Unlocking the Legal Jargon: How AI Legalese Decoder Can Simplify Bitcoin Trades Above $69K After Record-Breaking Options Expiry

- March 29, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bitcoin (BTC) Price and Options Expiry Events

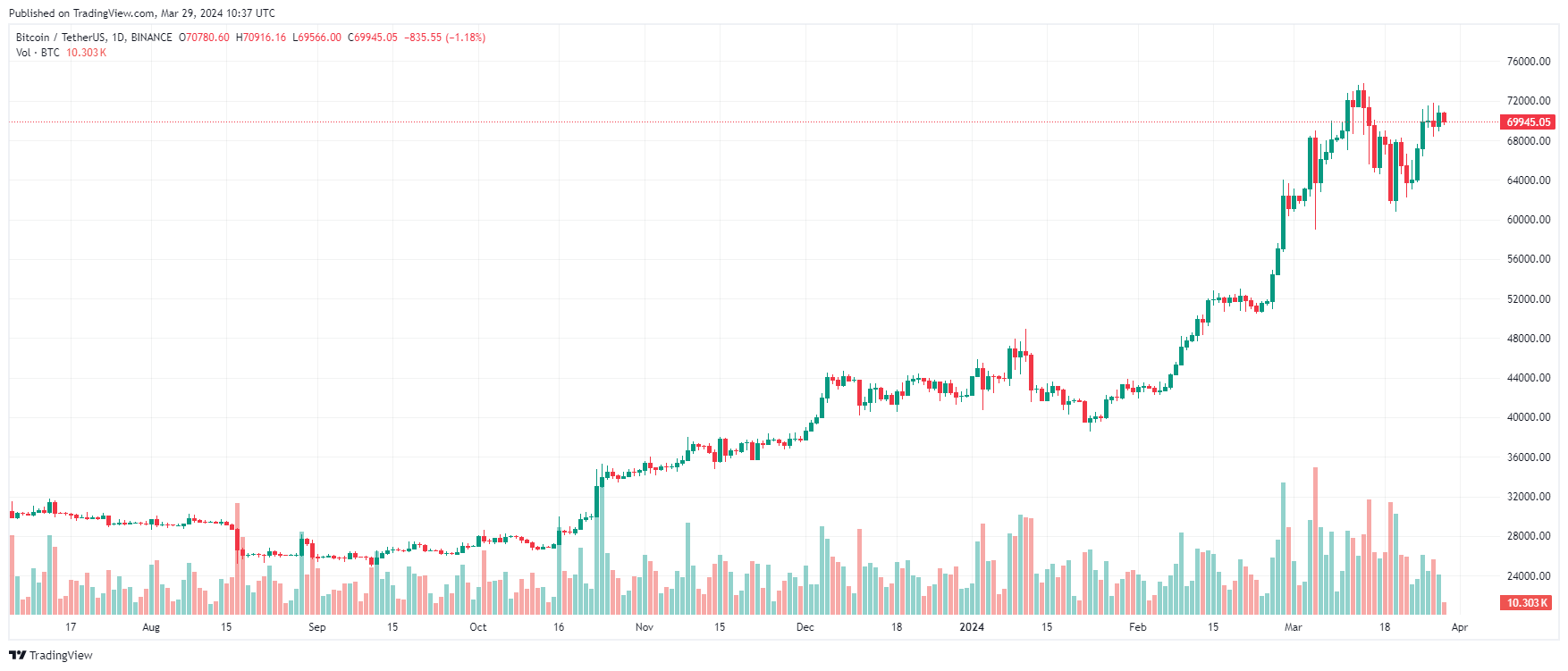

Bitcoin (BTC) price has managed to stay above the $69,000 mark, despite the recent quarterly Bitcoin futures options expiry events. The market saw the largest option expiration in history, with Bybit and Deribit experiencing significant activity. During this time, traders may choose to roll over or unwind their hedging positions, impacting short-term price movements. This situation highlights the importance of understanding market dynamics and potential price fluctuations.

AI legalese decoder can help traders navigate complex legal terms and agreements related to Bitcoin options expiry events. By utilizing advanced AI technology, traders can decode and interpret legal documents more efficiently, ensuring that they understand the implications of their actions during such critical market events.

