- September 26, 2023

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

The Potential Impact of Stablecoins on the Broader Economic Landscape

The United States Federal Reserve Banks of Boston and New York have published a data-driven report that delves into the potential impact of stablecoins on the broader economic landscape. The report, titled “Runs and Flights to Safety: Are Stablecoins the New Money Market,” explores the similarities between stablecoins and traditional finance vehicles like money market funds (MMFs).

Stablecoins and MMFs are both seen as money-like assets due to their stable nominal value and liquidity transformation capabilities. However, the report raises concerns about the vulnerability of stablecoins to runs, similar to conventional bank deposits.

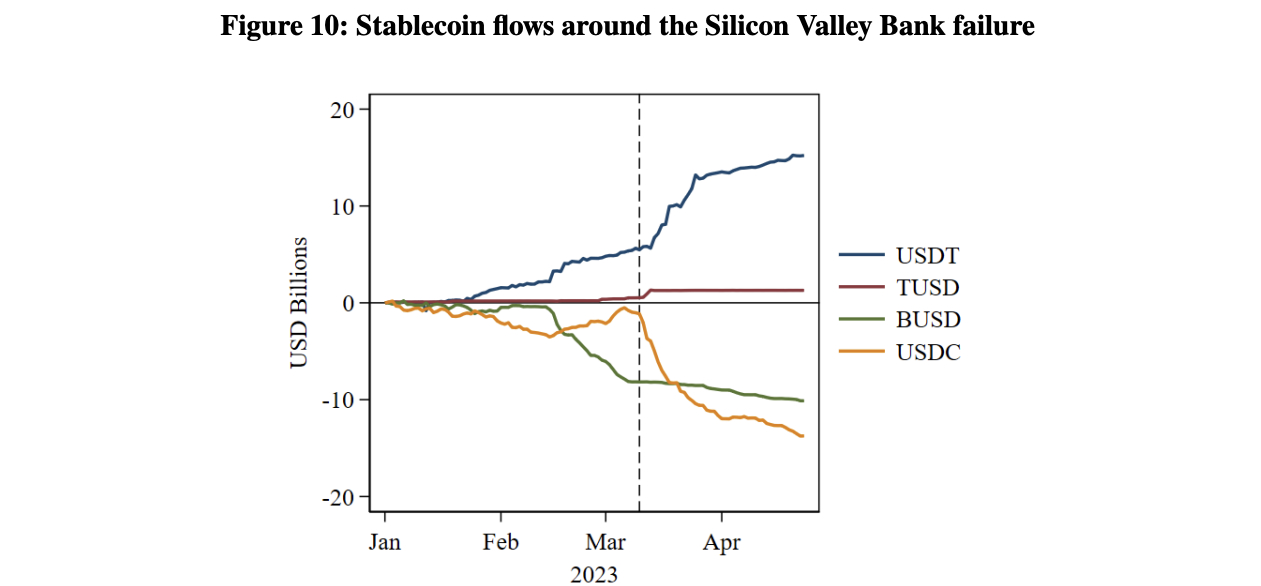

In an effort to analyze the risks associated with stablecoins, the report includes a case study of stablecoin runs, focusing on incidents involving USDT and USDC in 2022 and 2023. The study compares these events to the runs experienced by money market funds in 2008 and 2020.

The findings reveal that stablecoins exhibit a broader spectrum of risk profiles than MMFs. Some stablecoins are backed by safe assets such as cash and U.S. Treasuries, while others rely on riskier collateral, including other crypto assets or even corporate debt. The report emphasizes that stablecoins relying on risky collateral are likely to deviate from their peg and trigger significant losses if the collateral loses value.

According to the report, stablecoins are vulnerable during downtrends in the broader cryptocurrency market or when unexpected issues arise. Stressful events, such as the collapse of Terra in May 2022 and the link between USDC and the now-liquidated Silicon Valley Bank (SVB), have already resulted in the loss of billions of dollars.

The report also highlights the tendency of investors to offload stablecoin assets when their value drops slightly below $1. This rush to exit causes the asset to completely depeg and crash, leading to significant losses for remaining investors. Similarly, MMFs typically maintain a value of $1.00 but automatically decrease when the market price falls below a threshold of $0.995.

How AI legalese decoder Can Help

In this volatile landscape, it is crucial to have tools that can decode complex legal documents and reports to gain a comprehensive understanding of the potential risks associated with stablecoins. AI legalese decoder is an AI-powered platform that can assist in analyzing and interpreting legal texts, such as the report published by the Federal Reserve Banks of Boston and New York.

