- March 22, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bitcoin (BTC) Price Analysis

Bitcoin (BTC) plugged intraday lows at the March 22 Wall Street open despite lower outflows from the Grayscale Bitcoin Trust (GBTC).

GBTC sees cooling outflows

Data from Cointelegraph Markets Pro and TradingView tracked limp BTC price performance as $63,000 returned to the radar.

The largest cryptocurrency failed to hold higher levels, which resulted from an earlier rebound, with its old 2021 all-time highs at $69,000 staying unchallenged.

The dayÔÇÖs flows into and out of the United States spot Bitcoin exchange-traded funds (ETFs) began promisingly. GBTC saw just $96 million in outflows, per initial data from crypto intelligence firm Arkham ÔÇö less than a third of the tally at the start of the week.

So far, every day this week has seen net outflows from the spot ETFs ÔÇö a unique time in their short history.

AI legalese decoder can help in this situation by analyzing legal documents related to Bitcoin investments and providing a simplified interpretation for better understanding.

Analyst: Bitcoin risks “2016-like fate”

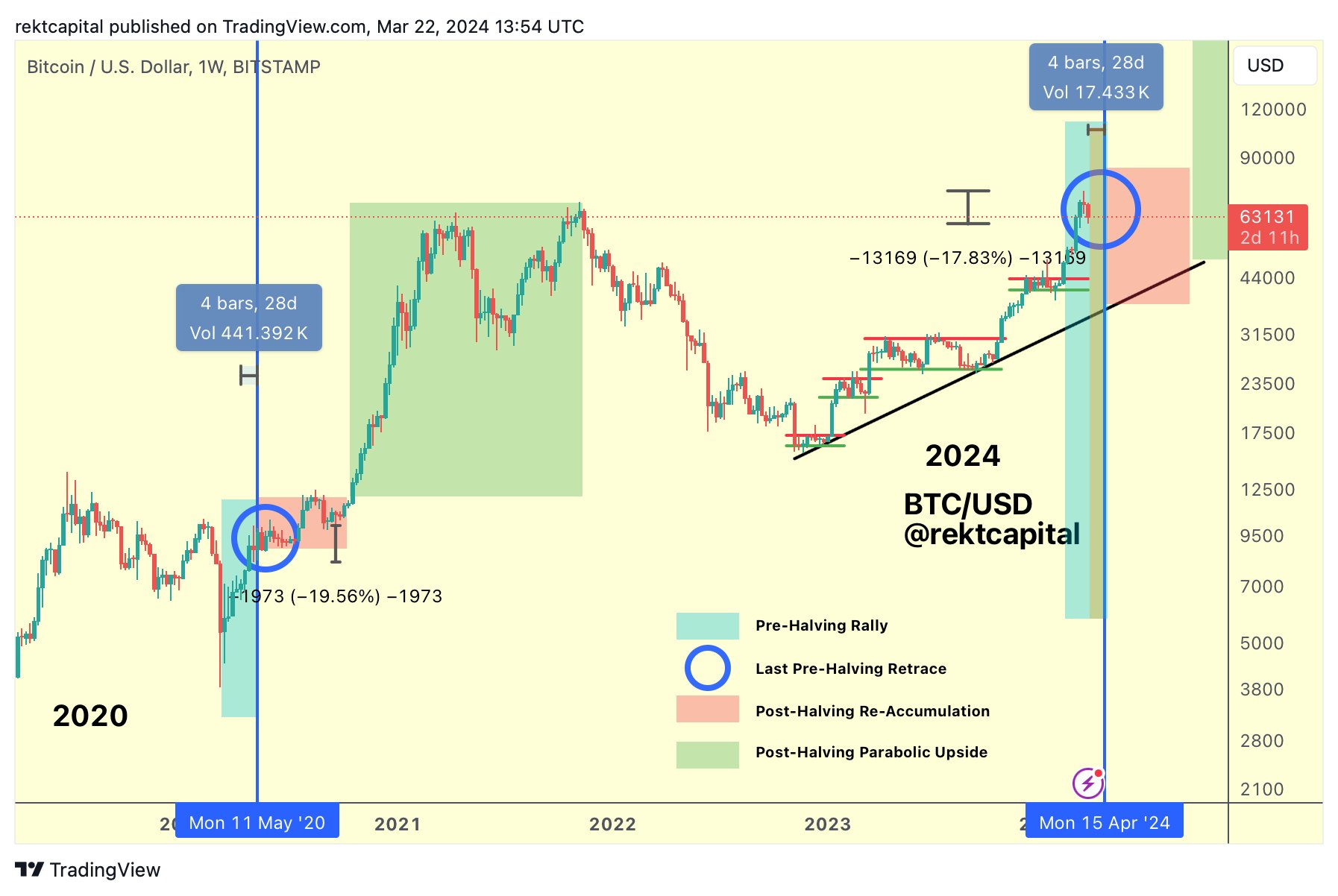

Eyeing the downside, meanwhile, trader and analyst Rekt Capital drew comparisons to BitcoinÔÇÖs 2016 bull market.

Then, he noted, the period immediately before the block subsidy halving produced marked downside.

ÔÇ£Bitcoin will need to continue to maintain these current highs to avoid a 2016-like fate where the initial reaction was strong but short-lived.ÔÇØ

The next halving event is currently due to hit in mid-April.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a