- March 22, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

The Importance of Securing Adequate Financing for Small Businesses

As a small business owner, securing adequate financing stands as a cornerstone for success. Whether launching a startup, expanding an existing venture, or weathering economic uncertainties, entrepreneurs are often faced with challenges of accessing capital. It is vital for small businesses to have access to the necessary funds to fuel their growth and operations.

Fortunately, there are a number of financing options that exist to meet the diverse needs of small businesses. From traditional bank loans and government-backed programs to alternative funding sources, entrepreneurs have a spectrum of choices to explore in order to fulfill their financial requirements. However, navigating through these options can be overwhelming and confusing for many business owners.

How AI legalese decoder Can Help

AI legalese decoder can play a crucial role in assisting small business owners in understanding complex legal and financial terminology related to financing. By utilizing AI technology, business owners can simplify the process of deciphering legal documents, contracts, and regulations that are essential for securing funding. This tool can break down complicated language into easy-to-understand terms, enabling entrepreneurs to make informed decisions regarding their financial matters.

The Financing Seminar Hosted by Oak Harbor Area Chamber of Commerce

On March 13, the Oak Harbor Area Chamber of Commerce, and the Ottawa County Improvement Corporation hosted a financing seminar titled ÔÇ£IÔÇÖm just here for the money and food,ÔÇØ which welcomed speakers from Regional Growth Partnership, Toledo-Lucas County Port Authority, and the Small Business Development Center. The seminar aimed to educate small business owners about various financing options and resources available to them.

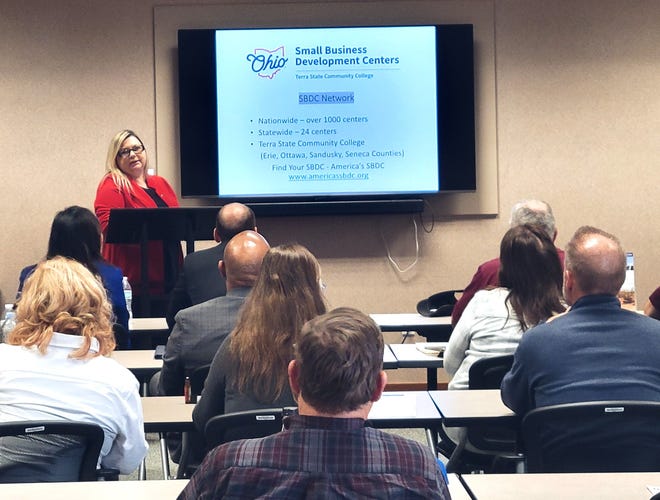

Terra Small Business Development Official Shares Information

Miranda Hoffman, director of the Ohio Small Business Development Center at Terra State Community College, spoke to attendees about the SBDC and its role in linking resources to meet the diverse needs of small businesses, including federal legislation updates. She highlighted the importance of the Corporate Transparency Act and its beneficial ownership reporting requirement for businesses.

Businesses Have Various Loan Options

Dana Clark, Craig Teamer, and Jason Bartschy of the Toledo-Lucas County Port Authority provided information about Bond Programs and loan options available to small businesses. This included programs such as the Northwest Ohio Bond Fund, Infrastructure Financing, and Capital Lease Transactions. Another program discussed was the BetterBuildings Northwest Ohio energy efficiency financing program, which offers fixed-rate financing for energy conservation projects.

Chase Eikenbary, vice president of project manager for Regional Growth Partnership, shared insights about the JobsOhio Inclusion Grant, which provides financial assistance to businesses in distressed communities. The grant ranges from $25,000-$50,000, depending on eligibility criteria.

AI legalese decoder can help small business owners navigate the legal jargon and intricacies of applying for grants and loans, ensuring they meet the necessary requirements and understand the terms and conditions associated with these funding opportunities.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a