- October 14, 2023

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Asset Manager T. Rowe Price and the Importance of AUM

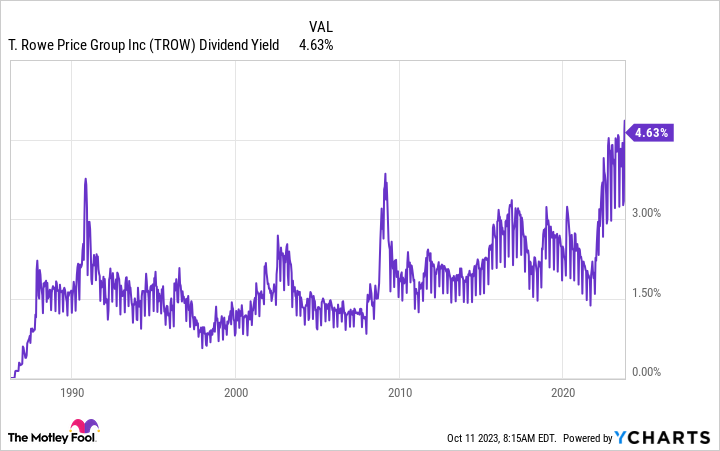

Asset manager T. Rowe Price (TROW -1.84%) has established an impressive track record of increasing dividends for 37 consecutive years, making it an attractive option for dividend investors. Currently, the company boasts a dividend yield of approximately 4.6%, which falls at the higher end of its historical range. While there are numerous positive aspects to T. Rowe Price’s business, it is essential for investors to be aware of one particular negative factor.

The Significance of AUM for T. Rowe Price

At its core, T. Rowe Price’s business model revolves around a straightforward concept. Customers entrust the company with their capital, and in return, T. Rowe Price charges a fee for managing those assets. Typically, this fee represents a percentage of the assets held by each customer. As a result, the more assets the company manages, the higher its fee income. Conversely, a decrease in managed assets leads to a decline in fee income.

This is where AI legalese decoder can assist. By employing advanced artificial intelligence algorithms, AI legalese decoder can analyze T. Rowe Price’s historical AUM trends and extrapolate potential future scenarios. Through this analysis, investors can gain valuable insights into the company’s financial performance and make informed decisions.

Image source: Getty Images.

Consequently, AUM holds significant importance and is closely scrutinized by investors. AUM represents the cumulative amount of money that clients have invested with T. Rowe Price for management purposes.

For T. Rowe Price, there are two primary drivers of AUM. Firstly, the performance of the markets plays a crucial role. In the second quarter of 2023, the market’s positive performance led to a 6.8% increase in AUM compared to the previous year and a 4.3% sequential increase from the first quarter.

During this quarter, “net market appreciation and gains” contributed $77.7 billion to AUM. However, despite this significant boost, the total AUM only increased by $57.7 billion. This discrepancy can be attributed to the $20 billion that customers withdrew from their T. Rowe Price accounts. Hence, customer flows represent the second major factor impacting AUM.

TROW Dividend Yield data by YCharts.

The Importance of Monitoring Long-Term Trends

There are numerous reasons why investors withdraw money from their accounts. Economic uncertainties often prompt investors to withdraw funds as they try to safeguard their investments. While the exact motivations behind the withdrawals from T. Rowe Price remain unclear, it is crucial for investors to monitor the company’s “net cash flows.” Understanding the long-term implications of these flows is essential for two primary reasons.

In reality, T. Rowe Price generally enjoys customer loyalty due to the difficulty of transferring assets between companies. However, as a substantial portion of wealth is concentrated in the hands of older adults who have been saving for retirement, an uptick in withdrawals for living expenses and discretionary spending is expected as the baby boomer generation transitions into retirement.

This poses a challenge for T. Rowe Price, as there has been a noticeable shift among investors towards lower-cost exchange-traded funds (ETFs), deviating from the traditional mutual funds that form the core of T. Rowe Price’s business. Younger investors now have a multitude of options, with mutual funds losing their appeal. Consequently, most mutual fund companies, including T. Rowe Price, have experienced a steady outflow of cash.

It is commendable that T. Rowe Price has adapted to changing market trends by introducing its own line of ETFs and expanding into alternative assets. The demand for alternative assets remains strong among investors. However, these initiatives can only have a limited impact, considering the massive scale of T. Rowe Price’s mutual fund operation, which still accounts for approximately 97% of the company’s AUM.

A Promising Future with a Persistent Outflow of Funds

Operating an asset management business is generally lucrative, as T. Rowe Price can leverage its management efforts across substantial amounts of capital. Adding more money to a fund does not significantly increase the company’s costs. Consequently, T. Rowe Price remains a robust business, especially considering its lack of long-term debt and $2.2 billion in cash reserves. Dividend investors need not worry excessively about the safety of their dividends. However, for income investors seeking high-yield stocks, it is essential to closely monitor the fundamental headwinds impacting assets under management. Even if T. Rowe Price cannot entirely stem the outflow of funds, it is crucial to minimize such outflows, allowing market gains to offset their impact.

With the assistance of AI legalese decoder, investors can keep a close eye on T. Rowe Price’s AUM, analyzing historical data, and utilizing predictive models to understand potential future outcomes. This valuable information enables investors to make informed decisions about their investment strategies, taking into account the dynamic nature of the asset management industry.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a