- April 29, 2024

- Posted by: legaleseblogger

- Category: Related News

Try Free Now: Legalese tool without registration

## Seeking Financial Improvement on Second Job

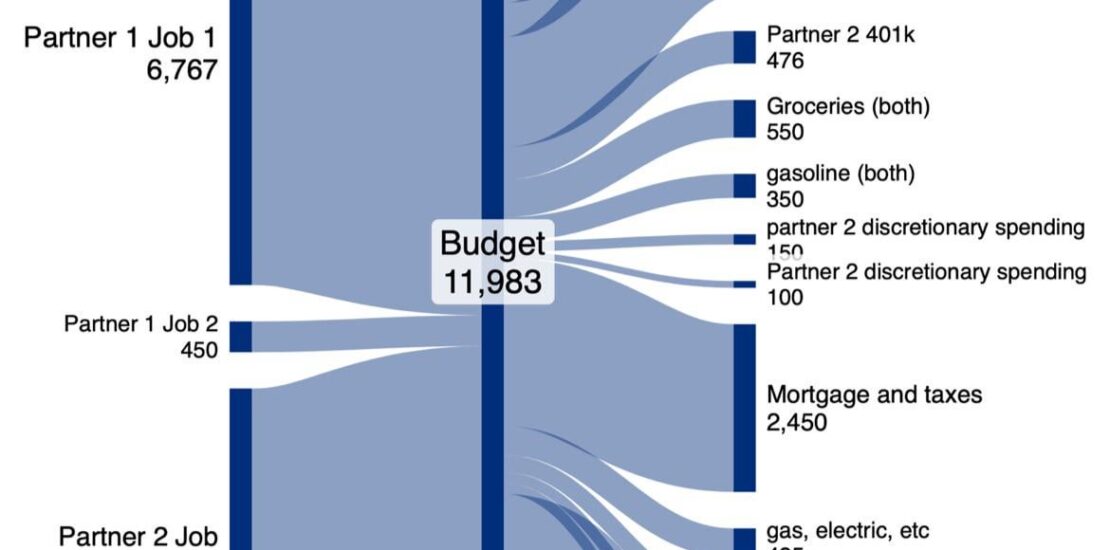

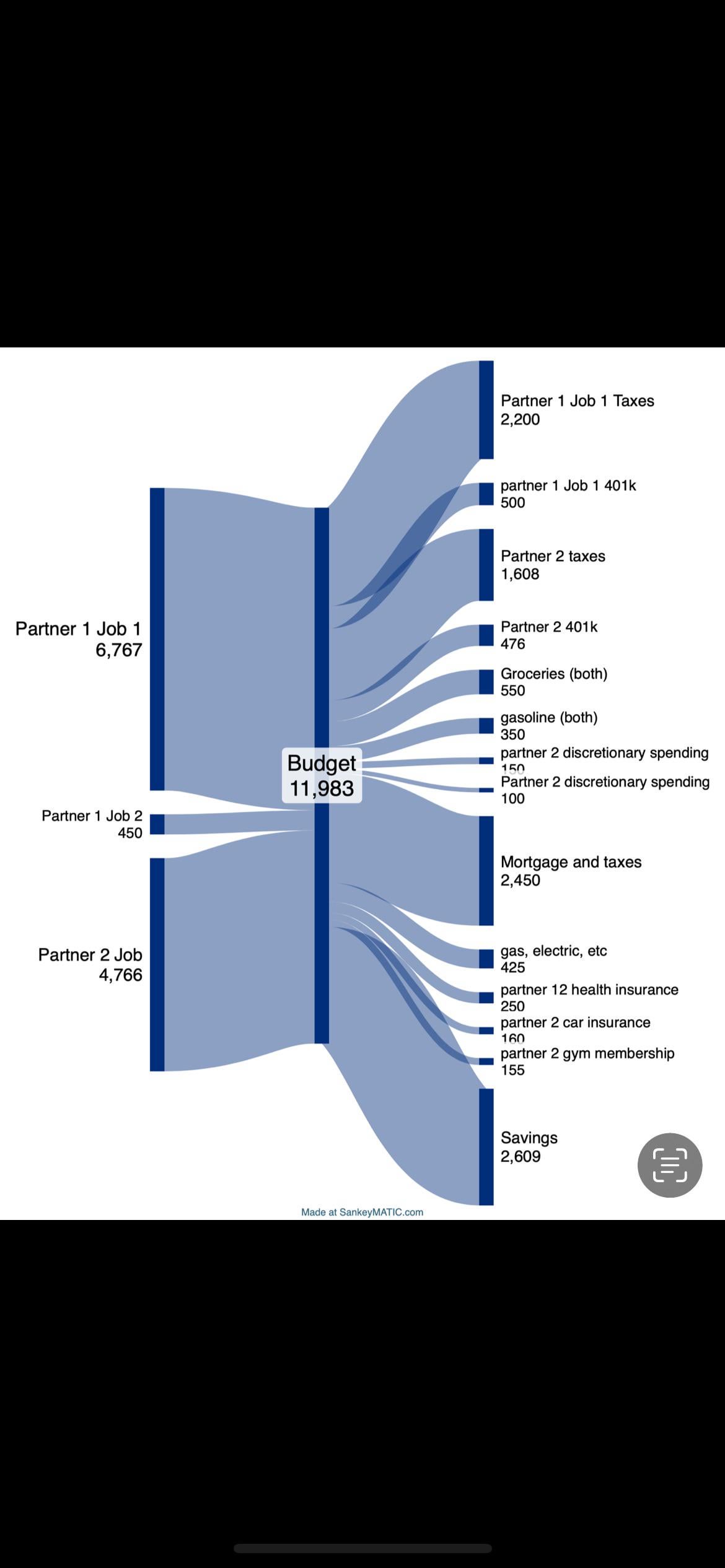

Hello all, I am new to this thread and seeking advice on how to improve financially. I currently have a second job as a 1099 worker, but I am unsure about the total amount of taxes I will owe. The estimated monthly income before taxes is around $450.

## Financial Planning for Unknown Expenses and Renovation

In addition to my second job, there are other unknown expenses such as wedding trips, occasional car issues, and upcoming house renovations that I need to budget for. My father, who is a contractor, will be providing the labor for the renovation, so I only need to budget for materials.

## How AI Legalese Decoder Can Help

AI Legalese Decoder can assist in calculating the estimated tax amount for your second job as a 1099 worker, taking into account the monthly income and providing a more accurate picture of your tax liabilities. It can also help in creating a budget plan for your upcoming expenses, such as wedding trips, car issues, and house renovations, by analyzing your financial data and providing recommendations on how to allocate your funds effectively. With the assistance of AI Legalese Decoder, you can better prepare for your financial future and make informed decisions.

Try Free Now: Legalese tool without registration

