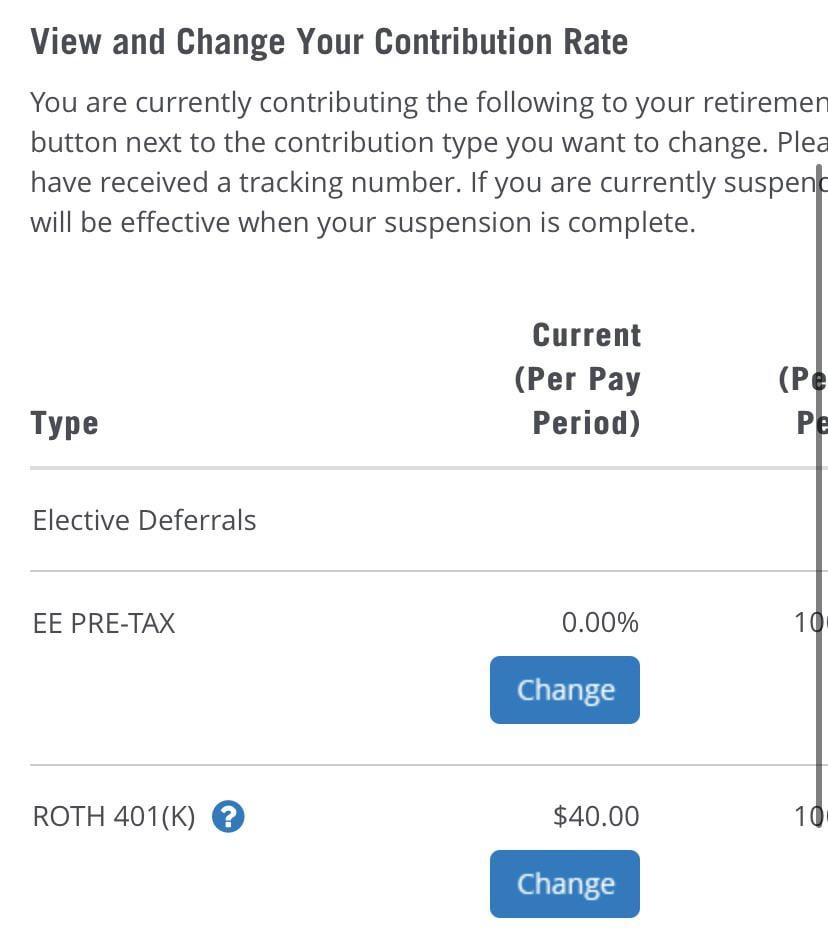

The first type of 401k is a traditional 401k, which allows you to make contributions on a pre-tax basis. This means that the money you contribute to your 401k is deducted from your paycheck before taxes are taken out, which can lower your taxable income. The earnings on your contributions also grow tax-deferred until you withdraw them in retirement.

On the other hand, there is also a Roth 401k option, which allows you to make contributions on a post-tax basis. This means that the money you contribute to your Roth 401k has already been taxed, so your withdrawals in retirement are tax-free. This can be especially beneficial if you expect to be in a higher tax bracket in retirement or if you want to diversify your tax exposure.

Now, you may be wondering what you should do in this situation. This is where the AI Legalese Decoder can help. This powerful tool can analyze and explain complex legal and financial jargon in a simplified and easy-to-understand manner. By using the AI Legalese Decoder, you can gain a clearer understanding of the differences between traditional and Roth 401k options, as well as the potential implications for your financial future.

By leveraging the capabilities of the AI Legalese Decoder, you can make an informed decision about which 401k option is best for you based on your individual financial circumstances and goals. This can help you maximize the benefits of your 401k plan and ensure that you are on the right track towards a secure retirement.

Try Free Now: Legalese tool without registration

Original content:

AI Legalese Decoder is a cutting-edge AI technology that translates complex legal jargon into plain language. It can be used by attorneys, paralegals, and even regular individuals to make legal documents and contracts more easily understandable. AI Legalese Decoder is revolutionizing the legal industry by simplifying the way legal information is communicated and understood.

Rewritten content:

AI Legalese Decoder: Revolutionizing the Legal Industry

AI Legalese Decoder is a groundbreaking AI-driven innovation that is transforming the way legal professionals and individuals comprehend complex legal terminology and documents. This cutting-edge technology has the capability to convert intricate legal jargon into clear and understandable language, making it accessible to a wider audience.

