- April 20, 2024

- Posted by: legaleseblogger

- Category: Related News

Try Free Now: Legalese tool without registration

## Monthly Budget Analysis in a Small Town in Michigan

### Overview

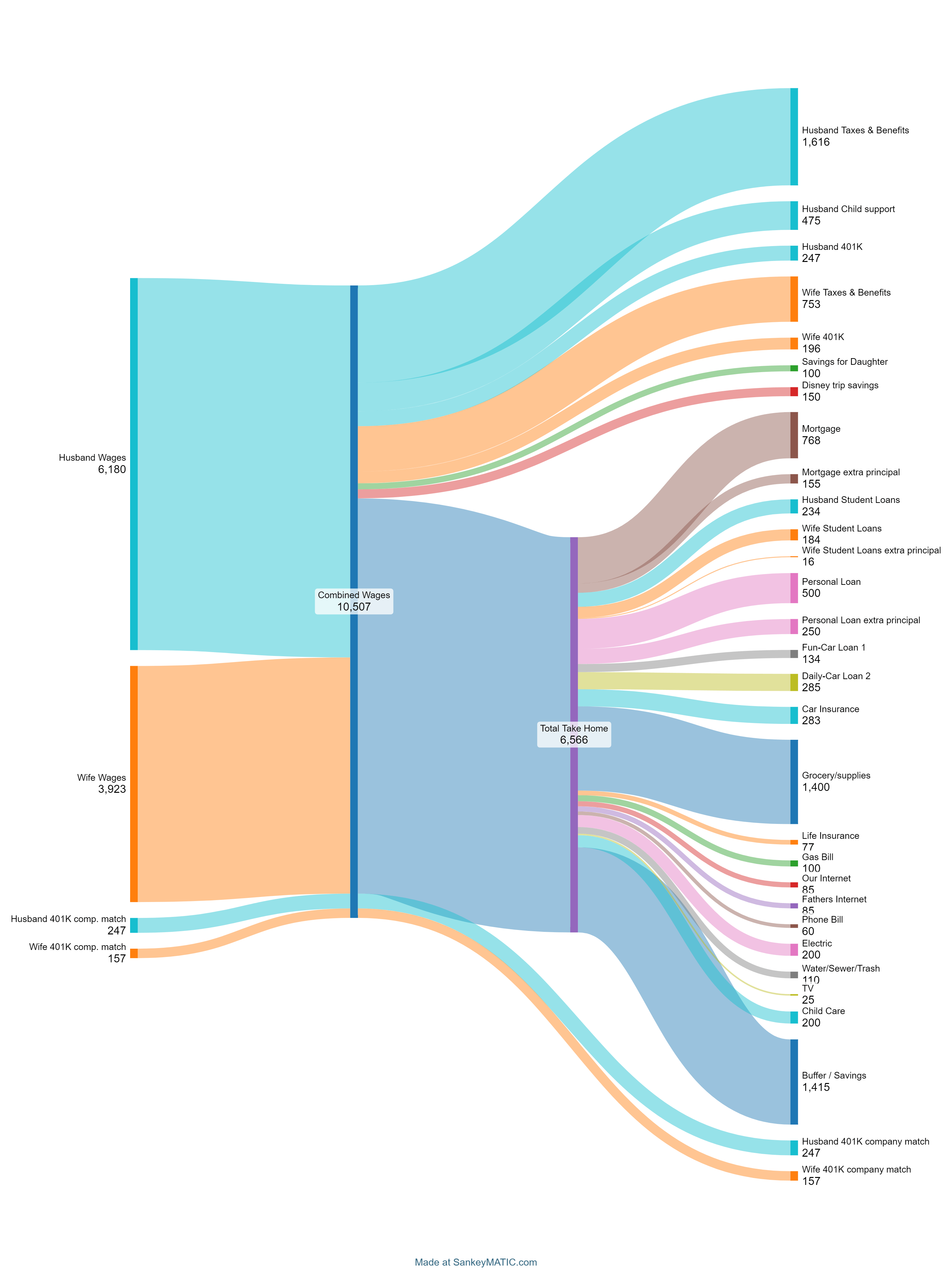

Here is a breakdown of our monthly budget in our small town in Michigan. We have three vehicles, one of which has been fully paid off. Additionally, we used a personal loan to build a workshop on our property.

### Living Expenses

We prioritize healthy and delicious meals, even though we acknowledge that we could reduce our grocery bill. However, we justify our spending on food as an investment in our quality of life. On the flip side, we don’t engage in many costly activities and prefer to stay home or engage in low-cost fun.

### Financial Planning

We have factored in childcare costs and car insurance costs, paying them only three months of the year and as a lump sum, respectively.

### How AI Legalese Decoder Can Help

AI Legalese Decoder can assist us in analyzing the legal jargon and contracts related to our personal loan for the workshop. It can help us decipher complex legal terms and ensure that we fully understand our financial obligations. Additionally, it can provide insights on potential cost-saving measures for our groceries and suggest budget-friendly activities to further optimize our expenses. By leveraging AI Legalese Decoder, we can gain a deeper understanding of our financial situation and make informed decisions to improve our budget management.

### Conclusion

We are open to your thoughts and suggestions on how we can further optimize our monthly budget.

Try Free Now: Legalese tool without registration

Title: How AI Legalese Decoder Can Simplify Legal Documents

Introduction:

Legal documents are notorious for their complex language and confusing terms that can leave many individuals scratching their heads in confusion. But fear not, with the help of AI Legalese Decoder, understanding legal jargon has never been easier.

