- April 29, 2024

- Posted by: legaleseblogger

- Category: Related News

Try Free Now: Legalese tool without registration

## Financial Stability and Planning for the Future

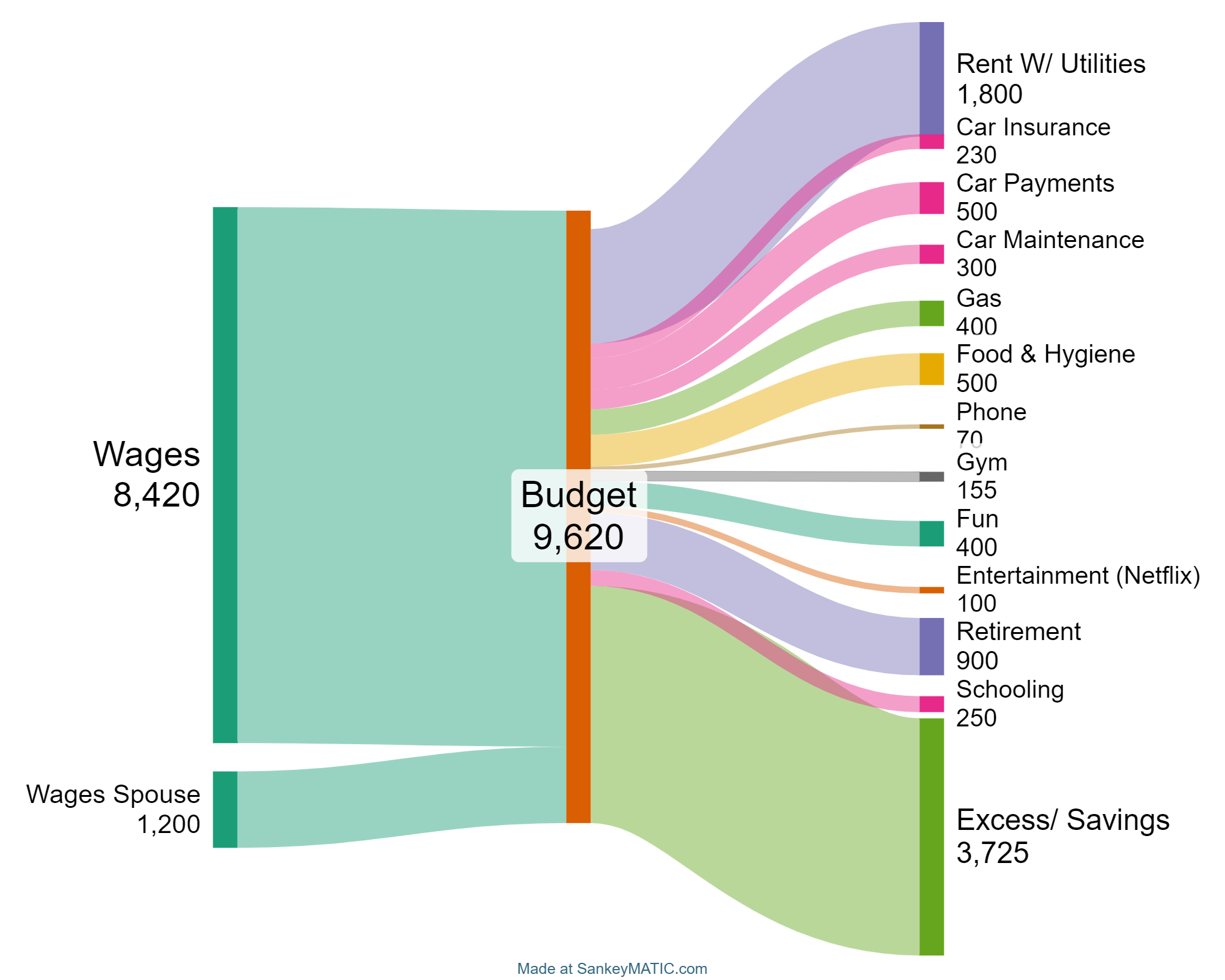

Currently, we find ourselves in a very stable financial position. I am fortunate to have a secure job, and my wife is working part-time while completing her college degree. The ultimate goal is to expand our family and eventually purchase a home. Anticipating a potential salary increase of 10-15% in the coming months, I am hesitant to factor this into our budget until it is confirmed.

