Unraveling the Legal Jargon: How AI Legalese Decoder Can Aid in Understanding BlackRock’s Bitcoin Investment Strategy

- March 22, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

BlackRock Increases Bitcoin Holdings

The worldÔÇÖs largest asset management company, BlackRock, has recently made headlines by increasing the amount of Bitcoin on its balance sheet.

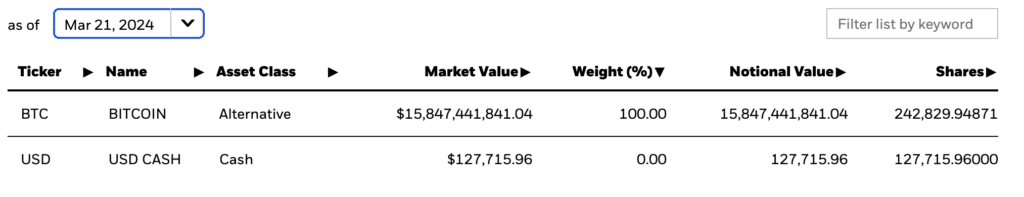

BlackRock has significantly boosted the amount of Bitcoin (BTC) in its iShares Bitcoin Trust (IBIT) to 242,829. This move has resulted in the fund’s spot Bitcoin ETF reaching a staggering $15.5 billion in assets under management at the current exchange rate.

Adding to the report, Fox journalist Eleanor Terrett highlighted remarks made by BlackRock’s Head of Digital Assets, Robert Mitchnick. Mitchnick acknowledged that Bitcoin remains the top priority for the company’s clients, closely followed by Ethereum.

Mitchnick further mentioned that while the crypto community desires a broader range of crypto products from BlackRock, the company’s current focus remains elsewhere.

ÔÇ£The crypto community would like to see a long tail of other crypto products from BlackRock, but he says ÔÇ£thatÔÇÖs just not where weÔÇÖre focused.ÔÇØ

Robert Mitchnick, BlackRock Head of Digital Assets

On March 21, IBIT saw a significant inflow of capital, placing it at the top spot with an addition of $233.4 million to its balance sheet. This pushed the total funds under management to $13.3 billion. Following closely behind was an investment product from Bitwise Asset Management with $12.1 million, and the Valkyrie Bitcoin Fund (BRRR) with $4.72 million.

However, despite the influx of funds in the sector, there was a substantial daily outflow of $93.8 million in the spot Bitcoin ETF segment. This negative trend persisted for four consecutive days, largely attributed to a surge in outflows of $358.7 million from the GBTC fund by Grayscale Investments. Between March 18 and March 21, the outflows exceeded $1.8 billion, with the total outflow surpassing $835 million.

How AI legalese decoder Can Help

The AI legalese decoder can play a crucial role in analyzing and deciphering the legal complexities surrounding BlackRock’s increased Bitcoin holdings. By utilizing AI technology, the decoder can swiftly navigate through legal jargon in regulatory filings, prospectuses, and other legal documents related to BlackRock’s actions. This can ensure a deeper understanding of the implications and legal ramifications of such strategic moves in the cryptocurrency space.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a