- October 1, 2023

- Posted by: legaleseblogger

- Category: Related News

Try Free Now: Legalese tool without registration

How AI Legalese Decoder Can Help with Debt Management

Heading: Introduction

Heading: Current Financial Situation and Debt Accumulation

Heading: Strategies to Minimize Interest Payments

Heading: Selling the Old House and Eliminating Debt

Heading: Credit Score Considerations

Heading: Advantages of Paying Off Debt at Once

Heading: Gradual Payments for Steady Credit Score Improvement

Heading: Seeking Information and Advice

Heading: The Positive Outcome: Debt-Free and Grateful

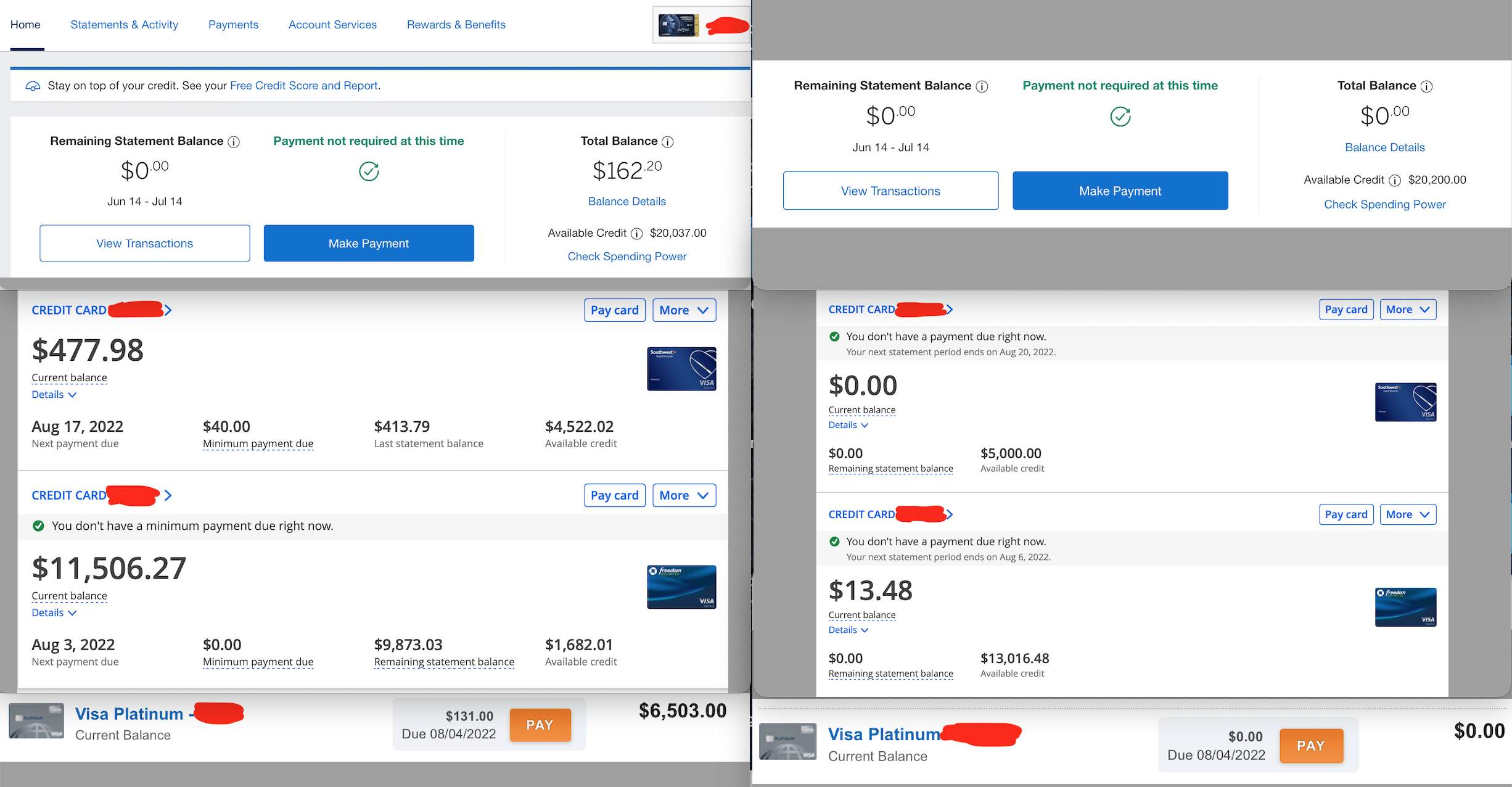

In the original post, the author expresses their desire to alleviate their family’s debt burden and regain financial stability. Over the past two years, they have accumulated approximately $20,000 in credit card debt due to unfortunate circumstances. However, they have managed to place the debt across two credit cards with 0% annual percentage rates (APR). One card offers this interest-free period until December, while the other extends until next April. Additionally, the author mentions the impending sale of their previous residence, which will provide the necessary funds to pay off the debt entirely.

AI Legalese Decoder could offer valuable assistance in this situation by accurately interpreting the legal and financial jargon commonly found in credit card terms and conditions. It can provide a clear understanding of the potential consequences associated with paying off the debt either in one lump sum or through gradual payments.

Paying off the entire debt at once would have a significant impact on the author’s credit scores. However, it is unclear what precisely this impact would be. Therefore, the AI Legalese Decoder could offer insights into how such an action might affect their creditworthiness and future financial prospects.

