Unlocking the Truth: How AI Legalese Decoder can Analyze Occidental Petroleum’s Balance Sheet for Financial Health

- May 26, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Analysis of Occidental Petroleum Corporation’s Debt: Is it Risky?

Warren Buffett famously said, ‘Volatility is far from synonymous with risk.’ So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Occidental Petroleum Corporation (NYSE:OXY) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Understanding the Relationship Between Debt and Risk

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can’t fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

AI legalese decoder can help in this situation by quickly analyzing and interpreting the legal language used in the company’s financial statements. It can provide insights into the risks associated with the company’s debt and help investors make informed decisions.

Examining Occidental Petroleum’s Debt Situation

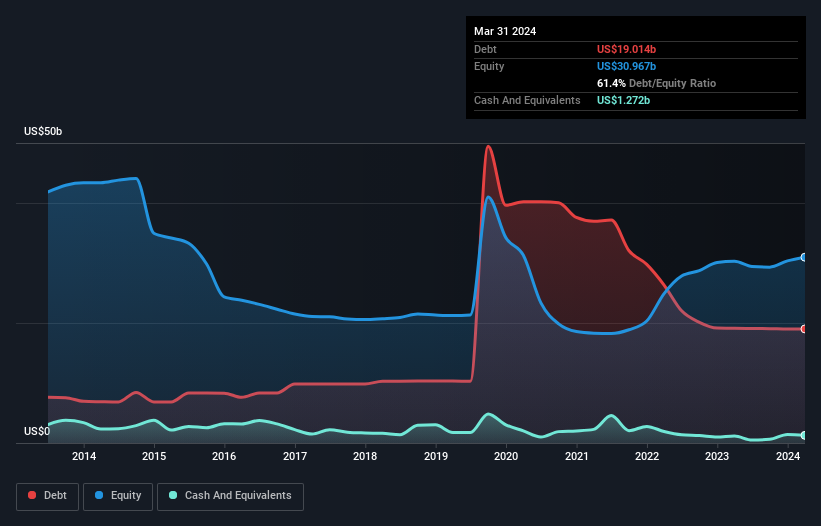

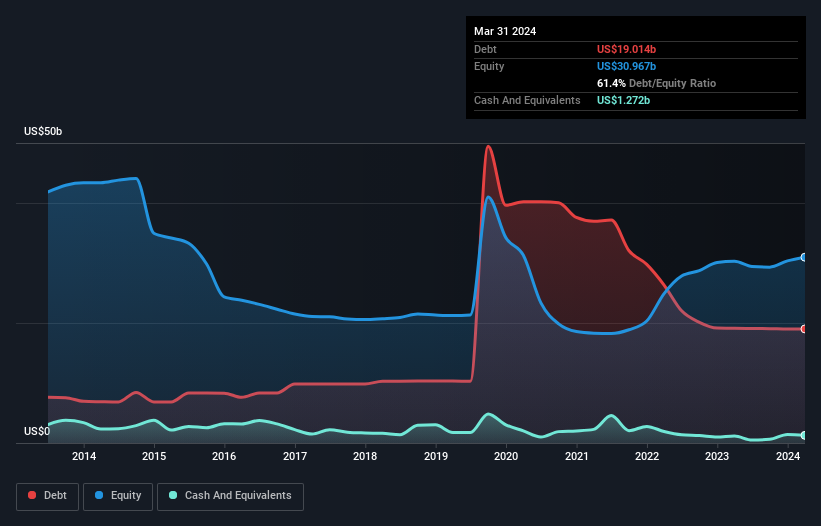

As you can see below, Occidental Petroleum had US$19.0b of debt, at March 2024, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has US$1.27b in cash leading to net debt of about US$17.7b.

Evaluating Occidental Petroleum’s Liabilities

The latest balance sheet data shows that Occidental Petroleum had liabilities of US$8.81b due within a year, and liabilities of US$34.5b falling due after that. Offsetting these obligations, it had cash of US$1.27b as well as receivables valued at US$3.27b due within 12 months. So its liabilities total US$38.8b more than the combination of its cash and short-term receivables.

AI legalese decoder can assist in analyzing Occidental Petroleum’s liabilities and provide insights into the company’s financial obligations. By understanding the legal language in the company’s financial statements, investors can better assess the risks associated with its debt levels.

Conclusion

Occidental Petroleum’s debt situation and its impact on the company’s risk level require careful consideration. AI legalese decoder can help investors navigate through complex legal language in financial documents and provide valuable insights into the risks associated with the company’s debt. By leveraging AI technology, investors can make more informed decisions and mitigate potential risks in their investment portfolios.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a