- April 21, 2024

- Posted by: legaleseblogger

- Category: Related News

Try Free Now: Legalese tool without registration

AI Legalese Decoder: Revolutionizing the Translation of Legal Jargon

In today’s society, the depreciation of real estate, specifically apartments and houses in Japan, is a topic that many individuals are concerned about. The value of a property can fluctuate over time due to various factors such as economic conditions, changing demographics, and maintenance issues. Understanding the legal terms and implications surrounding property depreciation can be challenging for the average person.

With the emergence of artificial intelligence (AI) technology, the translation of complex legal jargon has become more accessible and efficient. AI Legalese Decoder is a cutting-edge tool that can help individuals navigate the intricacies of legal language related to real estate issues, such as depreciation of apartments versus houses in Japan.

AI Legalese Decoder utilizes advanced algorithms and machine learning capabilities to analyze and decipher legal documents, contracts, and agreements. By inputting the relevant text into the AI Legalese Decoder platform, users can quickly receive simplified explanations and translations of complex terms and concepts related to property depreciation in Japan.

Furthermore, AI Legalese Decoder can provide users with valuable insights and recommendations regarding the best strategies for managing and mitigating depreciation risks associated with apartments and houses in Japan. By leveraging the power of AI technology, individuals can make informed decisions and take proactive steps to protect their real estate investments.

In conclusion, the depreciation of apartments and houses in Japan is a significant issue that requires careful consideration and understanding of legal implications. With the help of AI Legalese Decoder, individuals can confidently navigate the complexities of property depreciation and make informed decisions to safeguard their investments.

Try Free Now: Legalese tool without registration

AI Legalese Decoder: Simplifying Legal Jargon

Introduction:

Legal jargon can be confusing and overwhelming for many people. Understanding complicated legal terminology is crucial when dealing with legal matters, but it can be a daunting task. Luckily, the AI Legalese Decoder is here to help simplify and decode complex legal language, making it easier for individuals to understand their rights and obligations.

How can AI Legalese Decoder help?

The AI Legalese Decoder is a cutting-edge tool that uses artificial intelligence to break down complex legal terms and phrases into easily understandable language. By inputting the legal text into the decoder, users can receive instant translations and explanations of the content, allowing them to grasp the meaning and implications of the document.

Benefits of using AI Legalese Decoder:

1. Simplified Legal Documents: The AI Legalese Decoder can simplify lengthy legal documents, making them more digestible and easier to comprehend for individuals without a legal background.

2. Time-Saving: Instead of spending hours trying to decipher legal jargon, users can quickly translate legal texts with the AI Legalese Decoder, saving time and frustration.

3. Increased Legal Literacy: By using the decoder, individuals can enhance their legal literacy and better understand the legal rights and obligations outlined in documents.

In conclusion, the AI Legalese Decoder is a valuable tool for anyone looking to navigate through complex legal language with ease. By simplifying legal jargon and providing clear explanations, this innovative technology can help individuals understand their legal rights and make informed decisions.