**Original Content:**

The use of artificial intelligence in legal documents has become increasingly popular in recent years. With advancements in technology, AI algorithms are able to analyze contracts, agreements, and other legal texts much faster and more accurately than humans. This has led to significant improvements in efficiency and accuracy in the legal industry. However, one major challenge remains – the complexity of legal language, also known as legalese.

Despite the benefits of AI in legal document analysis, machines still struggle to accurately interpret and understand complex legal jargon. This can lead to misunderstandings, errors, and potential legal issues. As a result, many legal professionals are hesitant to fully rely on AI tools for document analysis.

**Doubled Content with AI Legalese Decoder:**

The use of artificial intelligence in legal documents has experienced a surge in popularity over the past few years. This trend can be attributed to advancements in technology that have enabled AI algorithms to swiftly and accurately analyze various legal texts, such as contracts and agreements. The integration of AI in legal document analysis has significantly enhanced both efficiency and accuracy within the legal industry, revolutionizing traditional methods of document review.

Despite the numerous advantages that AI technology brings to legal document analysis, a considerable obstacle persists – the intricate and convoluted nature of legal language, commonly referred to as legalese. Even with the power of AI algorithms, machines often struggle to accurately interpret and comprehend the nuances of complex legal jargon, leading to potential misunderstandings, errors, and legal complications. Consequently, many legal professionals remain cautious about fully relying on AI tools for document analysis due to concerns about accuracy and reliability.