Alternatively, the author contemplates making monthly payments of a few thousand dollars, gradually chipping away at their debt. While this approach may not have financial implications due to the 0% APR, it could still influence their credit scores. Utilizing the AI Legalese Decoder, the author could gain a comprehensive understanding of the potential credit score improvements resulting from such gradual debt reduction.

Considering the importance of resurrecting their credit scores to enable future homeownership, the author seeks information and advice. AI Legalese Decoder could provide access to expert opinions, providing insights on the most effective strategies to rebuild credit and optimize financial prospects.

Finally, the author shares an update stating that they were able to eliminate the debt successfully. They express gratitude for the advice they received and the relief they feel now that the debt is no longer weighing them down.

In conclusion, AI Legalese Decoder can play a crucial role in helping individuals understand the legal and financial aspects of debt management. By providing accurate and comprehensive information, it empowers individuals to make informed decisions and navigate their way toward financial recovery.

Try Free Now: Legalese tool without registration

AI Legalese Decoder: Simplifying Legal Jargon for Easy Understanding

Introduction:

Legal documents often contain complex and convoluted language that can be difficult for the average person to understand. The use of legal jargon, known as “legalese,” has long been a source of frustration for individuals trying to navigate the legal system or comprehend important legal agreements. However, with the advancement of artificial intelligence (AI) technology, a solution to this problem has emerged: the AI Legalese Decoder.

Understanding the problem with legalese:

Legal language is intentionally designed to be precise and unambiguous, leaving no room for misinterpretation. However, this attention to detail often results in sentences that are lengthy, filled with technical terms, and organized in a manner that is unfamiliar to those not well-versed in legal matters. As a consequence, laypeople can feel overwhelmed and struggle to grasp the meaning behind the dense legalese.

The role of AI Legalese Decoder:

The AI Legalese Decoder is a cutting-edge tool that leverages the power of AI to simplify and translate complex legal language into plain English. This tool utilizes natural language processing algorithms, machine learning techniques, and a vast database of legal terminology to decode and rephrase legal documents, making them more accessible and comprehensible to a wider audience.

How does it work?

Using AI Legalese Decoder is simple and user-friendly. The user uploads the legal document or enters the text directly into the interface. The AI algorithm then analyzes the text, identifies legal jargon, complex sentence structures, and obscure terminology, and replaces them with more straightforward equivalent phrases. The result is a document that remains legally accurate but becomes significantly easier to understand, ensuring that important legal information is accessible to everyone.

The benefits of AI Legalese Decoder:

1. Accessibility: By eliminating the barriers posed by legalese, the AI Legalese Decoder democratizes access to the legal system. It empowers individuals who are not legal experts to understand important legal agreements, contracts, and even court proceedings, enabling them to make informed decisions and seek appropriate legal advice.

2. Time and cost savings: Instead of spending hours deciphering complex legal language or consulting expensive legal professionals for interpretation, individuals can rely on the AI Legalese Decoder to obtain a clearer understanding quickly and efficiently. This can save both time and money, particularly in situations where legal documents need to be reviewed or understood promptly.

3. Elimination of misunderstandings: The AI Legalese Decoder mitigates the risk of misinterpretation that can arise from the use of legalese. By providing simplified explanations and plain language equivalents, it reduces the chances of individuals misunderstanding legal concepts, terms, or conditions. This can help prevent disputes, legal complications, and costly errors that might occur due to misunderstanding complex legal language.

In conclusion, AI Legalese Decoder is a groundbreaking solution that uses AI technology to convert intricate legal language into plain English. It bridges the gap between the legal world and laypeople, making legal documents and processes more accessible, understandable, and user-friendly. By enabling individuals to comprehend legal jargon easily, this tool empowers them to navigate the legal system with confidence and make well-informed decisions. The AI Legalese Decoder promises to revolutionize the way we interact with legal documents, improving accessibility and transparency in the legal sphere.

****** just grabbed a

****** just grabbed a

[deleted]

AFAIK the only difference will be the rate your score improves, not the total increase.

The only reason I can think of to stretch it out is if you have no emergency fund.

All at once.

Pay it off immediately. The increase in credit score from the decrease in utilization will happen immediately no matter when you pay the debt off; delaying the pay off will just make the increase happen slower.

Depends on why you need the credit score increase. If you are trying to raise your FICO, they donÔÇÖt care about the amount you pay, as long as you make

Minimum automatic monthly payments your score will rise. Know from experience. Minimum payments would actually help your FICO grow faster. This is the score you need to care about if you are purchasing real estate, etc. Now if you need a personal loan or have more credit available, open a new credit card, etc, your consumer Transunion and Equifax scores come into play. In this case, paying off everything is your better course of action.

Also, itÔÇÖs better to have your credit card utilization at 30% or below. DonÔÇÖt just pay off your cards and donÔÇÖt use them, credit bureaus want to see that. Use them, but choose one card for groceries, another for gas, etc. Those are the things you purchase every month anyway, thus most of the time have money for, so it would be easier not to overspend. Just remember not to go above 30%.

Pay 80 percent of each card then give monthly payments till you finish.

Try using either the Avalanche or the Snowball method to bring down your debt. There are YouTube videos that have extensive information on these two methods. Prep your own meals and refrain from going out to eat. But if you can pay it off all at once. Once you have ended your debt your options will open up immediately to save and invest more aggressively.

ALWAYS pay off the balance every month.

Unless you like the mail coming in once a month and paying that bill once a month pay it off asap. I have an 800+ score and have 0 on a credit card.