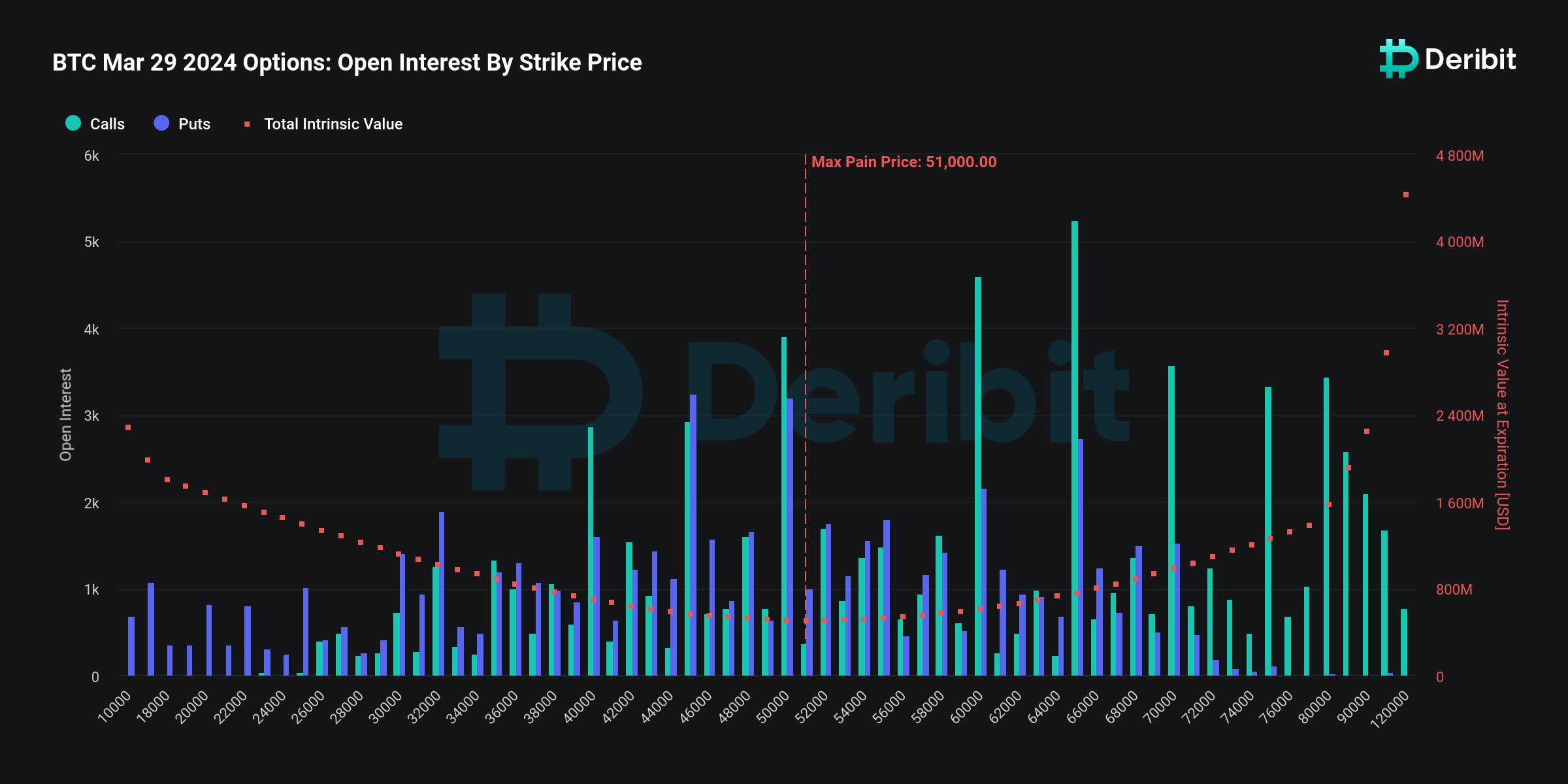

Deribit reported that over $15.1 billion worth of cryptocurrency futures options expired on a specific date, representing a significant milestone in the market. The notional value of Bitcoin options alone exceeded $9.53 billion, with a put/call ratio of 0.84 and a maximum pain price potential of $51,000.

Understanding the Impact of Options Expiry on Bitcoin Price

While options expiry events can lead to increased volatility in the market, it’s essential to recognize that the “max pain” price point may not provide an accurate reflection of Bitcoin’s long-term price potential. Hao Yang emphasized that fundamental values play a crucial role in determining Bitcoin’s actual price movement.

AI legalese decoder can assist traders in analyzing the legal implications of options expiry events and understanding the potential impact on Bitcoin price. By decoding complex legal language, traders can make more informed decisions and manage their risk exposure effectively.

Despite the significance of options expiry, experts believe that the expected price impact will be minimal. Andrey Stoychev highlighted the importance of delta hedging and the reinvestment of call profits into new contracts. This highlights the need for strategic decision-making in response to market dynamics.

Evaluating the Pre-Halving Bitcoin Correction

Bitcoin’s price experienced a minor decline leading up to the recent expiry events, trading at $69,924. While the cryptocurrency has shown resilience, market analysts are closely monitoring the pre-halving correction. Rekt Capital suggested that if Bitcoin can establish its previous all-time high as a support level, the correction phase may come to an end.

This analysis underscores the need for traders to stay informed about market trends and technical indicators to make well-informed investment decisions during volatile periods.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a