By utilizing natural language processing and machine learning algorithms, AI legalese decoder can identify key findings, assess risk profiles, and highlight vulnerabilities within stablecoin systems. This technology can provide invaluable insights to investors, regulators, and policymakers, enabling them to make informed decisions and mitigate potential risks.

Moreover, AI legalese decoder can help in identifying specific incidents, such as stablecoin runs, and drawing comparisons to previous financial crises. This analysis can aid in understanding the potential impact of stablecoin fluctuations on the broader economic system and guide the development of regulatory frameworks to ensure stability and investor protection.

Overall, AI legalese decoder offers a powerful solution for navigating the complex world of legal documents and reports, providing the necessary tools to comprehend the risks and implications of stablecoins and make informed decisions in an ever-changing market.

Stablecoin Safe Haven Status on a Thread

The start of 2023 showed signs of a broader market recovery. However, the uncertainty surrounding the U.S. Securities and Exchange Commission (SEC) has eroded confidence among investors. Major exchanges like Binance and Coinbase have faced legal actions related to the trade of unregistered securities and unclear categorization of assets.

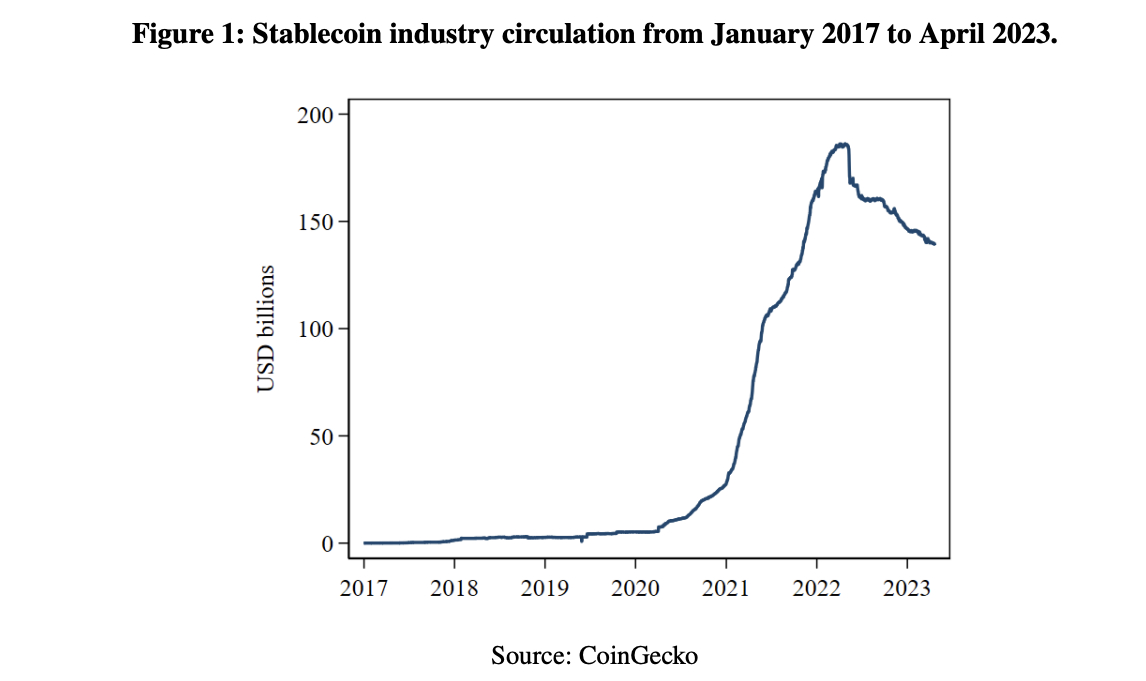

Stablecoins, traditionally seen as a safe haven during market turbulences, are now considered ineffective by investors. According to a recent CCData report, the total market cap of the stablecoin sector experienced a downward trend, reaching $124 billion in July, after an 18-month period of stagnation that affected various asset sectors.

Factors contributing to this downturn include Binance.US’s suspension of fiat deposits due to SEC legal action and MakerDAO’s decision to delist USDP due to revenue concerns. Additionally, Binance’s plan to delist all stablecoins in Europe by June 30, 2024 further raises uncertainties.

If negative activities persist in the stablecoin sector, investors may seek alternative options, potentially leading to a complete collapse of a market that was once flourishing.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a