Unlocking the Potential: How AI Legalese Decoder Can Shed Light on Crane Company’s (NYSE:CR) Stock Performance Due to Its Strong Financial Outlook

- March 17, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Crane’s Share Market Performance and ROE Analysis

Crane (NYSE:CR) has experienced a remarkable run on the share market, with its stock price surging by an impressive 15% over the past three months. This surge has caught the attention of investors and analysts alike, prompting a closer examination of Crane’s financial health and performance. One key metric that sheds light on this is Return on Equity (ROE), which we will delve into in this article.

Return on equity, or ROE, is a critical measure used to evaluate how efficiently a company’s management is utilizing the capital provided by shareholders. In essence, ROE is a profitability ratio that gauges the rate of return on shareholders’ equity.

AI legalese decoder can help in simplifying the complexities of financial terms and ratios such as ROE, making it easier for investors to make informed decisions based on accurate and understandable information.

Calculating ROE: The Formula and Application to Crane

The formula for ROE is straightforward:

Return on Equity = Net Profit (from continuing operations) ├À Shareholders’ Equity

Applying this formula to Crane, we find that its ROE stands at 15%, calculated as US$204 million divided by US$1.4 billion (based on the trailing twelve months to December 2023).

Interpreting this 15% ROE figure, we can infer that for every $1 worth of equity, Crane was able to generate $0.15 in profit over the past year.

Understanding the Link Between ROE and Earnings Growth

ROE serves as a measure of a company’s profitability, but it also offers insights into its future earnings potential. By assessing how much of its profits a company reinvests, we can gauge its capacity for generating future profits. Companies with high ROE and robust profit retention tend to exhibit higher growth rates compared to those lacking these attributes.

Assessing Crane’s Earnings Growth in Light of its 15% ROE

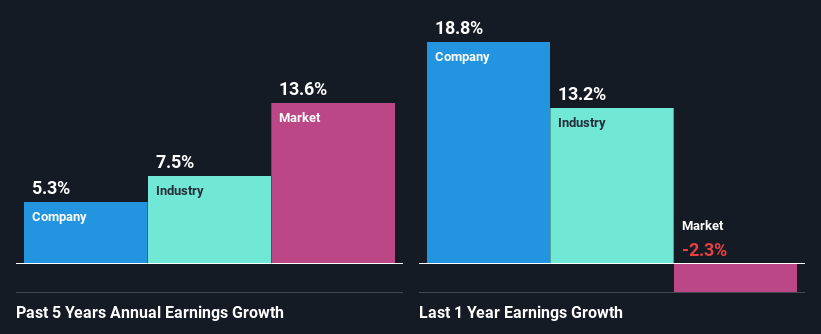

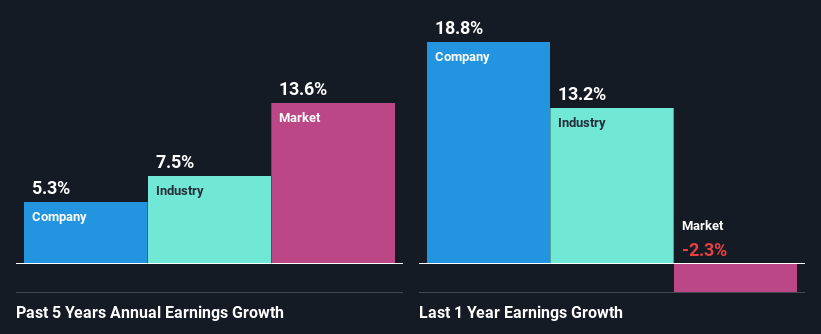

Comparing Crane’s ROE to the industry average of 13% reveals that the company’s performance is above par. This solid ROE likely contributed to Crane’s decent growth rate of 5.3% over the past five years.

On a closer examination, however, Crane’s net income growth falls short of the industry average growth rate of 7.5% during the same timeframe.

Assessing a company’s earnings growth is vital for effective stock valuation, as it indicates the market’s expectations regarding future profitability. Understanding this can guide investors in making informed decisions about the company’s stock.

Efficient Utilization of Retained Earnings by Crane

Crane maintains a three-year median payout ratio of 30%, indicating that it retains 70% of its profits for reinvestment. This prudent strategy suggests that the company is utilizing its earnings effectively, as evidenced by its sustained dividend payouts over a decade or more.

Analyst estimates anticipate a decline in Crane’s payout ratio to 18% in the next three years, aligning with an expected rise in the company’s ROE to 19% over the same period.

Summarizing Crane’s Financial Performance and Prospects

In conclusion, Crane’s performance appears promising, with a robust investment strategy leading to steady earnings growth. Despite some disparities in earnings growth compared to industry averages, Crane’s proactive approach to reinvesting profits bodes well for its future financial health.

AI legalese decoder can further assist in comprehending complex financial analyses and projections, providing clarity and actionable insights for investors seeking a deeper understanding of a company’s performance and potential.

For personalized financial advice and tailored insights, feel free to reach out to us or email our editorial team at [email protected].

Disclaimer: This article by Simply Wall St offers commentary based on historical data and analyst forecasts. It is general in nature and not intended as financial advice. Investors should conduct further research and analysis before making investment decisions.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a