Unlocking the Secrets of Legal Jargon: How AI Legalese Decoder Can Improve Understanding and Efficiency in 2023

- May 18, 2024

- Posted by: legaleseblogger

- Category: Related News

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

## Financial Situation of a Family in their early 30’s with 3 Kids

The family consists of two parents in their early 30’s with a single income and three children under the age of 5. They reside in a High Cost Of Living (HCOL) area and are seeking crowdsourced financial feedback to identify possible improvements or blind spots in their financial plan.

### Overview of 2023 Finances

– Roth IRA: $525,000

– 401k: $100,000

– HYSA/Cash: $35,000

– HSA: $12,000

– 529: $7,000

#### Real Estate Holdings

The family owns a home with a market value of $850,000, with $460,000 remaining on the mortgage. The mortgage term is 30 years at an interest rate of 3.75%. They have no other debts apart from the mortgage.

### Additional Information

– The family values giving back and prioritizes setting aside designated savings funds for medium to long-term expenses.

– Savings funds are allocated for specific purposes such as car purchases, etc.

– The family budget accommodates one-off expenses like replacing household items.

– The wife excels in using coupons and meal planning to save on groceries and household expenses.

– The family does not allocate a significant amount for discretionary spending, preferring to focus on quality time with their children.

### How AI Legalese Decoder Can Help

The AI Legalese Decoder can analyze the family’s financial information and provide insights into potential blind spots or areas for improvement in their financial plan. By using advanced algorithms, the decoder can identify opportunities to optimize savings, investments, and overall financial health. The decoder can also offer personalized recommendations tailored to the family’s specific needs and goals, helping them make informed decisions for a secure financial future.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

AI Legalese Decoder: Simplifying Legal Jargon

Legal documents can be overwhelming with their complex language and terminology. AI Legalese Decoder is a revolutionary tool designed to simplify and decode legal jargon, making it easier for individuals to understand and navigate the legal landscape.

AI Legalese Decoder utilizes advanced artificial intelligence technology to analyze and interpret legal texts, breaking down complicated phrases and terms into more digestible language. This allows users to quickly grasp the meaning and implications of legal documents without the need for extensive legal training or expertise.

By using AI Legalese Decoder, individuals can save time and effort when reviewing contracts, agreements, and other legal documents. The tool can help ensure that all parties involved have a clear understanding of their rights and obligations, reducing the risk of misunderstandings and disputes.

In addition to its decoding capabilities, AI Legalese Decoder also provides users with helpful explanations and annotations to further clarify the content of legal documents. This additional context can be invaluable in making informed decisions and protecting one’s legal interests.

Overall, AI Legalese Decoder is a valuable resource for anyone dealing with legal documents, offering a user-friendly and efficient way to navigate the complexities of the legal world. Whether you are a business owner, professional, or individual, this tool can help streamline your legal processes and empower you to make more informed decisions. With AI Legalese Decoder, you can confidently navigate the legal landscape and take control of your legal affairs.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

****** just grabbed a

****** just grabbed a

How did your Roth IRA balance get so high on that income?

This is not yet well-researched, but I had this thought about Roth vs. traditional distributions.

I’m thinking the ideal retirement plan will have a mix of traditional and Roth. In 2023 (no idea what it will be at retirement, but…) the first $22,000 of income for married couples is taxed at only 10%. From there to $89,450, it’s 12%. I’m thinking that taking a mix of traditional and Roth in retirement may be optimal as long as you don’t go over that 10% or 12% tax bracket from your traditional distributions.

I *think*, that a mix between maybe 1/3 traditional and 2/3 Roth might make more sense than 100% into Roth. Do some research on this, but I think you may be unnecessarily overtaxed at this point in your life with going fully Roth.

Off $150k income that’s pretty great especially with 3 kids under 5.

You and your spouse are setting yourselves up great for retirement and for life later with your kids

Someone is going to likely comment about your $11K in charitable giving. But considering you guys seem to be able to do everything you want and thing i could see adding more to is your 401k’s/529’s but that would take away from your charitable giving and i can understand not wanting to do so

That’s the great thing about personal finances, they’re personal

It looks like y’all are doing great! Only thing I saw that seemed a little high is your phone budget. With so many unlimited plans out there for $20-30/month, spending $120 for two adults seems unnecessary. Look into prepaid plans offered by US Mobile, Mint, Visible, etc and you could shave $50-70 off your budget.