With the prospect of increased expenses associated with children and homeownership looming on the horizon, I am seeking advice on how best to prepare. While I aspire to make a substantial down payment on a house, I am concerned that it may take several years to save up the desired amount. Is this a prudent decision, or should I reassess my approach? My wife’s graduation is approximately eighteen months away, and I am uncertain if there are any overlooked budgetary considerations that need to be taken into account.

## How AI Legalese Decoder Can Aid your Financial Planning

Using AI Legalese Decoder can streamline the budgeting process by helping you navigate complex legal and financial jargon. By utilizing this innovative tool, you can easily decode and comprehend any legal documents or financial terms that may impact your financial planning. This can help you make more informed decisions regarding your budget, savings goals, and overall financial strategy. With AI Legalese Decoder, you can confidently navigate the intricacies of financial planning and set yourself up for long-term success.

Try Free Now: Legalese tool without registration

**The Role of AI Legalese Decoder in Simplifying Legal Jargon**

In today’s fast-paced world, legal documents can often be filled with complex jargon and terms that are difficult to understand for the average person. This can lead to confusion and misunderstandings, which can result in costly mistakes or delays in legal processes.

AI Legalese Decoder is a revolutionary tool that uses artificial intelligence to analyze and simplify legal documents. By breaking down complex language into easy-to-understand terms, AI Legalese Decoder helps individuals and businesses navigate the legal landscape with ease.

With the help of AI Legalese Decoder, individuals can save time and money by avoiding the need to hire expensive lawyers or consultants to decipher legal documents. This tool can provide a clear and concise interpretation of legal jargon, enabling users to make informed decisions and take appropriate actions.

Overall, AI Legalese Decoder is a game-changing technology that is revolutionizing the way people interact with the legal system. By simplifying complex language and making legal documents more accessible, this tool is empowering individuals and businesses to take control of their legal affairs.

****** just grabbed a

****** just grabbed a

I would definitely but putting more into retirement or investment accounts but overall you’re doing well

You are not putting enough into retirement

Why are you guys saving so little for retirement?

Yeah where do I need to work to make $8,420 a month?!

Where the heck you livin that rent with utilities are this cheap?! My fiance and I bring in the same amount monthly as this chart but our rent + utilities alone is over $3.2k 😭😭

Edit: also car payments are $800 and insurance is $650 (2 cars)

Just so funny to see such a contrast with same income but different expenses. We don’t have nearly as much left over at the end of the month. Jealous, you’re doing great! We’ll never own a home lol.

Does this confirm the idea that “wages” is married and has a spouse?

food and hygiene for 2 @ 500?

you guys should shower up and go eat something nice

Do you have a long commute or do you need a truck for work? $1430 for your transportation is almost as much as your rent.

Why are you both not maxing out your 401K/IRA’s??

Why are you spending so much on your car and saving so little for your retirement

I’d say you’re doing great. I would reduce 401k to what the company matches. I would lean as hard as possible to pay off cars. Then I’d save aggressively to save for a house.

Jesus fucking Christ how is a $9,620 monthly salary middle class when the excess – $3,725 – is more than most people in America make in a year.

Nice chart, but it would have been better if you had bundled all 4 car-related expenses.

As for preparing for the future (kids, home), I would recommend that you make a separate budget/chart for each of these new circumstances.

Banana stand

If you’re paying $300 for car maintenance in a month, it’s time to consider a different vehicle. That’s close to a car payment you’re tossing out in maintenance cost

What do you do?

