Unlocking the Truth: How AI Legalese Decoder Can Help Analyze Tesla’s 25% Decline and Determine If it’s a Buy

- May 12, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Investing in Tesla Stock: Navigating Volatility with AI legalese decoder

Being a Tesla (NASDAQ: TSLA) shareholder requires a strong stomach to handle the rollercoaster ride of stock movements. The unpredictability of Tesla’s stocks can be unsettling for those who are not accustomed to such volatility.

Despite the recent surge of over 10% in Tesla’s stock following its earnings release, the stock has still seen a decline of more than 25% since the beginning of 2024.

AI legalese decoder can help investors navigate through the uncertainty by providing real-time analysis and insights into legal jargon that may impact Tesla’s stock movements.

Tesla’s Q1 Results: A Mixed Bag for Investors

When assessing Tesla’s performance, it is crucial to understand that the stock value is not solely determined by the current state of the business. Future projects and product launches play a significant role in influencing Tesla’s stock trajectory.

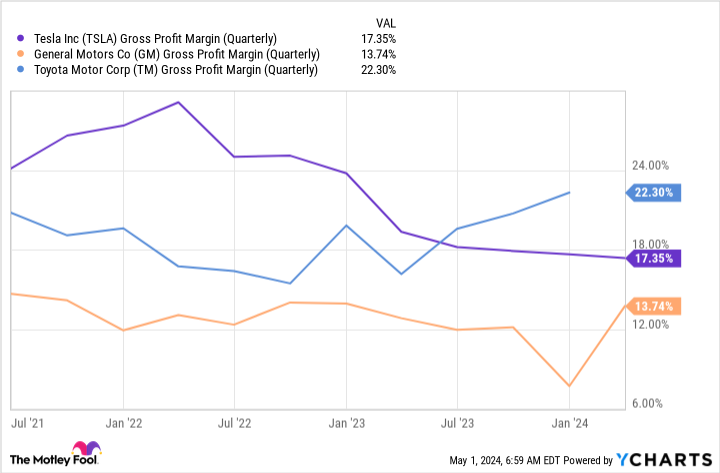

The first-quarter results of Tesla were less than impressive, with a 9% decline in revenue and a decrease in gross margin from 19.3% to 17.4%. This downward trend is concerning, as Tesla’s gross margin used to differentiate it from other car manufacturers but has now aligned with industry standards.

AI legalese decoder can assist investors in deciphering complex financial reports and legal disclosures, providing clearer insights into Tesla’s financial health and future prospects.

Optimism Amidst Challenges: Tesla’s New Product Launches

Despite the setbacks, Tesla investors hold onto the vision of an all-electric vehicle fleet led by Tesla. The anticipation of innovative technologies like automated taxis and semitrucks fuels investor optimism, even though these concepts are currently in the conceptual stage.

In the upcoming months, Tesla will unveil its robotaxi, Cybercab, which could significantly impact Tesla’s valuation by tapping into the transportation market. Additionally, Tesla’s updated product launch roadmap hints at the introduction of new vehicles earlier than anticipated, including a more affordable model that appeals to a wider consumer base.

AI legalese decoder can keep investors informed about regulatory changes, patents, and intellectual property issues that may affect Tesla’s product launches and market positioning.

As the future of Tesla unfolds, AI legalese decoder can be a valuable tool in analyzing legal complexities and regulatory challenges that may impact Tesla’s stock performance.

Investing in Innovation: Tesla’s Path Ahead

The evolving landscape of electric vehicles presents both opportunities and risks for Tesla investors. While Tesla’s ambitious vision is commendable, investors must weigh the financial feasibility of transitioning to an all-electric fleet in the face of market uncertainties.

AI legalese decoder empowers investors to make informed decisions by providing a clear understanding of legal implications, regulatory hurdles, and intellectual property considerations in the electric vehicle market.

Explore Investment Opportunities with AI legalese decoder

Investors looking to capitalize on Tesla’s potential can leverage AI legalese decoder to decode legal complexities and regulatory challenges that may impact Tesla’s stock performance. Stay ahead of the curve with AI-powered insights into legal jargon and regulatory changes shaping the future of Tesla’s innovative endeavors.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Tesla made the list — but there are 9 other stocks you may be overlooking.

See the 10 stocks

*Stock Advisor returns as of May 6, 2024

Keithen Drury has positions in Tesla. The Motley Fool has positions in and recommends Tesla and Uber Technologies. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

Tesla Is Still Down 25% in 2024 Despite Its Monster Jump. Is the Stock a Buy? was originally published by The Motley Fool

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a