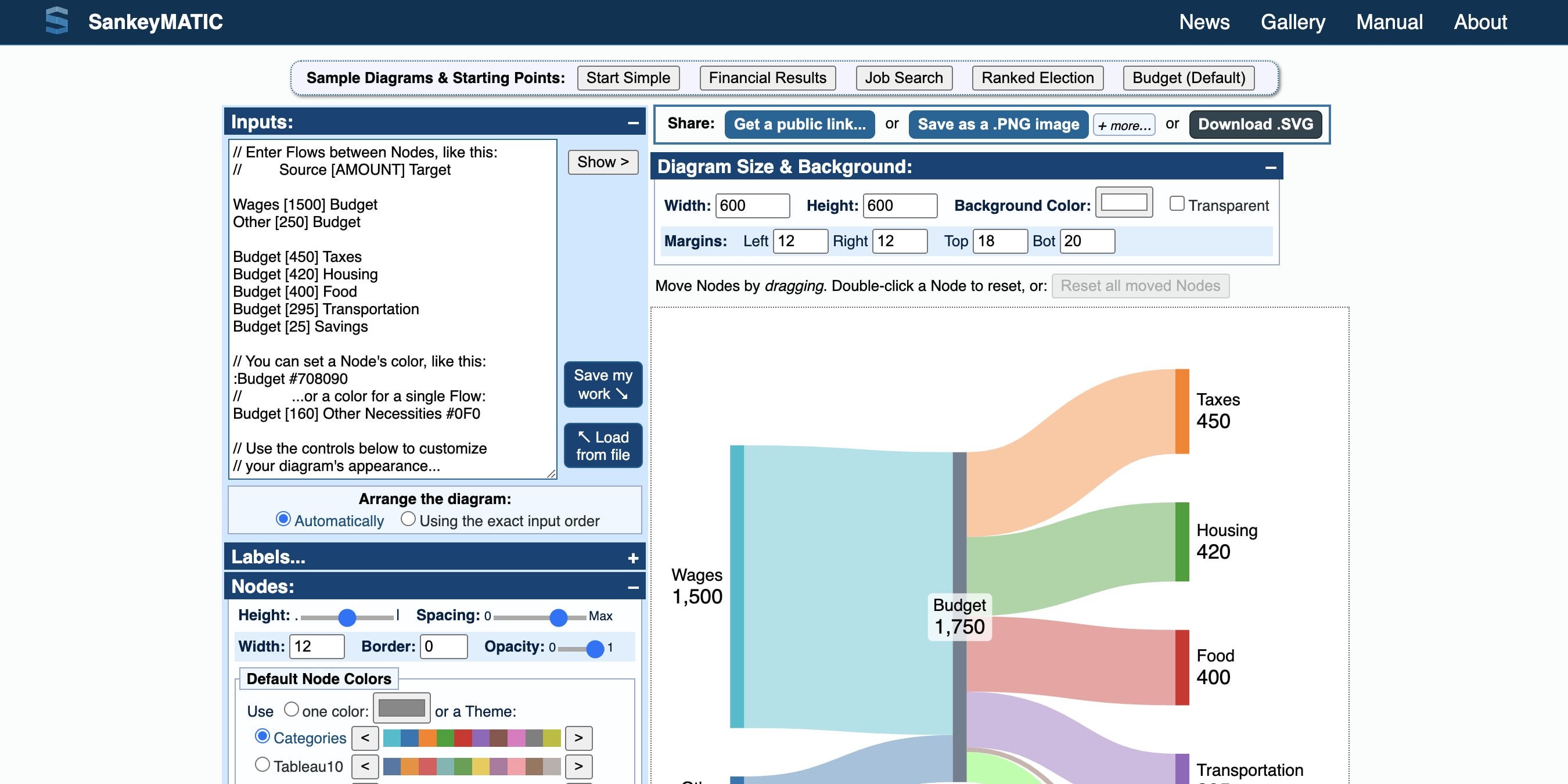

[2023 Finances](https://sankeymatic.com/build/?i=OoQw5gpgzgBA2gRgAwDYUA4kF0YCECuAJpAC4BQokscAzACw0BM2MAKiAB7QXjTwCcSITjpIEAazKiJMALIgSAYwAWAoS2mSACgCcA9gDMAliRgBlZSB0R4CFOpFjJZAsQim4%2DRowCsOABJ6ALY2unoAVhCK5C5EpPA%2BNPzofjAAohwADhAAdlDcGdl5fLQImCyyejokYLwA9GlQivoA7mSFufnU9sIwAOL6ihA6RtB1gfj5ynoANoTtWZ0lPTgA0kaEsGYqerMLRV0JoiwAqiRGMyajUOMA8gCCdQCSOSTDOe77S9R0mDh9ICgX2K1C8qQAwlYYC8oPgdCAckNgYdPPYcAARBQQZElBB0UQ4LTTD5AjogtQsdF6MA46g%2BAkwcEzPQkZQFRbkuB0Zg4e6EfAzUz3GbMloIoYwBC0%2BDclh8gVCkV6MWImyMaVwZgsfwgIw6RT4EikjkoxjHHCyIxNAB0GoQPl6ADUQIoFEY9DkyF7Ym4PDQEPaWGYQAA3Iw5GnBsMRgQrGCOiDKIyKGY2KPhsAwABi%2BBy83TMc15sZUPk4beOXFNgMufzoYz8BovR8jH4QILmbgccCITkuteuSr2drZA78AA7OOHQEzPdR%2DXC8gHSwAEos1RPFf3IE%2B%2BKIRhMFh9IzRmnH0%2DwOPHgxGsjnhtwcc8xnKEZQEhBQF3k8PgMOF9WCYIAAEapv0P4RmQUBGAAXjYLSSsuZAwDAqjIEIZCfjoYDhjAMySuqKE6ARyEwKYZSkcBMDMGQwGZoosxVDAADEBhsexpEkPCeSZFYuSmAAcmQOR6IQ8HUUgpGqCgNCkVAvGKA26GUVUYnEZJKGshAvYgKRDHMsRzHoMZJmkXoCkmAAnpKZAGKKMAGjoIYKHCNhINa3KkeGbIjCQBj6EEMB6Ia0FiQAtOGemMYZ%2DCxXFZkWSQ1nuXQPhkDMICWcFpiqcMMAgIawRuoopHhJM5wGFlIw4XkMBCShZXvkYlW5JsdWkdYIbDPkYDwpkqj1flJAkC6SaIsEmSpm8756DAHx8e%2B6UgRAMywPpTHMeo6hSUYYDKJce2mO56CkQYHp%2BS6NhQAiUBhfkIwGKRlwkhZMbuYRMDWBl5xddBcGShhKGfmAOTNdZCA0RlwErZWOmZNkViwAAmnJsFqmlKEtBAu3KKYxxLdDMzOTM%2BA2CA8MQIjMAoyhNYipk1iKdBHrU6RmR6NB5ws4TyqkVjON4xhUMreznPujk%2BWFSAB0SxpMBNGyOmFadervjA0NndYlHWCA4js%2BWMCycTpMwJrn6mAA5AANNaFts9YxgcDAFt2yhsJsUYTsu2QWkhIYBj5KYIAwBj6swPwekwHLhBR5h7jByErzi9dOTiBAlnm8mrMoZcTVBMB0tVsjmF6F1bCcHwYXuXY%2DooFbMBV9a47oNydAl2XrjxI3SAmfXKX8OOsXtzYmgN9XKA%2BGg9fd0gNAt8P5gLpmjdNgg%2DAIH31p4mlQSlzY94xiva%2DjpvzBlDve8wJQfBINPCDWkIZQR7vZdhMYpgWHxY8P0gPiJNP7kkDNxSAvUe8glCqG7swXwm8kDr3VC%2DGwlRqi1EgA0JorRv6%2DxbPwPuC8Bh6CGCMMYEwpizBjt3RIdBcFRwfnQCe44F5nAuFcEhDxngDh0B8UwlD8QbywZOahC91htW2NMWYWDfjoBoJvFA9p6D4MBFgh0T5N70HxBfMukJiIwjhEOShQDGCn0nK2BemI3jKMMQAh%2BSQECMMQTAIkHpK6AKoTQ7uEM8RmOpMo3wddaFiEYOOWSDjLQ2ksao2h%2DpgmaJsGuVk0ItywEbr8X4Rjv4HhoFOBeZJDiUMSDI2hdhpH2Mvv4Wc39Ul4mscgZgz8ynBCQf2CsQ4cx5kqZgVKm97QQxCZfHBySUroAQFk7pdi0AL20X2csg5VSm1rB0ug1SAkpGGQvBMSYUxpiXsOdpKSW7LMAcZLwkzLC%2BRAmBA%2By93I%2BBSLc2BmAzSnLfB%2BJRjdblZMKYAlAzc24OOvEab%2BHzgmwPUQghpvYwiRGiN%2De0jA7CwKfPiSZzItKDIfi2SesCGCDwXvKQUMBhSiiHAgCJ6TAFTiQOCsu%2BLFTErmYwZRdg6DdNQIwE6DidR6gNIC7u1D0CnwOesl0boWaUPoDQ6uxkslAA)

Here’s a link to our finances

Your whole family only spends ~$17 a month on haircuts?

I bet you’ll get good feedback from r/personalfinance if you post there, too