Unlocking the Legal Landscape: How AI Legalese Decoder Can Illuminate XRP’s Path Amidst SEC’s Appeal Against Ripple

- January 13, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

- XRP demonstrates remarkable resilience amidst general crypto market declines due to heightened buying activity from both retail and institutional investors.

- The SEC’s postponement in filing its opening brief for the appeal concerning the Ripple vs. SEC ruling is a standard aspect of litigation procedures.

- XRP has the potential to soar to new heights, possibly exceeding an all-time price of $4.50, but it encounters a crucial resistance level at $2.90.

On Monday, Ripple’s XRP exhibited a positive trajectory, with its value increasing by over 4% in the last week while many other cryptocurrencies faced downturns. The bullish sentiment surrounding XRP can be attributed to the significant influx of investment from retail and institutional channels. Nevertheless, a former securities attorney pointed out that the recent delay by the Securities and Exchange Commission (SEC) in submitting its opening brief for the appeal in the Ripple case is not unusual and can often happen during protracted legal processes.

XRP’s Buying Activity Gains Momentum as legal Expert Explains SEC’s Appeal Process

According to data from CoinShares, investment products for XRP observed inflows exceeding $41 million last week on a global scale. This influx underscores XRP’s resilience, particularly in a week where many other leading cryptocurrencies struggled to maintain their value.

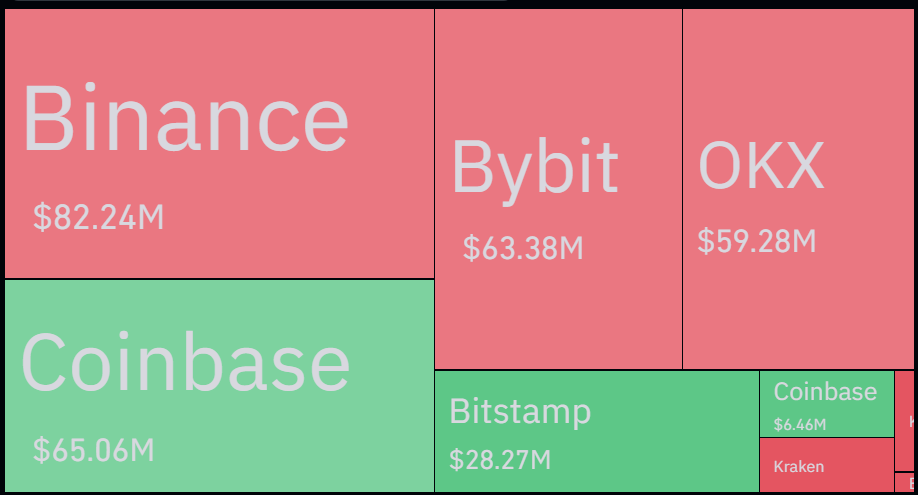

Only XRP performed favorably among the top 20 cryptocurrencies by market capitalization during this period. The buoyancy in XRP’s price was further backed by net outflows observed across major crypto exchanges. Unlike exchange-traded funds (ETFs) that often indicate bearish sentiment with outflows, significant outflows from exchanges suggest increasing bullish momentum. For instance, in the past week, prominent exchanges like Binance, Bybit, and OKX reported XRP outflows amounting to $82 million, $63 million, and $59 million, respectively. In contrast, U.S. investors engaged in XRP trading appeared more cautious, as Coinbase recorded inflows exceeding $65 million.

XRP Exchange Net Flows. Source: Coinglass

The XRP community is currently fixated on the impending January 15 deadline, when the SEC is expected to file its opening brief in the appeal against Judge Analisa Torres’s ruling. Community speculations suggest that the SEC might reconsider pursuing the appeal due to the prolonged lack of filing. However, seasoned securities lawyer Marc Fagel indicated that such delays are commonplace in legal practice. On his social media platform, he expressed, “In 30 years of litigation, the number of times I saw a lawyer (private or public sector) file a brief before it was due was roughly zero. That’s not indicative of the SEC; that’s just how litigation works.”

Fagel also elaborated that a new SEC administration taking office could choose to drop the appeal, even if they do submit a brief on January 15, though he characterized such a decision as “highly unusual.” With SEC Chair Gary Gensler and Commissioner Caroline Crenshaw set to leave shortly after Donald Trump’s presidential inauguration, rumors abound that Trump has nominated former pro-crypto SEC Commissioner Paul Atkins for leadership of the agency post-Gensler.

