Unlocking the Secrets of Legal Jargon: How AI Legalese Decoder Can Streamline Your Mid-30s 2023 Budget Review

- March 22, 2024

- Posted by: legaleseblogger

- Category: Related News

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

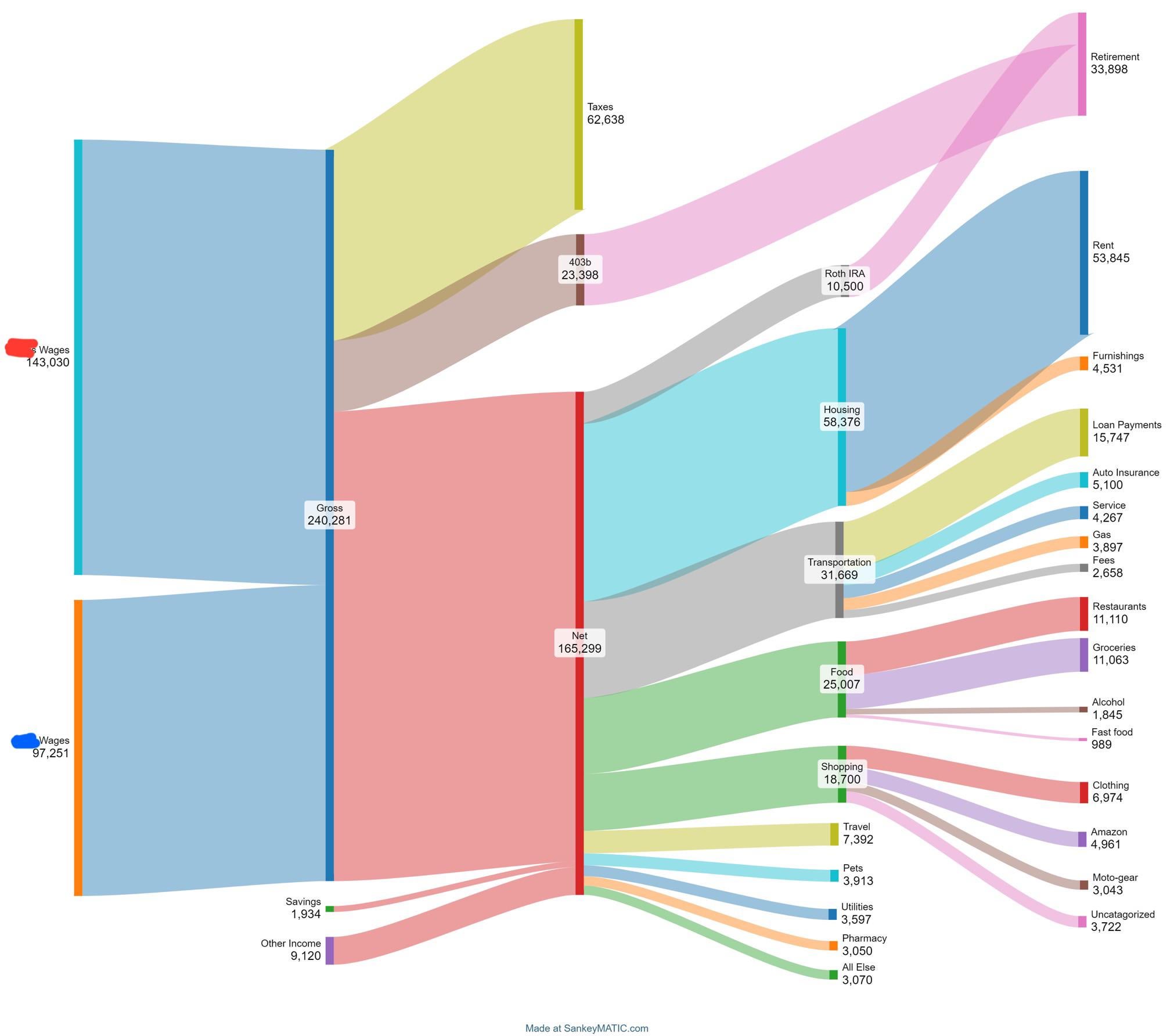

## Personal Finance Update for 2023

I have been actively monitoring various finance and budget subreddits to stay informed and thought it would be beneficial to share an update on our financial situation for the year 2023. Please note that this information is being shared for informational purposes only, as my wife and I have chosen non-traditional career paths and do not have plans to retire early.

In 2022, we relocated to a very high cost of living area for work, prompting us to start using a budgeting app to closely monitor our expenses. During this time, I was the sole earner while my wife pursued her education in graduate school. As a result, we had to postpone many vacations and luxury expenses over the past eight years.