How AI Legalese Decoder Can Help:

AI Legalese Decoder is a cutting-edge tool designed to assist legal professionals in overcoming the challenges posed by complex legal language. By leveraging advanced AI algorithms and natural language processing capabilities, AI Legalese Decoder can accurately decipher and translate intricate legal jargon into easily understandable language. This innovative tool not only streamlines the process of legal document analysis but also enhances the accuracy and reliability of the results, ultimately enabling legal professionals to make informed decisions with confidence. With AI Legalese Decoder, legal professionals can confidently harness the power of AI technology in their document analysis workflows, saving time and minimizing the risk of errors and misunderstandings.

****** just grabbed a

****** just grabbed a

401k should be like $1000+ a month *each* not <$500 which will also lower your taxable income.

Do you guys, like, DO anything?

1. Your grocery list. It must just be rock solid. I presume no kids? Even so, that’s great.

2. It’s not a suggestion, more just a personal preference, but I would up the discretionary spending a bit.

My wife and I aren’t big spenders at all, but after a lot of early family deaths this past few years we just decided that denying us a dinner out or a date here and there was worth it even if we weren’t saving “100% optimally.”

I’m still waiting to see a polycule post their finances. I was hopeful here until I realized I had read it wrong lol

Why are you guys saving so little in your 401ks?

I read this wrong at first and thought, maybe these polyamory folks have a point…

Might also be more clear if you clumped some of the expenses like putting all taxes together, all investments together, and all fun spending together (and then breaking them down into their individual streams).

I hate that these show budget before taxes. I prefer to consider budget to be after required taxes

Good on them for finding partner 12 to help carry the load of health insurance

At you’re income level, contributing more to your 401k will give you larger tax savings than any return you might be getting on your “savings.” Unless you’re saving for something specific, look into contributing more to the 401k and/or see if you can find a healthcare plan with an HSA.

How do you make the snakey boy

With your income and savings rate you should be each maxing a Roth IRA and contributing more than 500 each to 401k

Waiting on a partner 3 one

Wow what gym is 155 per month?

If you have the savings and space I would build a home gym. I believe mine was between 3-4k, a mix of new (Titan) and used equipment but including a full rack, bench, bar, plates, dumbbells, treadmill, and a couple accessory machines I got at a gym auction. So you’d break even in two years or less. Not to mention the convenience of it, my commute to the gym is now a flight of stairs.

Agree with your budget if you have no savings and/or trying to build up for some big purchases. You spend very little on groceries and almost no discretionary spend given your salary totals. I guess you could be a big gym user given the cost and that is your passion and hobby. Not a bad thing. If you already have savings, think about more to your 401k but remember all work and no play will make life less fun.

$0 going out?

Is this budget made with real numbers tracked from your spending, or are these estimates of what you think/ hope/want to spend? I ask just because you don’t have money for eating out, gifts, sinking fund for home maintenance, auto maintenance, or the assorted randomness life throws at folks, and your discretionary spending is so small. If these numbers are the actual totals of average spending, how long have you been able to save $2,600 / month? Are you saving for something in particular?

$2600 in savings but only $500 to the 401k doesn’t make sense to me. Up the contribution, lower your taxable income. I’m assuming you’re contributing up to the company match, if not up to you need to up it at least that amount. Maybe open an additional Roth IRA. I would say 2k for 401k/IRA and 1,100$ savings would be a better mix. Also I’m not sure how you manage $500 a month for 2 ppl in groceries…but my hats off to you.

Not sure your gym or insurance situation but something I discovered (only after asking our insurance agent at my work, owners had no idea this was even a thing) our insurance provides a flat $28/month for thousands of gyms. Cut my gym membership more than in half, removed any contracts and annual fees, and gave me access to tons of gyms. Might be worth looking into if your company’s insurance offers this perk based on how much you guys are paying for your memberships

I wish I could find a mortgage for $2400.

Add partner 3

This is a mess of a graph, but aside from other things people have pointed out, is that gym membership necessary? Is there a certain thing about that gym that makes it worth it?

A basic gym membership can be had for $15-35/month after calculating in annual fees, so is the extra $100/month ($1200/year) worth whatever added value it gives?

Does Partner 1 not have car insurance and why is partner 2 paying $150 per month for the gym. Seems steep

We’re similar but kid takes up most of that savings 🫠 (worth it of course)

Both need to Max the 401k