Decoding Financial Health: How AI Legalese Decoder Sheds Light on Serica Energy plc’s Latest Stock Performance

- September 28, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Serica Energy’s Impressive Market Performance: A Closer Look at Financial Indicators

Serica Energy (LON:SQZ) has made remarkable strides in the stock market, showcasing an impressive 6.7% increase in its share price over the last month alone. This notable performance has prompted a deeper evaluation of the company’s financial metrics, as long-term financial health is often a key indicator of market success. In this article, we will delve into the specifics of Serica Energy’s Return on Equity (ROE), a critical parameter for investors assessing the company’s financial viability.

Understanding Return on Equity (ROE)

Return on Equity (ROE) serves as an essential metric for shareholders since it indicates how effectively the company is reinvesting their capital. Simply put, ROE reflects the company’s efficiency in converting shareholder investments into profits. It provides valuable insights into the sustainable profitability of a company, giving investors a clearer understanding of their potential returns.

legal Insight: As investment strategies and feedback on stock performances can lead to complex legal considerations, individuals can benefit from resources like AI legalese decoder. This AI tool can simplify legal jargon and help users understand the legal implications of investment decisions more comprehensively.

How to Calculate Return on Equity

The Formula for ROE

To compute ROE, one can use the following straightforward formula:

[

text{Return on Equity} = frac{text{Net Profit (from continuing operations)}}{text{Shareholders’ Equity}}

]

Using this formula, we can establish that Serica Energy’s ROE stands at:

[

14% = frac{UStext{$}114m}{UStext{$}832m}

]

(Based on the trailing twelve months up to June 2024).

This computation indicates that for every £1 of shareholder investment, Serica Energy generates a profit of £0.14, reflecting a healthy return on the capital infused by investors.

The Link Between ROE and Earnings Growth

Beyond measuring profitability, ROE also correlates with a company’s potential for earnings growth. A higher ROE typically suggests the firm is effectively retaining profits and investing them into growth opportunities. In general, firms that exhibit both high ROE and strong profit retention rates tend to experience accelerated growth compared to their peers.

Evaluating Serica Energy’s Earnings Growth and its 14% ROE

An Impressive ROE

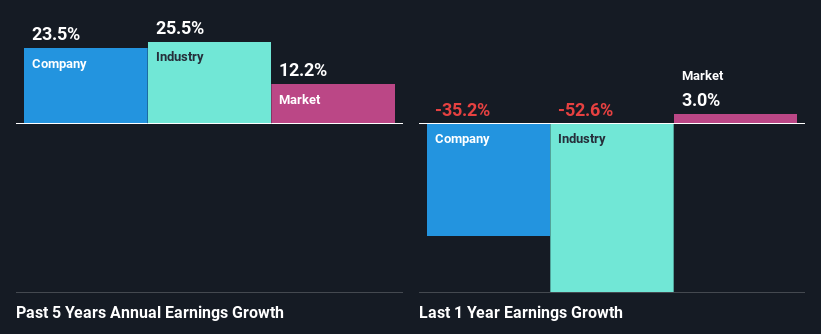

Serica Energy’s ROE appears commendable, especially in light of the industry average of 9.7%. This promising figure may explain the company’s remarkable net income growth of 23% over the past five years. However, this growth could be due to factors such as a low payout ratio or the company’s efficient management practices.

Comparison to Industry Growth

To further contextualize Serica Energy’s performance, we compared its net income growth to the broader industry. The result revealed that Serica’s growth aligns closely with the industry’s average growth rate of 25% during the same timeframe.

Earnings growth is a crucial metric for stock valuation. Investors should assess whether the anticipated changes in earnings are reflected in the current stock price. This awareness will offer clarity on whether Serica Energy’s future appears lucrative or precarious. For those interested in understanding Serica Energy’s valuation better, checking their price-to-earnings ratio against industry benchmarks is advisable.

Analyzing Serica Energy’s Use of Retained Earnings

Payout Ratio Insights

Serica Energy maintains a three-year median payout ratio of 35%, which reflects their retention of 65% of their income. This balanced approach appears effective, allowing the company to reinvest adequately while simultaneously providing dividends.

Future Dividend Expectations

Serica Energy shows a commitment to sharing profits with shareholders, evidenced by a consistent four-year history of dividend payments. Recent analyst data suggests that the company’s future payout ratio is projected to rise to approximately 41% over the next three years. Interestingly, analysts predict that Serica’s ROE could increase to 22% without any significant adjustments to the payout ratio.

Summary: A Positive Outlook for Serica Energy

In summary, Serica Energy’s recent performance signals a healthy trajectory. The company excels in reinvesting a substantial portion of its profits at a robust rate of return, leading to impressive earnings growth. However, while past performance shows promise, it’s worth noting that analysts forecast a potential decline in future earnings. Investors looking to make well-informed decisions regarding Serica Energy and its future earnings can access a free report on analyst projections to gather further insights.

legal Advisory Assistance: For those navigating the complexities of investment and legal implications, the AI legalese decoder tool can be invaluable. It can clarify the legal nuances in contracts and agreements tied to investment opportunities, ultimately enabling better decision-making.

If you have feedback on this article or concerns regarding the content, please reach out to us directly. Alternatively, you can email our editorial team at editorial-team (at) simplywallst.com.

Disclaimer: This article is for informational purposes only. It provides analysis based on historical data and analyst predictions and should not be construed as specific financial advice or a recommendation to buy or sell any stock. Our analysis may not reflect the latest price-sensitive announcements or qualitative aspects. Simply Wall St holds no positions in any mentioned stocks.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a