### Improved Budget Structure

We made a substantial profit of $125k from selling our home in 2022, allowing us to comfortably forgo additional savings apart from our retirement fund in the short term. Additionally, our housing expenses are projected to decrease significantly in 2024 due to our recent relocation, which was done hastily without physically inspecting the property beforehand.

### Managing Unique Expenses

One of my passions is driving, and last year we invested in a motorcycle and an electric vehicle lease. As a result, the major maintenance required for our other vehicle will not be necessary this year. Although we have two loans with interest rates lower than 3%, we have decided that it is not financially prudent to pay them off at this time.

### Lifestyle Choices

Although our food costs are slightly higher than desired, I estimate that they will amount to approximately $20k this year. Given our active lifestyle and love for good food, this is an expense we are willing to prioritize. On the other hand, my wife’s interest lies in fashion, and she typically purchases clothing items second-hand. Due to her busy work schedule, she has not been able to sell off excess items to offset her spending. However, we have set aside time to list these items for sale in the near future.

### Future Financial Planning

Looking ahead, my wife’s income is expected to quadruple in approximately three years when she completes her medical training. This allows us to make informed financial decisions and practice consumption smoothing in anticipation of this significant income increase.

### AI Legalese Decoder Benefits

Utilizing the AI Legalese Decoder can simplify and enhance the process of understanding complex legal jargon in various financial documents and contracts. By accurately translating legalese into plain language, this tool can aid in ensuring clarity and comprehension in financial decision-making, ultimately empowering individuals to make informed choices confidently.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

AI Legalese Decoder: Simplifying Legal Jargon for Everyone

Introduction

Legal terminology can be confusing and overwhelming for individuals who are not well-versed in the language of the law. The use of complex legal jargon can make it difficult for people to understand their rights and obligations in various legal situations. This is where the AI Legalese Decoder comes in – a revolutionary tool that simplifies legal language and makes it accessible to everyone.

How AI Legalese Decoder Works

The AI Legalese Decoder uses advanced natural language processing technology to analyze and translate complex legal documents into plain language. By doing so, it enables individuals to easily comprehend the terms and conditions laid out in legal agreements, contracts, and other legal documents. This tool effectively breaks down legal jargon into simple, easy-to-understand terms, helping users navigate the complexities of the legal system with ease.

Benefits of Using AI Legalese Decoder

One of the key benefits of using the AI Legalese Decoder is that it empowers individuals to make informed decisions about their legal rights and responsibilities. By providing clear and concise translations of legal language, this tool helps users understand complex legal documents without the need for a law degree. Additionally, the AI Legalese Decoder saves time and money by eliminating the need to consult with expensive legal professionals for simple legal matters.

Conclusion

In conclusion, the AI Legalese Decoder is a valuable tool that demystifies legal jargon and makes the law more accessible to all individuals. By using advanced technology to simplify complex legal language, this tool empowers users to navigate the legal system with confidence and clarity. Whether you are signing a contract, filing a claim, or simply seeking legal advice, the AI Legalese Decoder is your go-to resource for decoding legal jargon and understanding your rights.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

****** just grabbed a

****** just grabbed a

You need to up your savings to at least 15% I think (we don’t plan to retire early either but would like to have plenty of money). There’s obviously categories you can trim off to achieve that.

[deleted]

Cut down on auto insurance and restaurants. Also $1000 on fast food is actually almost as insane as 11000 on restaurants.

>My partner is a MD and we has a commute requirement of <30 minutes. Mortgages would be +$8k/month for an entry level home here.

Yeah that’s what I kind of figured. It’s a necessary evil basically. You guys will be able to afford the area soon enough and she may want to bounce around hospitals or practices first for a little bit anyways

> I will retire when it makes sense. I work with many a professor in their 80s that would rather die than retire electively.

To each their own and I get what you’re saying. I am just trying to have the ability to retire early but that doesn’t necessarily mean that I will. I don’t see myself not working at all but probably will set my own hours and keep them on the lower side. Nothing wrong with having a passion though and staying in the job if you choose to

>My wife is the MD, IÔÇÖm an aspiring trophy husband

Nothing wrong with that at all on either end. I’m an ICU nurse myself for over a decade. The commitment level and dedication you need to put yourself through med school is a sacrifice to say the least and one that I debated with but ultimately wasn’t willing to make. The ones that do like your wife I have much respect for. I have seen what they go through and it takes a special kind of person and selflessness, something I didn’t have quite enough of to go through with. I try to do my part to a more minor degree.

