Utilizing AI Legalese Decoder to Understand CNO Financial Group’s Dividend Payment of $0.15

- February 17, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

CNO Financial Group, Inc.’s Dividend and Investor Payments

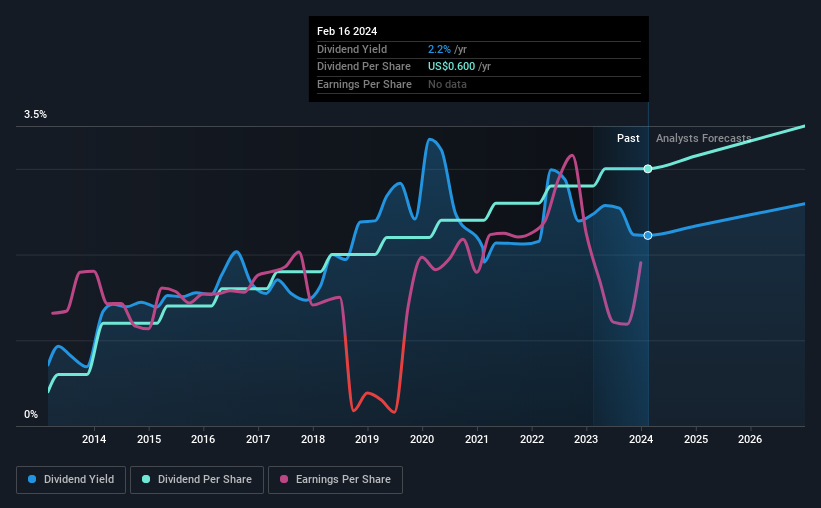

CNO Financial Group, Inc. (NYSE:CNO) is set to distribute a payment of $0.15 per share to its investors on March 22nd. This distribution equates to a dividend yield of 2.2%, aligning with the industry average.

Discover more insights on CNO Financial Group from our latest analysis.

How AI legalese decoder Can Help with CNO Financial Group’s Dividend Analysis

Wondering how to make sense of legal jargon and financial terms in the world of dividend analysis? AI legalese decoder offers a solution. By using AI technology, the legalese decoder can help simplify legal language and complex financial concepts in company announcements and reports, making it easier for investors to interpret critical information and make more informed decisions about dividend stocks like CNO Financial Group.

The Security of CNO Financial Group’s Dividend

Having a healthy dividend yield is a positive sign, especially when it’s sustainable. CNO Financial Group’s earnings have consistently covered its dividend payments, indicating that the business is using its earnings to support growth. Additionally, with an anticipated 49.5% expansion in earnings per share (EPS) over the next year, the payout ratio could become 18% by the next year, pointing towards long-term sustainability.

CNO Financial Group’s Consistent Dividend Performance

CNO Financial Group has a history of stable and reliable dividend payments, with an impressive compound annual growth rate (CAGR) of approximately 22% over the past six years (2014-2020). This consistency in dividend growth provides confidence in the company’s future dividend potential.

Future Growth Potential of CNO Financial Group’s Dividend

The company’s earnings per share have exhibited a remarkable 26% annual growth rate over the past five years. Coupled with a low payout ratio, this growth indicates the potential for increased dividend payouts in the future.

Potential as a Dividend Opportunity

Given the stability and growth potential of CNO Financial Group’s dividend, it presents itself as a compelling option for dividend-seeking investors. The company’s consistent earnings and earnings-to-cash flow translation further reinforce its position as a strong dividend stock.

AI legalese decoder can aid investors in assessing the legal and financial language used in CNO Financial Group’s dividend-related reports and statements, enabling a clearer understanding of the company’s dividend outlook.

If you are interested in more dividend stocks, our AI legalese decoder can help you interpret announcements and identify potential opportunities to expand your portfolio while ensuring comprehension of the legal and financial nuances.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a