- April 29, 2024

- Posted by: legaleseblogger

- Category: Related News

Try Free Now: Legalese tool without registration

## Introduction

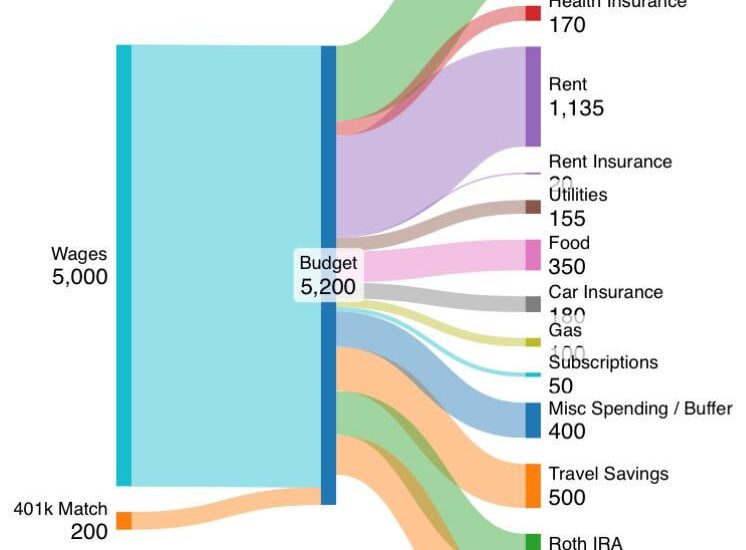

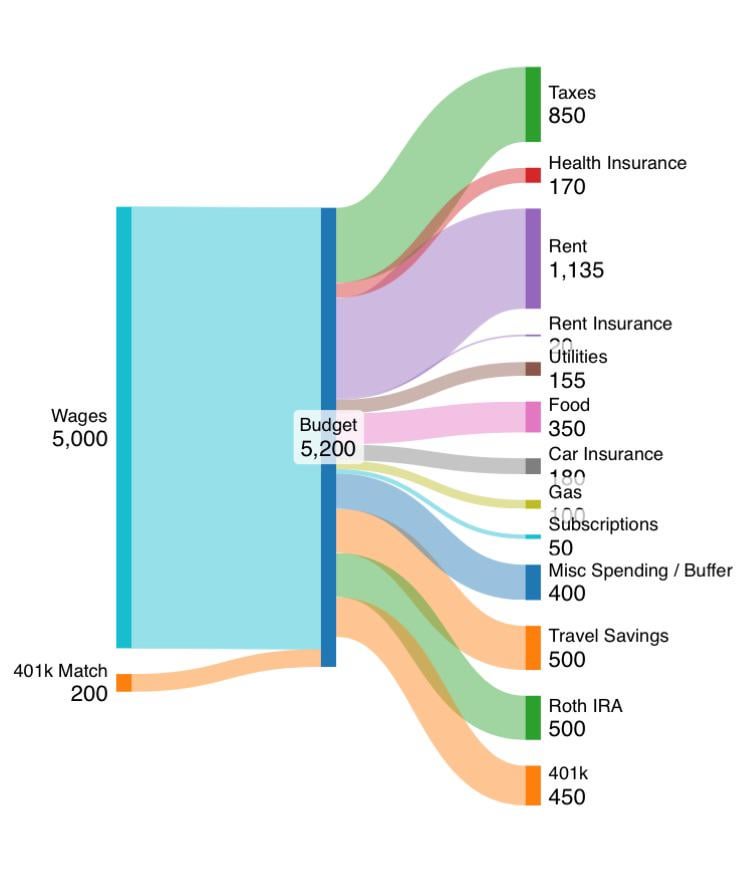

Greetings! I am a 25-year-old female who has recently reentered the workforce after an extended period of full-time travel. As I adjust to this new chapter in my life, I am focused on reestablishing my budgeting and savings habits.

## Current Financial Situation

During my travels, I allocated a significant portion of my income towards funding my adventures. I contribute $500 per month to a travel fund, from which I withdraw money whenever I book trips. Apart from these expenses, I believe that my budget is fairly standard. Any surplus funds at the end of the month are transferred to my primary savings account.

