- July 31, 2023

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

United States Crypto Investors Must Report Crypto Staking Rewards as Gross Income

Introduction

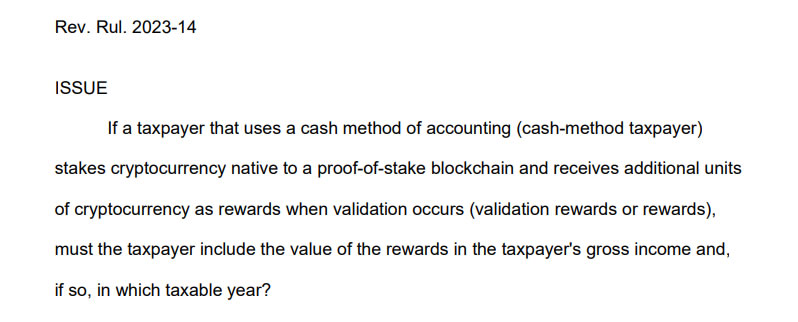

A new ruling from the Internal Revenue Service (IRS) in the United States states that crypto investors in the country must report their crypto staking rewards as gross income in the year it was received. This ruling, named Revenue Ruling 2023-14, provides clarity regarding how income earned from staking digital assets should be treated for taxation purposes.

Image Source: irs.gov

The Ruling Details

The ruling emphasizes that gross income includes income in any form, including money, property, services, and now staking rewards. It applies to cash-method taxpayers who receive any cryptocurrency as remuneration for validating transactions on proof-of-stake blockchains. This ruling applies to both direct staking of cryptocurrency and staking through a centralized crypto exchange.

According to the ruling, the fair market value of the crypto rewards must be included in the annual income and should be determined at the time the assets are received. The taxpayer gains dominion and control over the validation rewards and their fair market value is determined as of that date and time.

The IRS defines “dominion” as the time when the investor controls, possesses, and has the ability to sell, exchange, or otherwise dispose of the cryptocurrency rewards.

The Significance of the Ruling

This ruling is significant as it extends the previous tax treatment to include crypto staking rewards. Previously, the IRS subjected crypto-mining rewards to both income and capital gains taxes but lacked provisions for staking rewards, as highlighted by crypto tax firm Koinly. By treating crypto staking rewards like stock dividends, the IRS is now recognizing the taxable nature of these rewards.

This ruling has raised concerns and disappointment among some experts. Jason Schwartz, tax partner and digital assets co-head at Fried Frank, expressed disappointment, emphasizing that taxable income usually requires the existence of a payer or counterparty. Even so, the ruling stands, and crypto staking rewards should be reported as gross income for tax purposes.

How AI legalese decoder Can Help

The AI legalese decoder can assist crypto investors in understanding and complying with the IRS ruling regarding reporting of crypto staking rewards as gross income. It can provide a simplified and reader-friendly interpretation of complex tax regulations, making it easier for individuals to grasp the requirements and implications of the ruling. It can help in identifying the specific actions and transactions that need to be properly reported for tax purposes, ensuring compliance with the IRS guidelines. By leveraging AI legalese decoder, investors can alleviate the complexity and confusion surrounding tax obligations related to crypto staking rewards.

Conclusion

The recent ruling from the IRS clarifies that United States crypto investors must report their crypto staking rewards as gross income in the year they are received. This ruling extends the taxable treatment to include staking rewards and highlights the need for proper reporting and compliance. While the ruling has received mixed reactions, including disappointment from some experts, it is essential for investors to understand and fulfill their tax obligations. The AI legalese decoder can assist investors in comprehending the ruling and adhering to the tax requirements surrounding crypto staking rewards.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a