- April 23, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

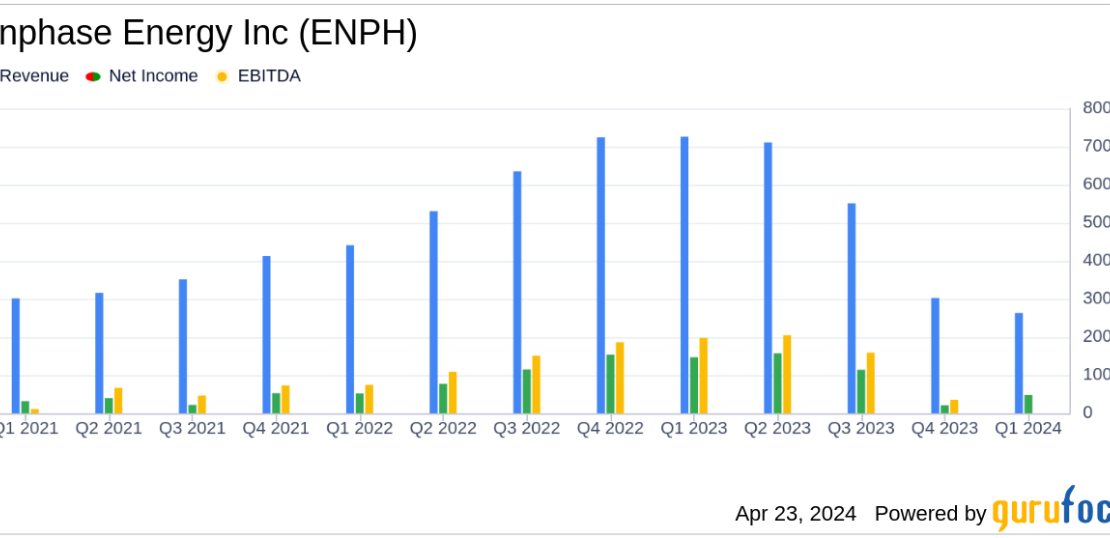

## Financial Analysis of Enphase Energy Inc Q1 2024 Earnings

– **Revenue:** Enphase Energy Inc reported a revenue of $263.3 million, falling short of the estimated $283.15 million by analysts. The AI legalese decoder can help analyze the discrepancy in revenue and provide insights on potential factors contributing to the shortfall.

– **Net Income:** The company reported a GAAP net loss of $16.1 million, while its non-GAAP net income reached $48.0 million, surpassing the estimated net income of $57.56 million. The AI legalese decoder can assist in understanding the reasons behind the net loss and how the non-GAAP net income exceeded expectations.

– **Earnings Per Share (EPS):** Enphase Energy Inc’s non-GAAP diluted EPS was $0.35, lower than the estimated $0.40. Utilizing the AI legalese decoder can offer a deeper analysis of the EPS performance and its implications for investors and stakeholders.

– **Gross Margin:** The non-GAAP gross margin was 46.2%, marking a decrease from the previous quarter’s 50.3%. The AI legalese decoder can provide valuable insights into the factors impacting the gross margin and potential strategies to improve it.

– **Free Cash Flow:** Enphase Energy Inc generated $41.8 million in free cash flow in the first quarter, showcasing strong cash management capabilities. The AI legalese decoder can help evaluate the impact of free cash flow on the company’s financial health and growth prospects.

– **Operational Efficiency:** The company reduced its operating expenses to $82.6 million non-GAAP, down from $86.6 million in the previous quarter. The AI legalese decoder can provide a detailed analysis of the operational efficiency measures implemented by Enphase Energy Inc.

– **Stock Repurchase:** Enphase Energy Inc repurchased 332,735 shares at an average price of $126.21, totaling approximately $42.0 million. The AI legalese decoder can analyze the impact of stock repurchase on the company’s capital structure and shareholder value.

## About Enphase Energy

Enphase Energy is a global energy technology firm headquartered in Fremont, California. The company is recognized for its innovative microinverter technology and focuses on serving the rooftop solar market. Enphase’s solutions integrate solar generation, storage, and communication on a single platform, with a significant revenue contribution from the United States. The AI legalese decoder can assist in deciphering the complex legal language used in financial disclosures and regulatory filings related to Enphase Energy.

## Financial Highlights and Challenges

In the first quarter, Enphase Energy witnessed a 34% decrease in revenue from the U.S. market compared to the previous quarter, attributed to seasonal variations and demand fluctuations. However, revenue from Europe exhibited a remarkable increase of around 70%. While the company reported a GAAP gross margin of 43.9%, its non-GAAP gross margin stood at 46.2%. Despite facing financial challenges, the company managed to achieve a non-GAAP operating income of $39.0 million. The AI legalese decoder can assist in analyzing the financial performance metrics and identifying areas for strategic improvement.

## Strategic Developments and Market Expansion

Enphase Energy has been actively expanding its product offerings and market presence, with recent launches including the IQ8P Microinverters and the third generation of IQ Batteries. These products are now available in multiple global markets, including the United States and Australia. The company has also announced strategic partnerships and new product introductions aimed at enhancing the accessibility and efficiency of solar energy solutions worldwide. The AI legalese decoder can provide insights into how these strategic developments impact the company’s market position and competitive advantage.

## Future Financial Outlook

For the second quarter of 2024, Enphase Energy projects a revenue range between $290.0 million and $330.0 million. The company anticipates GAAP and non-GAAP gross margins to fall within specific ranges. These projections also include the expected benefits from the net IRA benefit estimated to impact shipments of U.S. manufactured microinverters. The AI legalese decoder can help analyze the company’s financial outlook and forecasted performance metrics.

## Investor and Analyst Perspectives

Despite the challenges faced in the first quarter, Enphase Energy’s strategic initiatives and market expansion efforts provide a positive outlook for potential recovery and growth in upcoming quarters. The company’s focus on innovation and global market penetration remains critical in navigating the competitive landscape of the solar technology industry. Investors and stakeholders can leverage the AI legalese decoder to gain valuable insights into Enphase Energy’s financial performance and strategic direction based on regulatory filings and corporate disclosures.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a