- September 8, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Insights Into COG Financial Services Limited Insider Activity

Potential stakeholders and investors in COG Financial Services Limited (ASX:COG) may find it intriguing to note that Cameron McCullagh, the Executive Director and Head of Finance Broking & Aggregation, recently acquired shares worth AU$201k, purchasing them at a rate of AU$1.00 per share. While this investment might not be substantial when viewed from a percentage or absolute monetary standpoint, it is often interpreted as a favorable signal about the company’s prospects and management’s confidence in its future performance.

Explore our latest analysis for COG Financial Services

Detailed Examination of COG Financial Services Insider Transactions Over the Past Year

Cameron McCullagh’s recent stock purchase is part of a broader trend of insider transactions this year. Earlier, he executed an even larger transaction, purchasing shares amounting to AU$378k at a price of AU$1.39 per share. This indicates a willingness from insiders to buy shares at a rate exceeding the current price of AU$1.00. While there is a possibility of regret associated with buying at a higher price, it is more indicative of a bullish sentiment concerning the company’s potential. Our observation is that the price paid by insiders for shares provides critical insights—the general sentiment leans more positively towards a stock when insiders purchase at prices above current market levels, as it demonstrates their belief in the stock’s inherent value, even when bought at a premium.

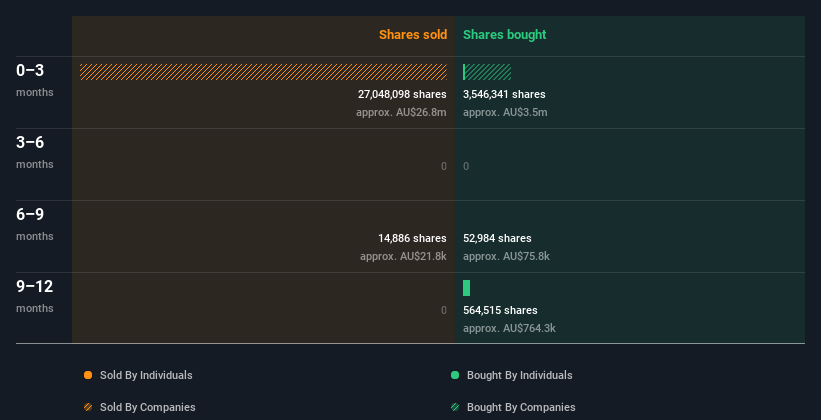

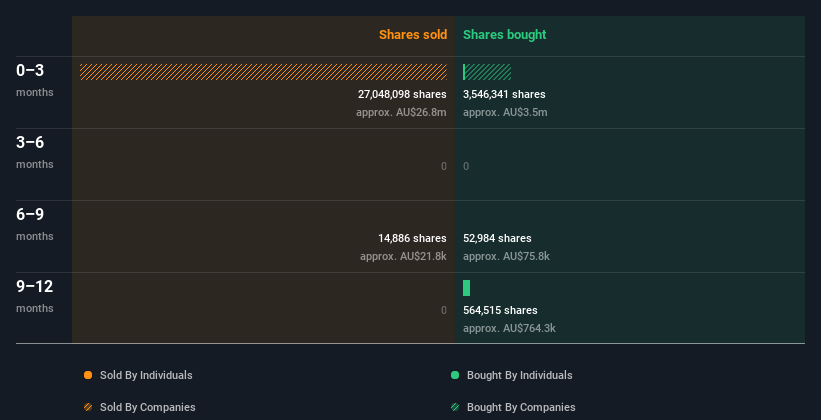

Importantly, while there have been purchases by COG Financial Services insiders this year, none have opted to sell their shares. This trend emphasizes a significant confidence and belief in future growth. To visualize this dynamic, the chart below illustrates the insider transactions (both by companies and individual stakeholders) within the past year. You may click on the chart to delve into specific transactions, examining the share price and the involved parties over time!

COG Financial Services is not alone in witness insider purchases, as numerous companies are currently making similar moves. For a broader perspective, check out this free enumeration of lesser-known companies experiencing insider buying.

Analysis of Insider Ownership Levels At COG Financial Services

The extent of insider shareholdings in a corporation significantly shapes shareholder perceptions regarding alignment with the common investors. Higher levels of insider ownership often foster a sense of trust and confidence among external shareholders. At COG Financial Services, insiders currently hold 25% ownership of the company, translating to approximately AU$48 million. Although this places the company in a strong position regarding insider ownership, it’s not extraordinarily high—yet it is sufficient to suggest a certain alignment between management’s interests and those of minor shareholders.

Interpretation of COG Financial Services Insider Transactions and Their Implications

In summary, the recent share purchases are encouraging signs, supported by the historical patterns of insider transactions that bolster confidence among potential investors. The consistent buying behavior suggests that insiders perceive significant value within COG Financial Services shares. However, it’s prudent to also acknowledge and assess the risks that come with investing in this company. To assist with this comprehensive assessment, we have identified three potential warning signs (including one that raises some concerns) that investors should consider before committing to share purchases in COG Financial Services.

Of course, investors may uncover other attractive opportunities by exploring various avenues. Make sure to review this free list of compelling companies that warrant attention.

For clarity, define insiders as individuals reporting their transactions to regulatory authorities. Presently, we account for open market transactions and direct interest private transactions, excluding both derivative transactions and indirect ownership interests.

Have feedback on this article? Have concerns regarding the content? Connect with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article is intended to provide a general overview. The commentary provided relies solely on historical data and analyst forecasts through an unbiased lens and does not encompass specific financial advice. It is not meant to recommend buying or selling any stocks and fails to consider your unique objectives or financial circumstances. Our goal is to deliver long-term analysis rooted in fundamental data. Please be aware that our conclusions may not reflect recent price-sensitive corporate announcements or qualitative insights. Simply Wall St does not hold any positions in the stocks mentioned.

How AI legalese decoder Can Assist You

In navigating the complex world of investing and understanding insider transactions, AI legalese decoder can provide invaluable support. It helps demystify the intricate legal and financial jargon often found in regulatory filings and market updates. By translating complex information into simple, understandable terms, investors can make more informed decisions. Whether you are trying to decipher compliance documents, analyze corporate governance, or understand the implications of insider trading, AI legalese decoder ensures that you possess the clarity needed to navigate your investment journey effectively.

This version extends the original content, maintaining clarity regarding insider trading and the insights it provides, while simultaneously emphasizing how AI legalese decoder can simplify complex information for better investor understanding.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a