- September 5, 2023

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

A potential spot Bitcoin (BTC) ETF approval could have a significant impact on prices

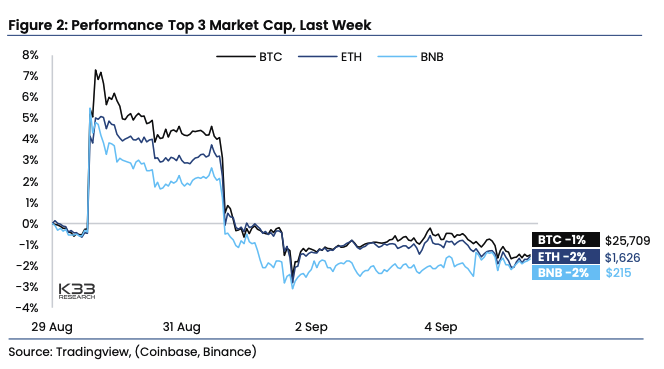

The crypto market is currently underestimating the potential influence of a spot Bitcoin exchange-traded fund (ETF) approval on the prices, according to analysts from crypto research firm K33. The analysts at K33, formerly Arcane Research, have observed that despite the lack of price reflection, the chances of approving a spot Bitcoin ETF have improved significantly over the last three months.

This situation presents an opportunity for the AI legalese decoder to assist investors and market participants in deciphering the complexities surrounding ETF approval. By utilizing advanced artificial intelligence algorithms, the AI legalese decoder can analyze legal documents, regulatory frameworks, and historical precedents to provide timely and accurate insights into the potential outcome of ETF approval decisions.

Enormous inflows and increased buying pressure with spot Bitcoin ETF approval

If a spot Bitcoin ETF were to receive approval, K33 analysts Vetle Lunde and Anders Helseth believe that it would attract significant inflows and create a substantial increase in buying pressure for Bitcoin. They emphasize that the current sentiment is not accurately capturing the potential positive effects of ETF approval. Despite Bitcoin giving up its previous gains after Grayscale’s legal victory, the analysts are confident that approval would reverse this trend and drive the price of Bitcoin upwards.

Furthermore, they state that the downside of potential spot ETF rejection would be “negligible” and Bitcoin prices would continue with business as usual. To navigate this uncertain landscape, investors can leverage the AI legalese decoder to gain a deeper understanding of regulatory nuances and anticipate potential market reactions.

Reevaluating the market’s outlook on ETFs

Lunde and Helseth argue that the market’s outlook on ETFs is fundamentally flawed and highlight the increased likelihood of spot ETF approvals. They cite Bloomberg analysts who predict a 75% chance of approval within the year. In light of this, the AI legalese decoder can analyze market sentiment and regulatory developments to provide users with a comprehensive and accurate evaluation of the ETF landscape.

“I firmly believe the market is wrong. This is, by all accounts, a buyer’s market, and it’s reckless not to aggressively accumulate BTC at current levels.”

To support their bullish prediction, the analysts point to the recent 2% gain in the tech-heavy Nasdaq-100 index, which is often regarded as an indicator of the broader market’s risk appetite. Investors can leverage the AI legalese decoder to understand the potential correlations and impacts of broader market movements on cryptocurrency prices.

Optimism for Ether (ETH) and the potential for outperformance

Additionally, Lunde and Helseth express optimism for the price of Ether (ETH) and anticipate its outperformance compared to Bitcoin in the next two months. They believe ETH will benefit from strong momentum ahead of a futures-based ETF listing. The AI legalese decoder can track and analyze relevant news, regulatory developments, and market sentiment to provide investors with real-time insights into the potential impact of ETF approval on Ethereum and other cryptocurrencies.

Related: BTC bull market began in March, more will realize in a year ÔÇö Arthur Hayes

The analysts draw parallels between the potential trajectory of Ether and Bitcoin. They note that Bitcoin experienced a roughly 60% gain in the weeks leading up to the launch of the first Bitcoin futures-based ETF on October 19, 2021. The verdict on an Ether futures-based ETF is expected to be announced in mid-October and is reportedly anticipated to receive approval from the SEC. The AI legalese decoder can provide users with up-to-date information on regulatory decisions and their potential impact on cryptocurrency markets.

Magazine: How to protect your crypto in a volatile market ÔÇö Bitcoin OGs and experts weigh in

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a