XRP Poised for a Potential Surge Beyond 80% After Breaking Through Key Resistance

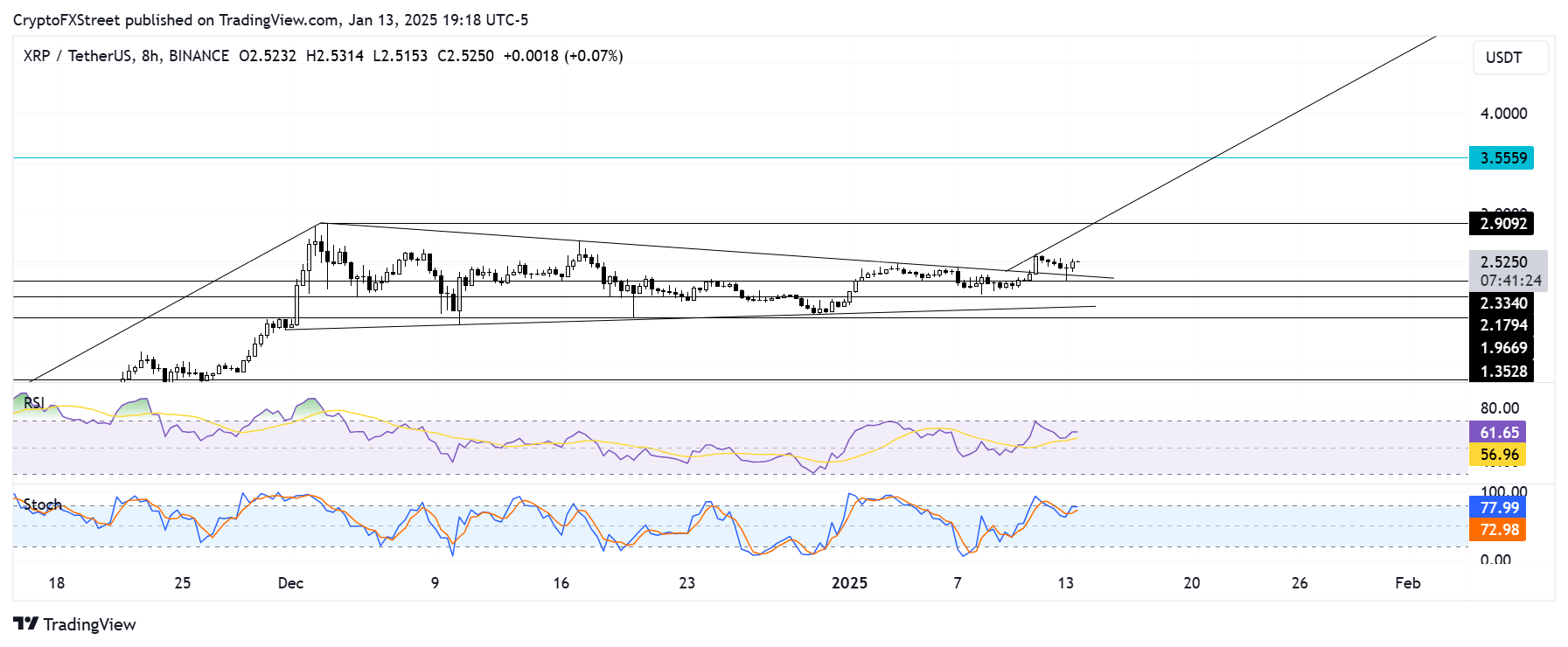

In the last 24 hours, XRP has witnessed a total of $20.83 million in futures liquidations, comprising $13.55 million in long position liquidations and $7.28 million in short positions, as per Coinglass data. Over the weekend, XRP successfully broke above the upper boundary of a bullish pennant formation that had been consolidating since early December, signaling bullish sentiment among traders.

If XRP can maintain this breakout and reinforce the pennant’s upper boundary as a solid support level, analysts predict the potential for the cryptocurrency to rally beyond $3.55 and aim for a new all-time high near $4.50 in the upcoming weeks.

XRP/USDT 8-hour chart

However, a crucial resistance hurdle at the $2.90 level looms, marking XRP’s highest price point over the past six years. Any retracement into the pennant may force XRP to test its lower boundary support line, positioned around the psychological threshold of $2.00. The prevailing bullish momentum is reflected in technical indicators, with both the Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) remaining above their neutral levels. It is worth noting that a daily close below the $1.96 support level would invalidate the bullish outlook.

Leveraging AI legalese decoder for Clarity Amidst legal Uncertainties

In a landscape filled with legal complexities such as the ongoing Ripple vs. SEC case, utilizing resources like AI legalese decoder can be incredibly beneficial. This powerful tool is designed to help individuals and entities understand intricate legal language, simplifying dense legal texts into more digestible formats. As XRP investors navigate the uncertain waters of crypto regulations and potential legal ramifications, AI legalese decoder can provide clarity to the legal documents and briefs associated with ongoing litigation.

By demystifying legal jargon, this tool empowers investors to make more informed decisions based on the potential outcomes of their investments and the legal landscape’s evolution. As we await further developments in the Ripple case, leveraging AI legalese decoder can enhance one’s understanding of the consequences of legal decisions on asset performance, ultimately allowing for more strategic trading and investment choices.

Cryptocurrency Prices FAQs

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a