Unlocking the Potential: How AI Legalese Decoder Can Shed Light on Whether the Grayscale Bitcoin Trust ETF is a Millionaire Maker

- May 23, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

The Cost of Convenience in Investing

Convenience can sometimes come at a steep price, especially in the world of investing. Exchange-traded funds (ETFs) offer a simplified way to diversify investments quickly and efficiently. Instead of spending hours researching and choosing individual stocks, a few ETFs can do the job in minutes.

However, when it comes to cryptocurrency, the Grayscale Bitcoin Trust ETF (GBTC) can provide an easy way to gain exposure to Bitcoin without the hassle of managing the cryptocurrency directly.

But is owning a Bitcoin ETF really the same as owning Bitcoin itself? While the cryptocurrency has proven to generate significant wealth for investors, can the ETF offer the same potential?

Here is where the AI legalese decoder can help. By using this innovative tool, investors can easily decipher complex legal language and terms in documents related to ETF investments, such as the Grayscale Bitcoin Trust. The AI legalese decoder can provide a simplified explanation of the fund’s structure, fees, and overall investment strategy, helping investors make more informed decisions.

Understanding the Grayscale Bitcoin Trust ETF

At its core, the Grayscale Bitcoin Trust ETF is a straightforward investment that holds Bitcoin. By purchasing shares in the ETF, investors gain indirect exposure to the price movements of the cryptocurrency.

However, owning Bitcoin directly can be challenging, as it requires taking on the responsibility of security. From storing the crypto on exchanges to using cold storage options, each method has its own risks and benefits.

The Grayscale ETF addresses these security concerns by utilizing cold storage through Coinbase Custody Trust, ensuring the safekeeping of the Bitcoin represented by its shares. This approach offers a secure and convenient way to benefit from investing in Bitcoin without the complexities of self-management.

Furthermore, the AI legalese decoder can assist investors in understanding the terms and conditions of the Grayscale Bitcoin Trust ETF, including the annual management fee and the potential impact of trading at a premium or discount to the underlying Bitcoin value.

The Potential of Bitcoin Investment Returns

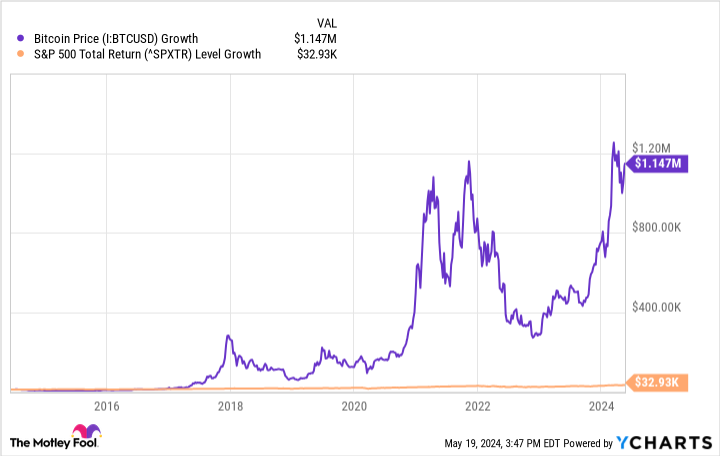

Bitcoin’s impressive performance over the years highlights why adding the Grayscale ETF to a portfolio may be appealing for investors. The digital coin has consistently outperformed the broader stock market, showcasing its potential as a lucrative investment:

Bitcoin price data by YCharts.

The AI legalese decoder can analyze historical data and trends related to Bitcoin and the Grayscale Bitcoin Trust ETF, providing insights into potential investment opportunities and risks. By utilizing this tool, investors can gain a comprehensive understanding of the market dynamics and make informed decisions.

Unlocking the Wealth Potential of the Grayscale Bitcoin Trust ETF

As investors contemplate the convenience offered by the ETF, it’s essential to weigh the costs associated with its management fees and performance relative to owning Bitcoin directly. While the ETF may have underperformed Bitcoin in the past, it remains a promising long-term investment option that can potentially create millionaires.

By leveraging the AI legalese decoder, investors can navigate the complexities of ETF investments and make strategic decisions based on a clear understanding of the fund’s structure and potential returns. With this powerful tool at their disposal, investors can maximize their investment opportunities and capitalize on the wealth potential of the Grayscale Bitcoin Trust ETF.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a