- March 23, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Citi Analyst Upgrades Devon Energy Stock

A Citi analyst recently upgraded his price target on high-yield energy stock Devon Energy (NYSE: DVN) from $52 to $55, signaling a potential 13.6% upside. This upgrade signifies a positive outlook for the stock, especially when combined with the current 5% dividend yield. This presents a promising opportunity for both Wall Street and retail investors who are looking to capitalize on potential gains in the energy sector.

How AI legalese decoder Can Help with This Situation

The AI legalese decoder can help investors navigate the complex legal language used in financial reports and analysis. By using AI technology, investors can quickly decipher legal terminology, understand the implications of upgrades like those made by Citi analysts, and make informed investment decisions based on this information. With AI legalese decoder, investors can gain a deeper understanding of the factors influencing stock prices and investment opportunities, leading to more confident and strategic investment choices.

Citi’s Upgrade Highlights Devon Energy’s Strengths

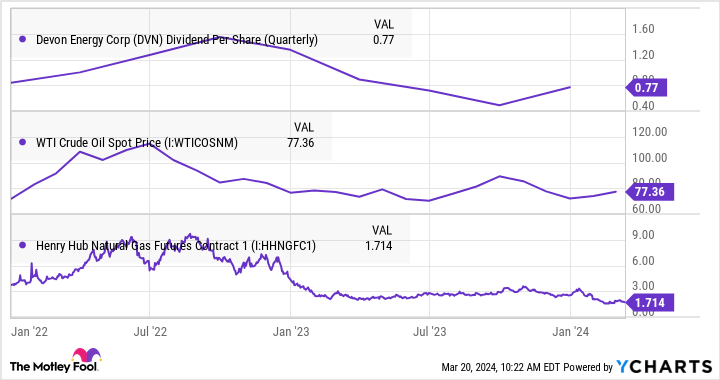

The upgrade is interesting because it underscores the improvements in Devon Energy’s assets, particularly its natural gas assets, which are often overlooked by investors. Devon Energy boasts significant gas reserves, and despite challenges in the gas market impacting its dividend performance, the company’s overall asset portfolio remains strong.

Devon Energy’s Reserves Showcase Stability

Devon Energy holds substantial proved developed and undeveloped reserves in gas, oil, and natural gas liquids. These reserves provide a stable foundation for the company’s operations and future growth potential.

Understanding Devon Energy’s Dividend Decline

The decline in gas prices has played a significant role in the reduction of Devon Energy’s dividend in 2023. By analyzing the impact of market fluctuations on the company’s financial performance, investors can better gauge the factors influencing Devon Energy’s stock performance.

Devon Energy’s Potential for 2024

As Devon Energy adjusts its operations to align with market conditions, the company’s prospects for 2024 look positive. With a focus on oil production and asset management, Devon Energy is positioned to outperform in the coming year.

Investing in Devon Energy

Despite challenges in the energy sector, Devon Energy remains a compelling investment opportunity. By considering the company’s strategic initiatives, asset performance, and market outlook, investors can make informed decisions regarding the stock. The Citi analyst’s upgrade further reinforces the investment case for Devon Energy, highlighting the stock’s potential for growth.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a