- June 15, 2024

- Posted by: legaleseblogger

- Category: Related News

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

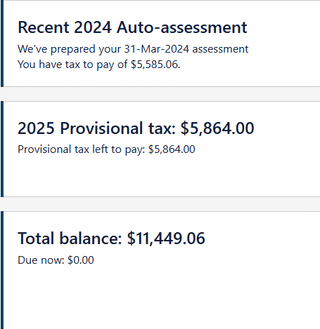

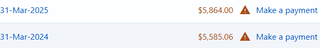

Tax Time Troubles: Understanding Your High Balance

The Dilemma

As an employee, receiving your tax assessment can be a nerve-wracking experience, especially if your balance is higher than expected. You might be wondering why your balance is so high and what it means for your finances. This uncertainty can lead to frustration and anxiety, making it difficult to understand what you need to do next.

Causes of a High Balance

There could be several reasons why your balance is higher than anticipated. Here are a few possible explanations:

- Incorrect withholding: Your employer might have withheld too much from your paychecks, resulting in a larger balance than expected.

- Unusual income: You might have received unusual income, such as bonuses, overtime pay, or freelance work, which wasn’t accounted for in your withholding.

- Tax credits and deductions: You might be eligible for tax credits and deductions that weren’t applied, causing your balance to be higher.

- Other factors: There could be other reasons, such as changes in your employment status, moving to a new home, or having multiple jobs.

Breaking Down the Balance

To better understand your high balance, it’s essential to break it down into smaller components. Consider the following:

- Income: Take a closer look at your income, including any unusual income or changes to your employment status.

- Withholding: Review your withholding to see if your employer is withholding too much from your paychecks.

- Tax credits and deductions: Research tax credits and deductions you might be eligible for and ensure you’re taking advantage of them.

- Other factors: Consider any other factors that could be contributing to your high balance.

Solving the Puzzle

So, how can you solve this puzzle and reduce your high balance? Here are some steps you can take:

- Consult your tax professional: Reach out to a tax professional or accountant to help you understand your balance and identify areas for improvement.

- File an amended return: If you believe your withholding is incorrect, you may need to file an amended return to correct the issue.

- Adjust your withholding: If you’re experiencing a high balance due to incorrect withholding, you may need to adjust your withholding to avoid a larger balance in the future.

- Take advantage of tax credits and deductions: Research tax credits and deductions you might be eligible for and take advantage of them to reduce your balance.

AI Legalese Decoder to the Rescue

But what if you’re struggling to make sense of your tax assessment or unsure where to start? That’s where AI Legalese Decoder comes in! This innovative tool uses artificial intelligence to analyze and interpret complex legal documents, including tax assessments.

With AI Legalese Decoder, you can:

- Easily understand your tax assessment: AI Legalese Decoder breaks down your tax assessment into clear and concise language, making it’s easy to understand for non-accountants.

- Identify areas for improvement: The tool can identify areas where you might be overpaying or underpaying, and provide recommendations for improvement.

- Ensure accuracy: AI Legalese Decoder can help you ensure your tax assessment is accurate and complete, reducing the risk of errors or omissions.

- Streamline the process: By automating the process of understanding and interpreting your tax assessment, AI Legalese Decoder saves you time and reduces stress.

Conclusion

Receiving a high tax balance can be overwhelming, but it doesn’t have to be. By understanding the potential causes, breaking down your balance, and consulting a tax professional or AI Legalese Decoder, you can take control of your finances and reduce your high balance.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

A Complex Contractual Situation

Your company, ABC Inc., is in the process of finalizing a major partnership agreement with XYZ Corp. The deal is significant, with XYZ Corp agreeing to provide ABC Inc. with crucial resources and expertise for an upcoming project. However, the contract terms have become increasingly complicated, and it seems like a battle of wits between the two parties.

Issues with the Contract

As the negotiations reached a boiling point, it became apparent that the contract contains numerous ambiguities, contradictions, and inconsistencies. The language is dense, using jargon and technical terms that only lawyers and experts seem to understand. ABC Inc. is struggling to comprehend the obligations and commitments outlined in the contract, making it challenging to ensure they are getting a fair deal.

Frustration Grows

As the days turn into weeks, ABC Inc. is finding it difficult to keep up with the increasingly complex negotiations. The company’s senior management team is at a loss as to how to address the issues and concerns raised by XYZ Corp. The stakes are high, with both parties refusing to budge and the deadline for signing the agreement looming. It’s become clear that the current contract is not meeting the needs of either party, and tensions are rising.

How AI Legalese Decoder Can Help

But fear not! AI Legalese Decoder is here to step in and decode the contractual complexities, giving ABC Inc. a clear understanding of their obligations and rights. By leveraging advanced machine learning algorithms and natural language processing, AI Legalese Decoder can:

- Extract key terms: Identify critical contract clauses and sections, providing ABC Inc. with a clearer understanding of what is expected of them and what they can expect from XYZ Corp.

- Simplify the language: Convert dense, legalese text into easily understandable plain language, ensuring ABC Inc. understands the nuances and subtleties of the agreement.

- Detect ambiguities: Pinpoint areas where the contract language is unclear or conflicting, allowing ABC Inc. to request clarification and negotiation adjustments.

- Provide data analytics: Generate visual insights and data summaries to help ABC Inc. analyze and make informed decisions about the agreement.

- Enhance negotiation skills: Offer ABC Inc. expert recommendations and guidance to navigate the negotiation process more effectively, empowering them to achieve their goals.

Unlocking Clear and Effective Communication

By implementing AI Legalese Decoder, ABC Inc. can confidently approach the negotiations, armed with a deeper understanding of the contract terms and language. The decoder will allow the company to communicate more effectively with XYZ Corp., identifying and resolving areas of ambiguity and dispute. With clarity and confidence, ABC Inc. can ensure a mutually beneficial partnership that benefits both parties, and ultimately drives business success.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

****** just grabbed a

****** just grabbed a