- May 6, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Financial Performance of Bain Capital Specialty Finance Inc

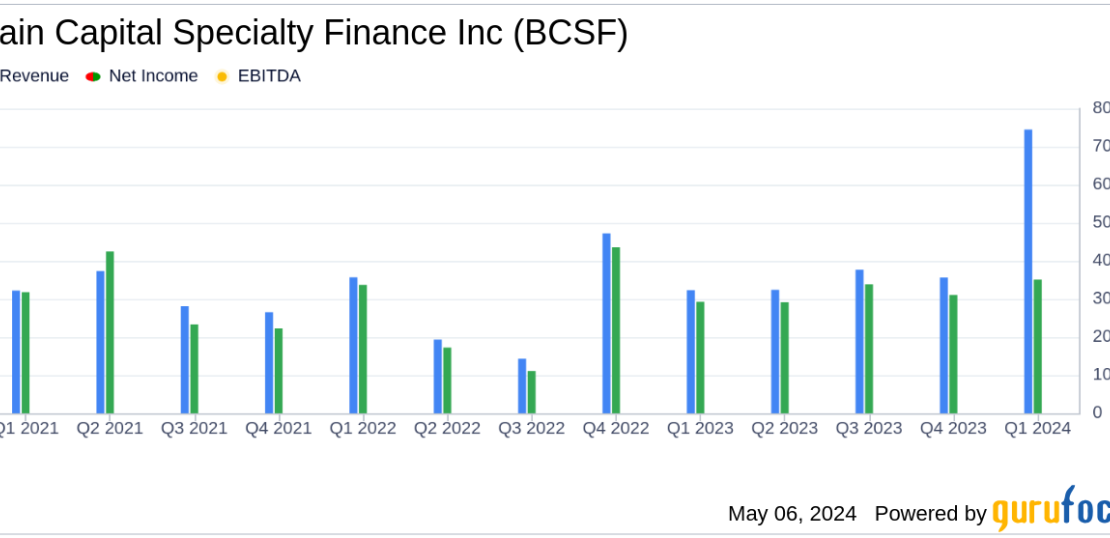

Bain Capital Specialty Finance Inc (NYSE:BCSF) recently released its 8-K filing on May 6, 2024, revealing its financial results for the first quarter that ended on March 31, 2024. The company reported earnings per share (EPS) of $0.55, which matched the estimated EPS of $0.55, indicating a strong financial performance.

The company also declared a regular dividend of $0.42 per share and an additional dividend of $0.03 per share for the second quarter of 2024. This highlights BCSF’s commitment to shareholder value and consistent financial management practices.

AI legalese decoder Advantages

The AI legalese decoder can assist investors and analysts in deciphering complex legal and financial terms within Bain Capital Specialty Finance Inc’s 8-K filing. By utilizing this tool, users can easily comprehend concepts such as earnings per share (EPS), net investment income, net asset value (NAV) per share, revenue, dividends, portfolio health, and investment activity.

With a deeper understanding of these financial metrics, users can make informed investment decisions and gain insights into BCSF’s financial standing and performance. The AI legalese decoder simplifies dense legal language and complex financial data, enabling users to navigate financial reports with ease and accuracy.

Key Financial Insights from BCSF’s Q1 Performance

For the first quarter of 2024, BCSF reported a net investment income (NII) of $34.0 million, slightly lower than the NII in the previous quarter. The company’s net asset value (NAV) per share also increased, signaling a positive trend in asset valuation amidst market volatility.

BCSF’s investment portfolio demonstrated strong diversification, with holdings spread across 153 companies in various industries. The company’s proactive management of investments on non-accrual reflects an improvement in credit quality and risk management.

Strategic Investment and Portfolio Management

During the quarter, BCSF actively invested $403.1 million in 83 portfolio companies, showcasing its dynamic investment approach. The net investment fundings of $107.1 million, after factoring in repayments and sales, underscore the company’s strategic portfolio management strategy.

Challenges, Opportunities, and Dividend Declaration

While facing challenges such as an increased net debt-to-equity ratio, BCSF’s senior-secured investment approach and stable credit quality position the company well to navigate market uncertainties. The board’s consistent dividend declaration reflects confidence in the company’s cash flow generation and financial stability.

Future Outlook and Value Proposition

BCSF remains well-positioned to capitalize on opportunities in the middle-market lending space, supported by a strong balance sheet and strategic investment capabilities. With a prudent investment strategy and aligned EPS, the company is poised to deliver sustained value to shareholders amidst market fluctuations.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a