How AI Legalese Decoder Works:

AI Legalese Decoder is a cutting-edge tool that utilizes artificial intelligence to analyze and interpret legal documents. By inputting a document into the AI Legalese Decoder platform, users can receive a simplified version of the content that is easier to understand and digest. This tool breaks down complex legal language into plain, straightforward terms, making it accessible to individuals without a legal background.

How AI Legalese Decoder Can Help:

Imagine receiving a contract or agreement filled with legal jargon that seems like it’s written in a foreign language. Instead of spending hours trying to decipher the document on your own, AI Legalese Decoder can simplify the content for you in a matter of seconds. Whether you’re a business owner, consumer, or just an individual looking to understand your rights and obligations, AI Legalese Decoder can be a game-changer in navigating the world of legal documents.

In addition, AI Legalese Decoder can help identify any potential pitfalls or hidden clauses in a document that may not be immediately apparent. This tool can provide you with a clearer understanding of the implications of a legal agreement, allowing you to make informed decisions and protect your interests.

Conclusion:

With AI Legalese Decoder, deciphering legal documents doesn’t have to be a daunting task anymore. This innovative tool can simplify complex legal language and empower individuals to confidently navigate the legal world. Say goodbye to confusion and frustration, and hello to clarity and understanding with AI Legalese Decoder.

****** just grabbed a

****** just grabbed a

You guys have such a huge amount of your take home going towards debt. Not including the mortgage you have $1600 per month going towards debt.

As said in other comments, car loans make people poor.

I don’t know the balances and interest rates, but if I were in your shoes, I would pull all of the extra payments and whatever you can pull from savings and really get after some of these debts. You guys have a decent income but are giving so much of it away.

Get on the same page and figure out a plan to attack the debt and you guys will be smooth sailing. Once debts are taken care of, pump up your 401k numbers. I’m not sure your age, but more for later never hurts.

Looks like a shit ton of loans…

need to know where you shop to pay $1400/mo for groceries (genuinely just curious tbh)

Increase student loan payments and paying down some of these debts. Also increase 401k contributions.

Thanks for all of the comments and advice. We are looking into rearranging things based on suggestions.

Aside from our mortgage and student loans all of loans mature within the next 5 years. We didn’t initially think this was “bad” but all of the comments have really opened our eyes a bit.

I figured I would clarify the 1400 groceries and supplies includes of course our food and household necessities, vitamins and perscriptions, also food and treats for our animals and fish a perscription for one of the animals, gas for our cars and any other week to week spending. Our animals are elderly and we don’t intend to have any more pets in the future.

As we continue to eliminate our debt we will work to putting more towards our retirement. We are both around 30 years old.

Any reason not to focus the multiple ‘extra principle’ amounts towards one debt?

What is a part time child? Isn’t your child always your child?

Do you have plans to retire at any point in the future? You’re saving less than 5% of your income towards retirement. The general rule is to put 15% for a regular retirement in your 60s. Please consider putting more towards retirement and don’t make your kids your retirement plan. If I were you, I’d set an example for the kids, teach them about budgeting, stop normalizing consumer/car debt and teach them to put their future first.

1400$ a month on groceries is ridiculous. What is the interest rate on the personal loan? Because if it is over 7% I’d would be throw all my extra money at that. Also why do you need a “fun car”? You also are not saving nearly enough for retirement.

These categories are too high:

* Supplies/Grocery $1400 (no idea what is going on here)

* Phone Bill $60 (you can get cell phone service for $15)

* You Internet $85 (you can probably get this to $50)

* Father’s Internet $85

Lower those bills then apply the excess you have to your highest interest rate loan.

I love that you save for trips to Disney

Pay more towards principles balance on highest interest rate loans first. If you are ever plan to go bankrupt, not a suggestion btw, then it would be better to pay off student loans first.

If you already have an emergency fund, your cash savings don’t need to be so high. Agreeing with others on the major points: lower your food costs, sell your 3rd car which will get rid of the loan and lower insurance. Allocating that savings and cutting those costs will let you save more for retirement and/or attack your loans with the highest interest rates like the personal loan.

This looks like a healthy budget to me. Sure there are some areas you could trim like others have said. Your debt is also taking a noteworthy amount but you’re paying them off, not getting behind. It I can see that you are saving monthly for your goals and spending more where you consider it worthwhile.

Financial success is found through good habits and consistency. It’s easier to maintain than big one time payments here and there to try to pay it all off at once, here you can do everything low and slow but consistently.

You’re also human beings who want to enjoy life so I don’t even mind that you have the third car or spend more on food. As long as you aren’t wasting excess food or throwing it all away I don’t see the problem with eating healthy and enjoyable food.

If you find your living paycheck to paycheck or stressed by money I would recommend paying the minimum monthly payment on your house, and possibly the other loans until you have saved enough to eliminate the “float” and have a month or two expenses in the checking account so you don’t have to watch the account for each bill to make sure there is enough. Then start paying off the highest interest loan first, snowballing that money into the next loan until they are payed off.

Good luck!

401k seems measly. You should start at 10% each and go up from there. I don’t think you saved as much as you think.

Just saw all your loans…. you are deep in debt. You need to dig yourself out of it first.

Is that your maximum 401k match?

You don’t need 3 vehicles at all. Get rid of one. You can easily improve quality of life/eat well and eating under $1400 a month. Thats ridiculous. My dad fed a family of five on $1000/month.

People with student loans and personal loans don’t get to have “fun cars.” Sell it.

What are y’all using to generate these graphs?

Can someone tell me what app or program this is