Do you guys have the basics of a 6-8month emergency fund in a HYSA yet? If not I would focus on that first, once that is in place, pay off car/reduce costs there and increase savings for 401k/roth. Then save extra towards a home. You can also do some side hustles to increase income to help pay for down payment.

$500 for food a month?!!!

You better start saving for retirement or you will work for the rest of your life

155 for gym?

Tell your wife, get your money up not your funny up growl

What price home are you looking for? Your income could support maybe $400k when your wife earns a full time income. For first time home buyer I would put 5% down to get into the house faster. That would only be $20k which you will have at the end of this year. I’d actually recommend having closer to $50k for closing costs and a buffer.

For extra security I would consider buying the home after your car is paid off. As others have said you should be saving nearly triple what you are now for retirement

How much are you driving? I have a car which gets 14 mpg at best and am only spending 200-240 a month on gas.

I was really expecting to open this up and see $5,000 for candles. Thanks Reddit you’ve ruined me.

Echoing everyone else, contribute enough to match employer in 401k, max out 2 Roth IRAs, save the rest for house. That’s 6k in 401k (if my math is right) 13k in both IRAs, for a total of 19k in retirement accounts. That leaves you with 36k a year to save for a house.

And ffs go take your lady out sometime!!

Everyone always forgets about gifts.

Birthdays, Christmas, anniversaries, Mother’s Day, Father’s Day, etc.

Gifts are a notable chunk of our budget.

[deleted]

If you can put the excess into a tax advantaged retirement plan, you save a significant amount of money.

Idk why people are criticizing OP for saving in cash outside of retirement. He wants to buy a house. People get obsessed with retirement savings.

Presumably you’re pretty young. You’re gonna have the next 30+ years to catch up on retirement. This is exactly what I did. Avoided PMI and don’t regret my decision at all. I’m making more income now and able to throw even more at retirement than I would’ve at the time. I’ve more than caught up. But saving when I did allowed us to get a house before interest rates went thru the roof and still put 20% down and pay cash for our wedding and honeymoon.

Question: what’s your plan for childcare once you have the kids? Every middle class family I know (and yes, 100k/yr is middle class) take a massive hit to their budgets during their kids’ early years due to childcare costs, and they really struggle. This is even for families that have lower cost options through churches and the like. I admire the fact that you’re saving for a house, but what’s going to come first, the house or the kids? It would suck to wipe out your savings by buying a home and be saddled with a mortgage, then not be able to afford childcare, unless of course you move to rural Mississippi or something.

I’m gonna ask the same question I asked in the last post in this sub.

Is that gym membership necessary? Is there a certain thing about that gym that makes it worth it?

A basic gym membership can be had for $15-35/month after calculating in annual fees, so is the extra $100/month ($1200/year) worth whatever added value it gives? I think it’s fine to have niceties if you feel like it’s worth it, but it’s definitely something I would take a look at.

I’m going to assume your spouse is in school, correct?

If possible to reduce rent via moving home or something of the like that would be your biggest help…if possible avoid paying someone else’s mortgage

You need to be putting a good 15% into retirement.

Are you currently renting a house or apt? If you are already in a house then what is your rush to buy?

Tool?

Where can I make this chart?

Is this pre or post tax for wages/budget?

How do people eat on 500 is beyond me. Which state is that, i want to move

Wow we should do it too

You need to be saving much more for retirement. I am not sure how old you are but if you are between 20 -40 you are in the best decade of your life for compound growth. I would be maxing two Roth IRAs and contributing as much as you can to the work 401k.

In terms of the house you dont need to put 20% down on your first house. Many CPAs say it’s ok to put down 5-10% as long as your total mortgage payment doesn’t exceed more than 25% of your monthly income.

1430/mo on car-related stuff seems like low hanging fruit. Every one of those categories seems like it’s at least double what I would expect.