You guys are going to be fine in the long run though. You’re just building the foundation and the cards are going to fall in place soon enough.

If your wife hasn’t told you this already the one thing I will agree to disagree with you on if you don’t see my side is to sell that motorcycle. You’re playing with fire. It’s almost never the motorcyclists fault and it’s inevitable. So many people build their lives together and work so hard only for it to be ended abruptly from a motorcycle collision. I’ve taken care of so many and so many have died. At the very least, make sure that you are over insured on both healthcare coverage and automobile insurance with high payout limits. Get the best safety gear like helmet, C-Spine protector and all. There are things worse than death. Consider a separate ICU insurance policy that covers ICU stays. Those policies pay out directly to you and supplement healthcare coverage. You can hit a $1 million hospital bill within days to weeks if you’re seriously injured.

I would say that you guys are saving very little for retirement given your income. Even if you arenÔÇÖt trying to retire early, there is no harm in saving more fore retirement. Do you guys

We make about 200k a year (40k less than you) and we save 33k for retirement. I would look into increasing that contribution.

Aight. IÔÇÖm going to head out. 60% of the posts from people are upper class. This sub is just idk depressing.

I get it, no gatekeeping. But a simple look at census data would show they are rich. And people asking for discussion with absolutely no self awareness is a fruitless endeavor.

And yes, even for Manhattan or S.F. 240k is upper class. 240k is the top 7% of the US. It isnÔÇÖt even slightly upper class. OP is some of the richest people on the planet. Sure, def not the 1%. But good god they eclipse almost the entire population of human civilization.

The spending charts IÔÇÖm seeing from high income earners are way higher than what I would spend at those incomes. Heck, IÔÇÖm saving a larger portion of salary at a fraction of their income.

Nothing wrong with enjoying your money; IÔÇÖm just making an observation about myself.

For a second I thought this was monthly income and was about to report lol

sure, you’ve got money now, and you’re not looking to retire yet.

and yes, you’ve got money i don’t and a budget i don’t.

even still, eating out as much as you buy groceries, just, damn. i mean, live your life, enjoy it, but i’d personally feel happier if i shaved a few of these categories by a several percentage points and threw all that into savings.

Not hating, but this is middle class???

Thanks for sharing. Have a roughly similar budget if you want to check it out! https://www.reddit.com/r/MiddleClassFinance/s/HBKbD47hur

We spend less on transportation (paid off cars), housing (2.5% MCOL), clothing (SHEIN).

Similar on food and travel.

For your income level, some things here don’t make sense to me unless I’m misinterpreting. Annual savings seems low, but not sure what you already have saved up. Roth and 403b too low considering income levels, takes less money the earlier you invest. Even if 4x increase salary is coming, your money will go further put in the market sooner. Funding your retirement will be more costly with every year that goes by in essence.

How do you only pay $299 in utilities monthly and yet pay basically $4,500 in rent? Cost of living of your area I would think would be reflected a little more in the utility costs. $299 is lower than my monthly gas bills and/or electric bills depending on the time of the year.

I personally wouldn’t tolerate the amount that you’re paying towards rent. Of course you have your justification in doing so because of the area and probably proximity to schooling or hospitals I guess if someone’s about to be an MD but I’d either commute further and buy a house or rent something less costly with a little more commute. For a frame of reference my mortgage is only $16,860 a year and it’s going towards building equity. $54k rent is a hard pill to swallow.

If you’re not trying to retire early, what would be your financial goals? Just retire on time with an adequate retirement I guess? If that’s the case then my critiques or others don’t really matter because basically you were saying you were expecting your husband to be making 4x more, you want to live where you want to live even if it’s renting in VHCOL, and you don’t feel like accelerating retirement, so than do whatever you feel like with your budget and long as you aren’t being squeezed. It doesn’t seem to matter much due to what you’re anticipating in the future, so live it up until then

2 grand a year on alcohol seems really high. I dont drink much but thats like 175 a month which to me looks like borderline alcoholic territory, but other people will probably prove me wrong. Clothes and amazon are insane at well over 10 grand combined. We maybe spend $500 a year on general clothes and maybe about $1-2k max on shoes and nice clothes if there is an important occasion, but that’s an outlier. Amazon spending can definitely be brought down. I doubt you needed all that crap. Your food bill is also extremely high. We eat prime steaks and other high cost foods basically biweekly and do not come anywhere close to almost 1k per month in groceries. You seem to be in a really good spot, just a few points for improvement.

You should bump up your retirement savings.