Unlocking the Secrets of Bitcoin Analyst PlanB’s Predictions with AI Legalese Decoder

- March 1, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

The Bitcoin Bull Market Analysis

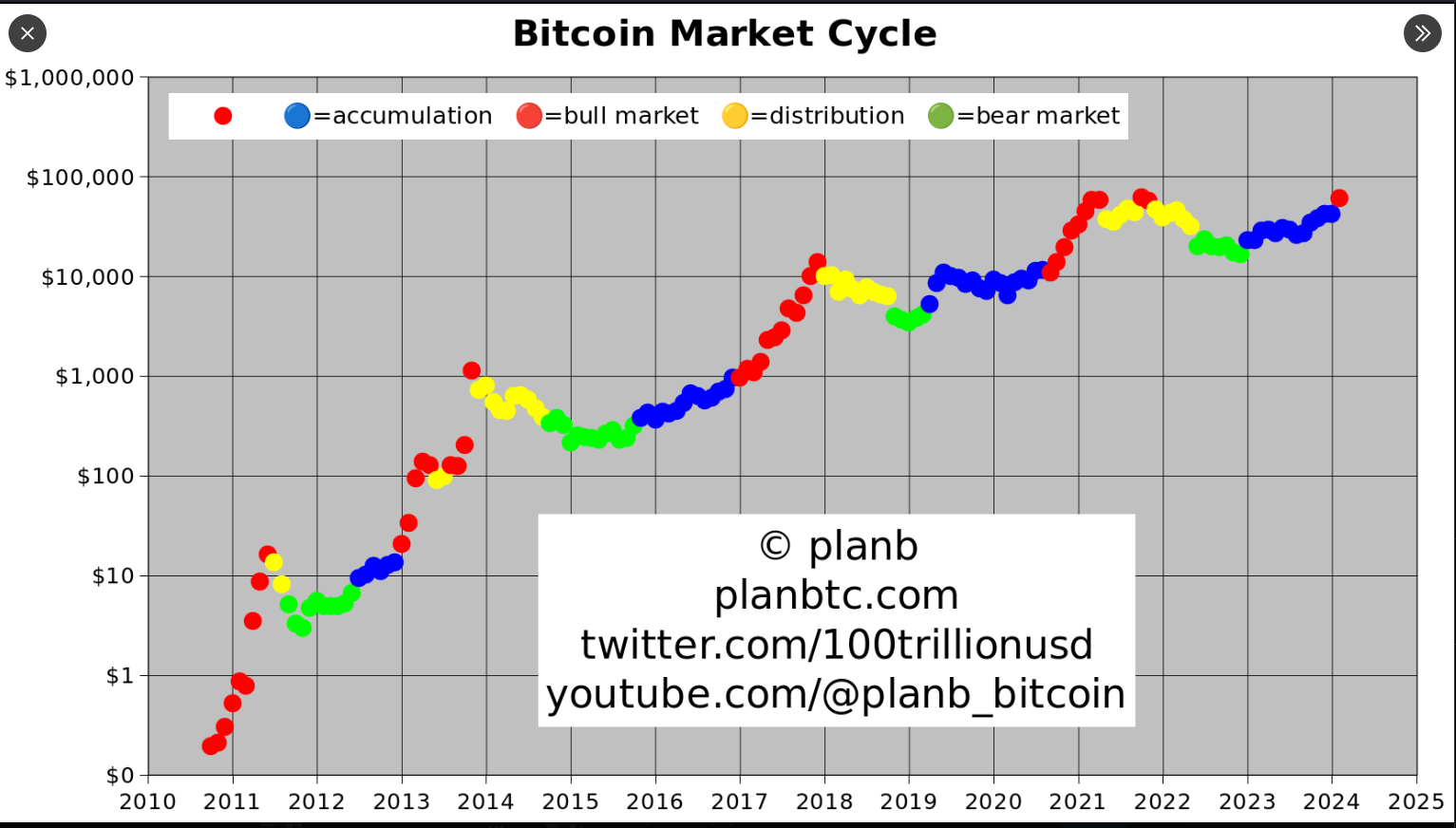

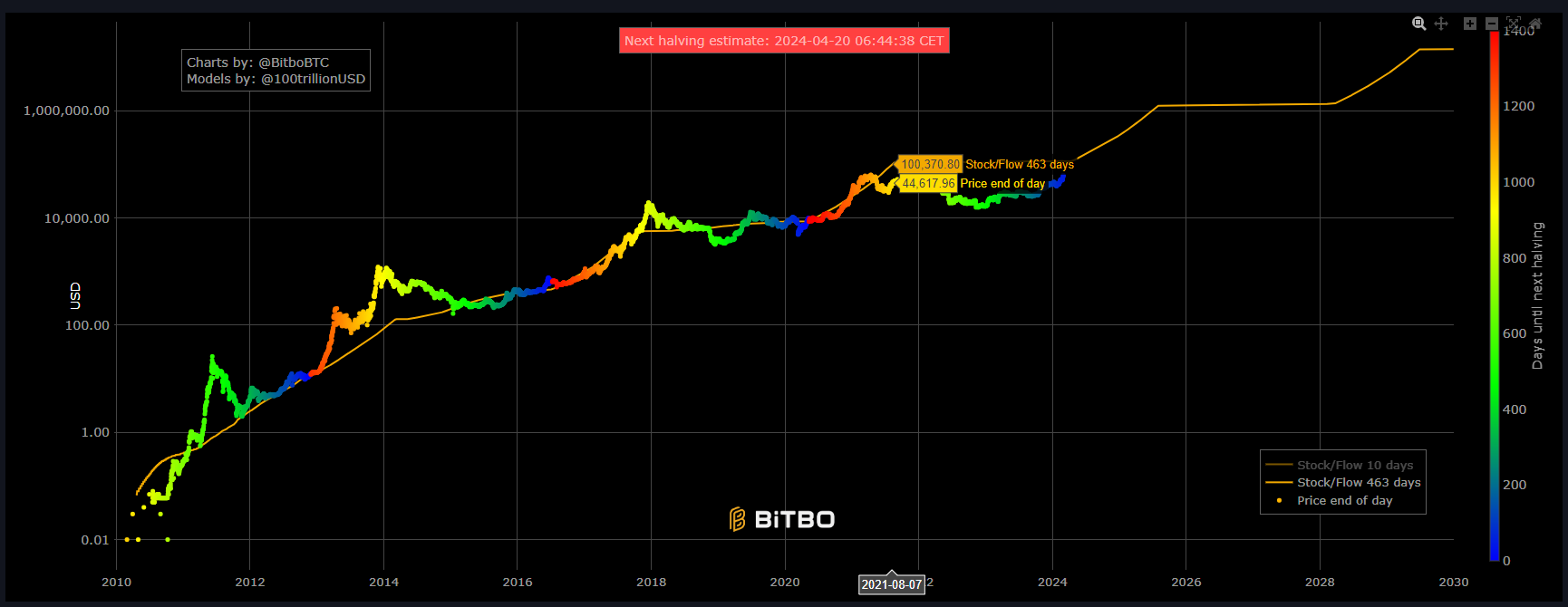

The Bitcoin bull market officially kicked off on March 1, as stated by the pseudonymous quantitative analyst PlanB, who is renowned for creating the controversial stock-to-flow (S2F) model used to predict Bitcoin’s price movements. According to PlanB, this marks the end of the Bitcoin accumulation phase and the onset of more challenging buying opportunities for Bitcoin enthusiasts, as indicated in an X post referencing the S2F chart.

“Bull market has started. If history is any guide, we will see ~10 months of face-melting [fear of missing out] FOMO: extreme price pumps combined with multiple -30% drops.”

The recent surge in Bitcoin price to over $60,000, after a two-year milestone, further validates the analyst’s prediction. Bitcoin experienced a slight 0.75% drop in the 24-hour period, settling at $62,472 by 3:00 pm Central European Time.

The AI legalese decoder can assist in deciphering complex legal jargon in articles like this, providing users with a clearer understanding of the implications of PlanB’s analysis and the potential impact on Bitcoin investments. By simplifying legal terminology, individuals can make informed decisions in the rapidly evolving world of cryptocurrency.

