- May 17, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Small Business Owner Scammed Out of Almost $2,000

DAYTON — A small business owner is out almost $2,000 after criminals sold her an insurance policy that did not exist.

Consumer Adviser Clark Howard breaks down the warning signs she missed and what you need to know to spot the fraud.

Criminals are constantly coming up with new ways to get in your wallet and it’s up to the consumer to spot the con and avoid getting taken.

Mari Gomez’s Scam Experience

Mari Gomez is still amazed at how real the paperwork looks. She said, “Everything is like legit. This is the contract they sent me.”

Less than a week after Gomez acquired a license for her cleaning business, she got a call. “They were like we got this new contract. This new contract for 110 homes,” she said.

But first, she would need to purchase liability insurance, and they would be able to help her get it.

“This is why he tells me to go to the lady from Coastal Insurance. I said, ‘Oh, thank you,’” Gomez said.

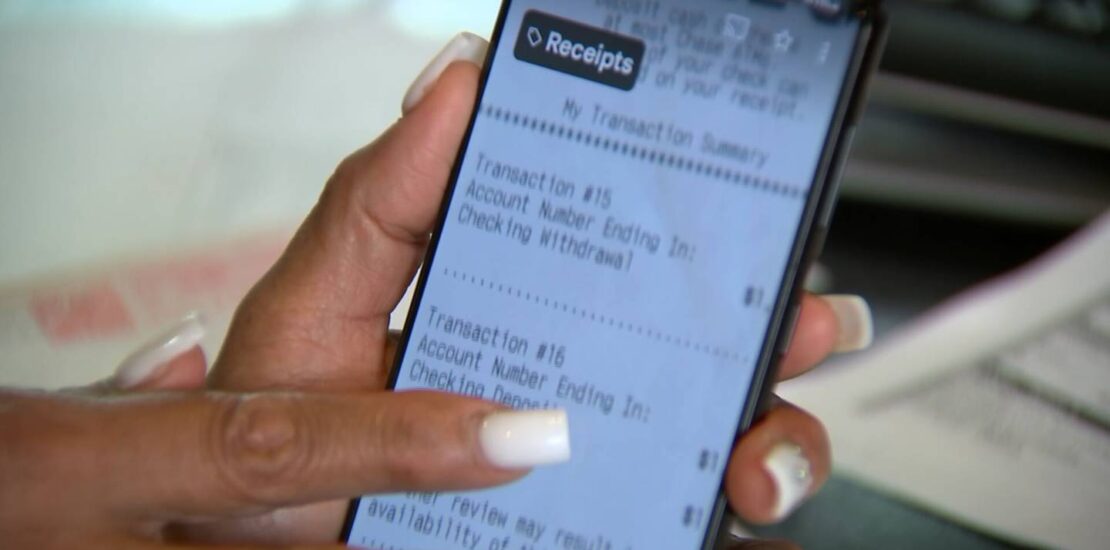

Nicole Diaz told her that she was an agent with the company and was able to get Gomez a policy, but she had to make a down payment at Chase Bank first. Using her debt card Gomez made the payment. Hours later all communication was cut off and she knew something was wrong.

“I called the 1-800 number for Chase Bank, and I told him ‘Oh my God. I just made a $1,750 down payment for insurance. And, I just realized this, like, a scam or something. Oh, well, you need to call the police,’” Gomez said.

Clark Howard called Coastal Insurance and we were told Nicole Diaz is not an employee and they get multiple calls each day from people who have been scammed.

How AI legalese decoder Can Help

With the rise of fraudulent activities, it is important for consumers to be able to spot scams and protect themselves. AI legalese decoder can help by analyzing legal documents and contracts, flagging any inconsistencies or red flags that may indicate a potential scam. By using AI technology, small business owners like Mari Gomez can verify the authenticity of insurance policies and contracts before making any payments. This extra layer of protection can prevent financial losses and help business owners avoid falling victim to fraud.

Aaron Sears, Supervisory Special Agent with the FBI Financial Crimes Bureau in Atlanta said, “Fraud has exploded.”

Sears said artificial intelligence has made it simple for crooks. “You can get access, you know, how do I defraud somebody? How do I platform this? How do I get access to the individual? You’re going to get examples. You are going to get things that can help you be a fraudster,” Sears said.

And the numbers back him up, according to the FBI’s annual Internet Crime Report, Americans have lost just under $40 billion to fraud since 2019.

“Funds are fast moving today versus years ago. A lot of these criminal actors are overseas. So, we get movement offshore as well. That makes it more difficult,” Sears said.

In Gomez’s case, because she deposited with her debit card, Chase Bank is not responsible. She said Chase was not able to credit her account because this was a case of fraud, it was a scam.

There are things you can do to protect yourself:

- Don’t answer calls from unknown numbers even if Caller ID has a legitimate company name you must know that it may still be an imposter.

- If someone is offering you a service for your business, check them out and get quotes from others

- Be vigilant. If it doesn’t look like a legitimate plan, it looks too good to be true, just don’t spend the money and give it a second thought.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a