## Financial Goals

While I do not consider my budget to be overly extravagant, I am contemplating ways to reduce my expenses and build a substantial long-term savings fund. This fund will serve as a financial cushion for future endeavors, such as purchasing a home or pursuing other aspirations in my thirties. It is worth noting that I am currently debt-free and do not have any outstanding loans.

## Seeking Guidance

I am curious to know if my current financial trajectory aligns with typical expectations for someone my age. Should I be more proactive in accelerating my savings efforts, or am I on a satisfactory path towards achieving my long-term financial goals?

## How AI Legalese Decoder Can Help

With the advanced capabilities of the AI Legalese Decoder, you can accurately analyze and interpret complex legal documents and financial terms. By utilizing this innovative tool, you can gain valuable insights into your financial situation, identify potential areas for improvement, and make informed decisions regarding your savings strategy. The AI Legalese Decoder simplifies the process of deciphering intricate financial concepts, empowering you to take control of your financial future with confidence.

Try Free Now: Legalese tool without registration

**AI Legalese Decoder: Breaking Down Complex Legal Jargon**

Legal documents are notorious for being filled with complex and confusing language that can be difficult for the average person to understand. This can make it challenging for individuals to navigate the legal system and understand their rights. AI Legalese Decoder is a revolutionary tool that can help individuals decipher complex legal jargon and understand their legal documents.

With AI Legalese Decoder, users can simply upload their legal documents to the platform, and it will automatically analyze and translate the complex language into plain, easy-to-understand terms. This can help individuals better understand their legal rights and obligations, and make it easier for them to navigate the legal system.

Additionally, AI Legalese Decoder can also provide recommendations and suggestions for legal action based on the content of the document. This can help individuals make informed decisions about their legal matters and ensure they are taking the appropriate steps to protect their rights.

Overall, AI Legalese Decoder is a valuable tool for individuals who are struggling to understand complex legal documents. By breaking down the language barrier and providing clear, concise translations, this tool can help individuals navigate the legal system with confidence and clarity.

****** just grabbed a

****** just grabbed a

You’re saving just under 20% of your gross income for retirement, which is excellent. The obvious place to cut is the travel budget, where another 10% of your income is going.

At this point it’s a question of priorities — does the travel out-weigh the other things you can do with the money?

Unpopular opinion but I wouldn’t normally cut the travel budget when you’re young. Enjoy it as much as you can. But think about how much of an emergency fund you have. Do you have 6 months of expenses if you lose a job? Do you have a enough for an emergency expense – car, health, get stranded on a trip. Do you have travel insurance when you are out of your home country in case you have health costs?

When you do want a house or a new car, how much of a downpayment do you need? If you think you’ll want those things in the next few years then that’s where you can either drop the retirement slightly or the travel slightly, or find a cheaper place to live (more roommates?)

If you get a bonus or get paid biweekly (so 2 months are 3 paycheck month) or get a tax refund or a money gift for holidays, that money should go straight to savings

No your budget isn’t bad per se, but I would definitely try to save some money in a straight savings account as a part of your budget. If you’re looking to buy a house, you’re currently only building capital “if you have any left over”. You really don’t have too much wiggle room, but overall I think you’re doing great!

What’s the misc spending? $400 is a lot. I would break that down further

That taxes split is pretty big, you should probably get rid of that and save more.

I thought it said $400 on butter and I had questions. But you seem to have a decent lock. I just don’t see any non travel savings.

This doesn’t add to 5,000

What did you use to make the chart?

In today’s economy I feel your budget is pretty normal. But what I feel is that you should try saving a little more u can if you remove some from buffer and travel savings. Then you can also decide if you want to invest some of it or just wanna put it in a different bank account so u can save it.

Keep your budget for Roth IRA and 401K the same

All the best!!!

Looks pretty good on a savings front. With the match you’re saving 23% of your gross wages. Personally I’d forgo the travel in your 20s and use that money to max out the Roth IRA and increase 401k contributions or save for a down payment on a house.

Also, looking into an High deductible health plan and getting an HSA if you have one available through work. It’s a great way to get a tax deduction and save for retirement.