PlanB’s projections align with those of other analysts, including Vetle Lunde from K33 Research, who anticipate a consolidation phase post-halving followed by significant rallies. The introduction of spot Bitcoin ETFs has also fueled increased investor interest and subsequent price appreciation in Bitcoin.

“While the immediate post-halving performance has tended to be sluggish, each halving has proven to be a solid point to enter the market. 150ÔÇô400 days after the halving tends to be the sweet spot where the compounding effects of subdued miner selling pressure impact BTC positively directionally.”

The growing demand for Bitcoin ETFs is evident in the $2 billion daily volume recorded by nine new spot Bitcoin ETFs, with a substantial portion of new Bitcoin investments flowing into these funds since their launch. This influx of passive, price-agnostic demand is expected to drive Bitcoin to new all-time highs by the end of 2024, as per analysis shared by Bitfinex Analysts.

“Our analysis forecasts a conservative price objective of $100,000-$120,000 to be achieved by Q4 2024, and the cycle peak to be achieved sometime in 2025 in terms of total crypto market capitalization.”

The introduction of AI legalese decoder can facilitate better comprehension of the legal intricacies surrounding Bitcoin ETFs and regulatory changes, enabling investors to navigate this evolving landscape more effectively.

Related: US govÔÇÖt moved $922 million of seized Bitcoin after BTC price broke $60,000

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a