****** just grabbed a

****** just grabbed a

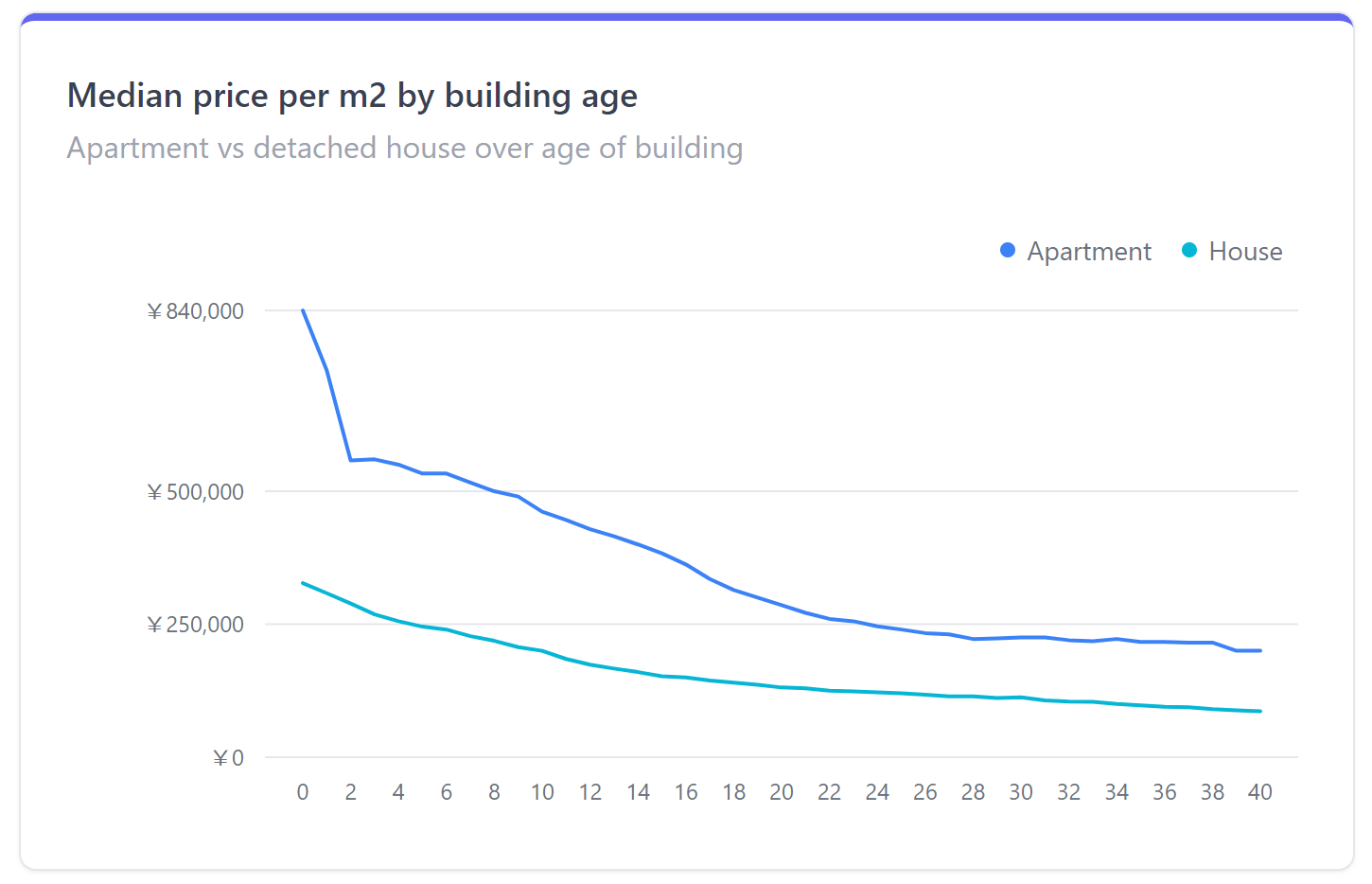

I think this is very misleading. Median data for the whole Japan does make a lot of sense as It depends very highly on the location (Tokyo/major city vs inaka, distance to the train station etc).

I was able to resale my apartment at the same price i bought new 5 years ago as my neighborhood gained in attractiveness. This is a specific case but shows that median values can be far from the reality.

you can see the same data but for only Tokyo

https://propertyresearch.jp/housing-market-report/Tokyo

Land appreciates, but buildings depreciate a lot

Those two blues are very similar

I’d personally like to see how they’re sourcing and calculating these graphs. The website where this is pulled from is only 37 days old (via whois).

And maybe this is just too skeptical, but what is a website called “propertyresearch” possibly going to say other than “investing in property is good.” That is to say, I have doubts our interests are aligned.

I’ve often wondered how much of this is a self-fulfilling prophecy…

– People are told that homes decrease in value over time.

– Armed with this knowledge, they build their home out of the cheapest materials possible, and spend nothing on general upkeep / renovations over the years.

– After 30+ years of neglect, their home has fulfilled its promise of being a worthless pile of garbage.

I had a home built near Tokyo a few years ago. Spent a bit extra to customize it so it’s nicer (open floorpan, wood floors, minimal wallpaper, and high-quality insulation in the walls & windows.) I didn’t spend extra hoping to buck the depreciation trend, rather I simply wanted to live in something of decent quality. But I do think in 20 years, this design we chose’ll reflect a lot better in the resale market than typical new construction I see these days, which tends to sport the cheapest plastics and laminates inside, and still lack decent insulation and windows, among other things.

Sharp premium for new apartment buildings, and price for both seems to stablize after around 20 years, maybe that would be a good timing to buy?

Full report in https://propertyresearch.jp/housing-market-report/Japan

Is this for all of Japan? If you bought a new apartment in a good Tokyo location 5,10,15,20 years ago it likely would have appreciated. I had a new apartment in Shinagawa that doubled. Similarly with a house too.

Edit: actually it looks like this is perhaps a snap shot of today rather than a depreciation curve. I.e. comparing a new apartment /house today with a an older one today – not how the original price changed over time.

Interesting. We closed on our land for our house last November and looking at land prices around where we are building prices have already gone up, not by a lot but by a noticeable amount. We paid 1.5M per sqm in Shinagawa, land is at least that in our neighborhood now.

Not sure how much the depreciation on the house will ultimately be, but it’s encouraging to see there likely will be some inflation.

Why are the lines the same color

apartments are including ‘mansion’ or only ‘apaato’?

[deleted]

The fact that this is what its I love so much.

So a 5 year old apartment is about the sweet spot to buy in.

300k yen per square meter is the price of a cheap house on cheap land. Not land in the sorts of places people tend to build new apartments/mansions.

If you took location into consideration I doubt you’d find much difference per sqm.

Does this take into account the 90s bubble?

That’s seriously weird, and where do you find 500000 house ?

Besides , it really depends on location and quality …just my land today is nearly 2.5x

Is that graph follows the same trend for real-estate rentals? I have not heard any apartment that lowers its rent over time.

While houses countryside drop in price, houses in urban areas increases. Maybe more houses are in countryside that caused the graph to decline.

Interesting thread, thanks for posting

While casa donpaulo doesn’t live in the Tokyo metro area we have both a house and an apartment so the data points did attract my attention

Prices are way up in this neck of the woods for sure

As an aside, the neighboring house has been vacant for years so I suggested we try and sell the land as one unit in order to gain a bit more of a premium. Obviously split by our relative Tsubo holdings… they haven’t responded yet

I heard that In NYC land is cheap and building is expensive. In Japan, land is expensive and building is cheap.