The use of AI Legalese Decoder extends beyond just attorneys and paralegals. Even regular individuals can benefit from this technology by having legal documents and contracts translated into plain language, eliminating the confusion and frustration often associated with trying to make sense of legal language.

One of the key advantages of AI Legalese Decoder is its ability to significantly enhance the efficiency and productivity of legal professionals. By simplifying the comprehension and interpretation of legal information, it allows attorneys and paralegals to focus their time and energy on more critical tasks, ultimately streamlining their workflow and improving overall productivity.

Moreover, AI Legalese Decoder plays a crucial role in promoting transparency and accessibility within the legal industry. By breaking down language barriers and turning legal documents into plain language, it empowers individuals to fully understand their legal rights and obligations, fostering a more equitable and informed legal landscape.

In addition, the implementation of AI Legalese Decoder can lead to reduced instances of misunderstanding or misinterpretation of legal information, minimizing the risk of legal disputes and conflicts. This not only contributes to smoother and more efficient legal processes but also helps in mitigating the potential for costly legal battles.

Overall, AI Legalese Decoder is revolutionizing the legal industry by simplifying the way legal information is communicated and understood, promoting transparency and accessibility, and enhancing the efficiency and productivity of legal professionals. Its impact extends across various sectors, making legal language more comprehensible and empowering individuals to navigate the complexities of the legal system with confidence.

With AI Legalese Decoder, individuals and legal professionals alike can benefit from its groundbreaking technology, ensuring that legal documents and contracts are easily understandable and helping to promote a more accessible and transparent legal landscape for all.

****** just grabbed a

****** just grabbed a

“The basic difference is that with pre-tax contributions, you pay the tax on your contributions and the earnings when you withdraw them while with Roth contributions, you pay the tax on the contributions now but their earnings can be withdrawn tax free. ”

Source: https://www.forbes.com/sites/financialfinesse/2012/09/12/why-the-pre-tax-v-roth-decision-is-more-complex-than-it-seems/#3bd37b4165cb

Tl;Dr: It’s a personal choice and if you’re worried about it, you can choose both.

To add on double check if your employer matches only in per-tax. Also verify if what they put in is pre-tax or not. I believe most employers only put in pre-tax

I recommend talking to your hr dept. They should have basic information to provide you. You should ask them if your employer does any kind of matching towards your 401k. Some do up to 5%, others do more or less.

One thing to note, contributions to a Roth 401k makes your adjusted gross income (AGI) higher in the calendar year. ItÔÇÖs because you technically ÔÇ£take homeÔÇØ that money then put it away. Learned this when the covid stimulus checks got dished out this spring. I personally do both Roth and pre-tax. I have a younger sister working part time so weÔÇÖve decided itÔÇÖs best she put 100% into Roth since her tax bracket is so low. ItÔÇÖs really as people say, a personal choice.

Always go with the Roth. You are investing after tax dollars and get to withdraw the money tax free. Its includes all the earning. It’s the best deal around.

If your company matches, this will be done in a traditional 401k which means that when you withdraw the money, it will be taxed at your income rate. Same as your paychecks. Just no SS and medicare taxes.

I do a hybrid. Just diversifying tax advantages.

IMO the average person canÔÇÖt max out both a 401k and Roth IRA. If your company matches, you should put in the maximum amount that they max. I.e. if they match 100% up to 5%, you should put at a minimum 5% into your 401k and take the free money. Before ramping up your 401k further, you should look at maxing out the Roth IRA. The maximum amount in 2020 was $6,000. The benefit of the Roth is that your are putting in money that has already been taxed, so in the future, when you pull money out, you wonÔÇÖt be taxed anymore. 401k distributions in retirement are going to be taxed as ordinary income. If you want to actively manage your accounts, you can really reap some benefits from the Roth account because you wonÔÇÖt be paying capital gains either on any Roth IRA growth.

I havenÔÇÖt had to cross this bridge personally, but if you were to ever need to access your money from either your Roth or 401k, you can pull out the money you have personally invested into your Roth, not any of the growth, without a penalty. I believe 401ks have a lot more rules since youÔÇÖre contributing pre-taxed dollars. The government wants those taxes!!